Indus Towers Ltd.'s share price surged nearly 5% after Citi Research forecasted a dividend yield for the telecommunications infrastructure company, following Vodafone Group's exit from its stake in it.

Citi maintained its 'buy' rating on Indus Towers, setting a target price of Rs 485 per share, which suggests an upside potential of 35% from its previous closing price of Rs 358.75.

This positive outlook comes after Vodafone Group announced plans to divest its entire 3% stake in Indus Towers, valued at approximately Rs 2,841 crore.

The stake sale will be carried out through open market transactions, with proceeds from the sale set to be used by Vodafone Group to repay its outstanding borrowings of around $101 million. These borrowings are secured against Vodafone's Indian assets.

Citi estimates that the residual proceeds, after repaying the borrowings, will amount to Rs 1,900-2,000 crore, which Vodafone is expected to inject as equity into Vodafone Idea. This capital infusion will help Vi clear its past dues to Indus Towers, with Citi suggesting that this amount could translate to Rs 7 per share for Indus.

This surplus, along with Indus Towers' regular free cash flow generation, positions the company to potentially pay out dividends in the range of Rs 11 to Rs 12 per share for the second half of the next fiscal, according to Citi.

The brokerage expects dividends to grow further to over Rs 20 per share annually in fiscal 2026 and fiscal 2027. This would equate to an attractive dividend yield of 6% at current levels, making the stock an appealing proposition for income-focused investors.

In light of these developments, Citi has placed Indus Towers under a 90-day positive catalyst watch, signaling the potential for further upside in the stock's performance.

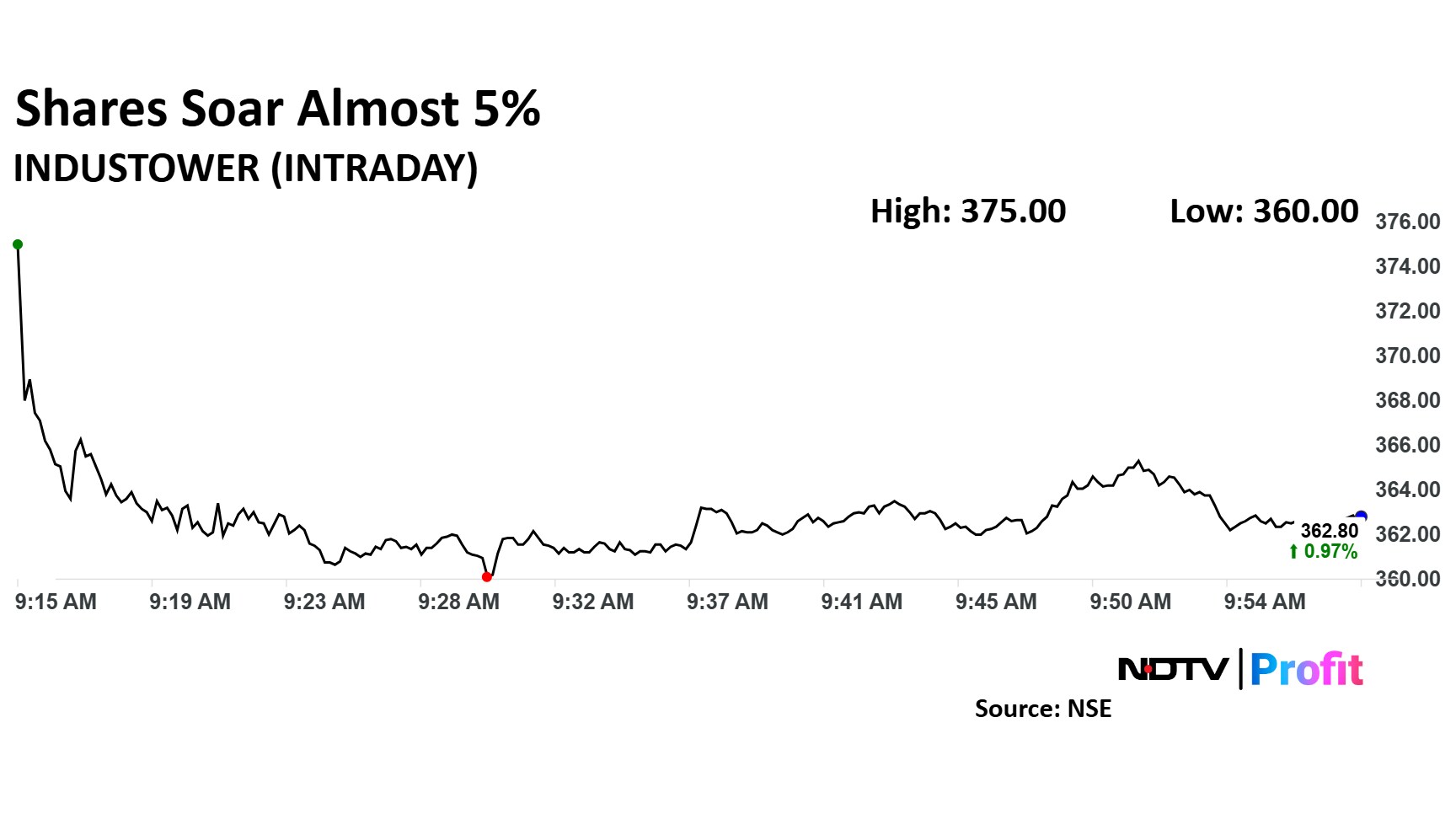

Indus Towers Share Price Today

Share price of Indus Towers rose as much as 4.98%, before paring gains to trade 1.44% higher at Rs 362.35 apiece, as of 09:48 a.m. This compares to a 0.17% advance in the NSE Nifty 50.

The stock has risen 94.86% in the last 12 months. Total traded volume so far in the day stood at 3.43 times its 30-day average. The relative strength index was at 64.

Out of 23 analysts tracking the company, 12 maintain a 'buy' rating, five recommend a 'hold' and six suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 94.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.