Indus Towers' share price continued its upward trajectory for the second consecutive day, rising nearly 1% on Thursday, following a 1.78% increase on Wednesday. The surge comes after Citi elevated Indus Towers to its top telecom pick, citing positive growth prospects and strategic acquisitions.

Citi's report highlighted that Indus Towers has received shareholder approval for the acquisition of 16,100 towers from Bharti Airtel and Hexacom for up to Rs 3,300 crore. This acquisition is expected to be earnings accretive, leading to a 3-5% increase in the company's FY26-27 Ebitda and a 1-2% rise in EPS forecasts.

Citi forecasts a core Ebitda compound annual growth rate of 10% for Indus Towers from FY25 to FY27, driven by an 8% tenancy CAGR. The brokerage also noted the stock's attractive dividend yield of 5-7%, making it a compelling investment opportunity.

Key catalysts for Indus Towers' growth include the resumption of dividend payouts, potential government relief for telecom operators, and improvements in Vodafone Idea's operating performance and debt raise completion. Citi has retained its 'buy' rating on Indus Towers with a lower target price of Rs 470.

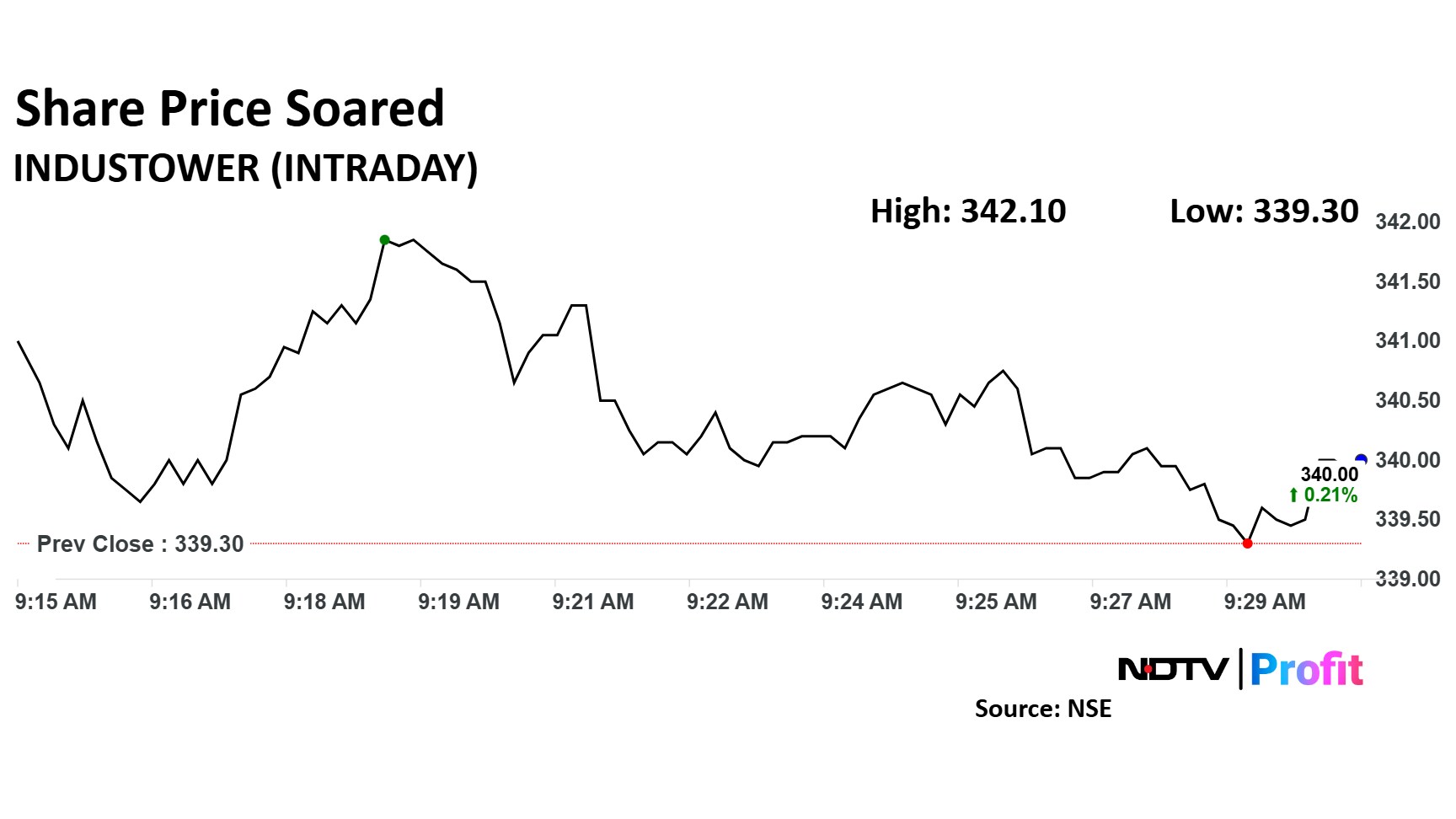

The scrip rose as much as 0.83% to Rs 342 apiece. It pared gains to trade 0.34% higher at Rs 340 apiece, as of 09:27 a.m. This compares to a 0.56% advance in the NSE Nifty 50 Index.

It has risen 35.80% in the last 12 months. The relative strength index was at 52.

Out of 24 analysts tracking the company, 13 maintain a 'buy' rating, six recommend a 'hold,' and five suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 21.7%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.