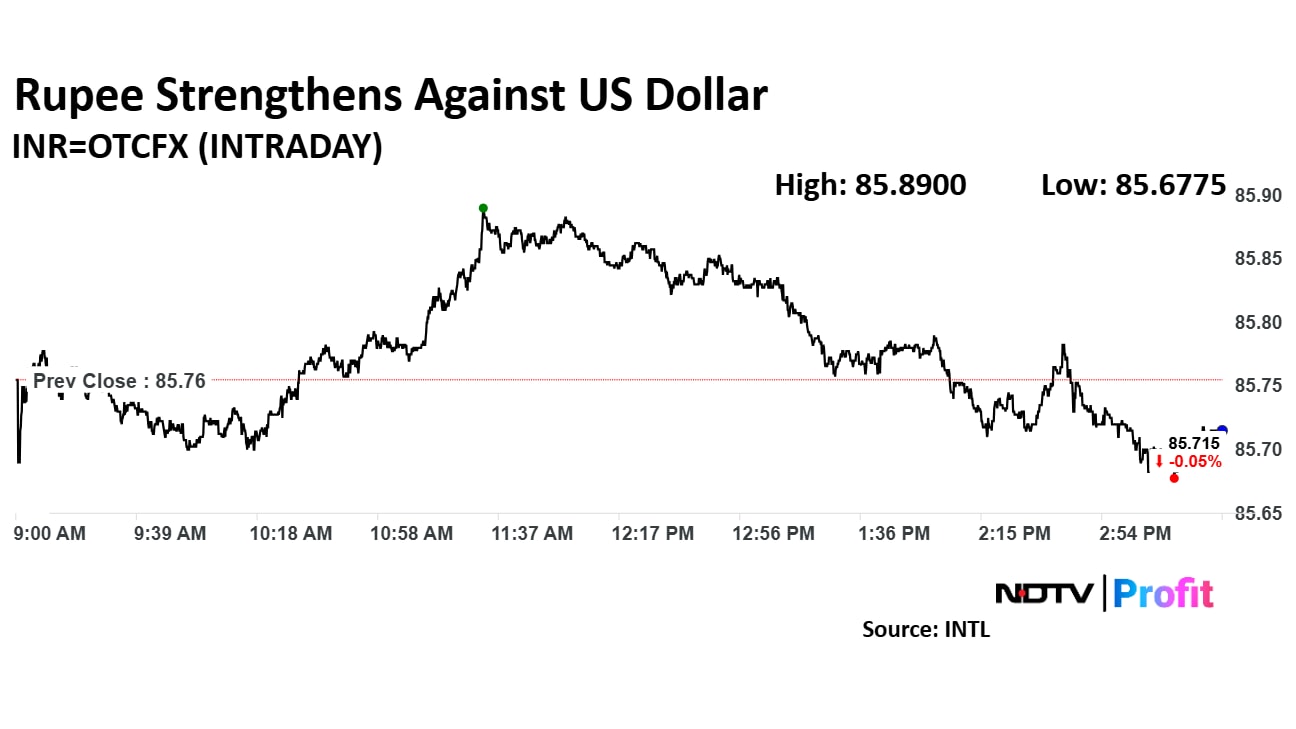

The Indian rupee closed higher against the US dollar on Wednesday. The domestic unit closed five paise higher at 85.71 against the greenback, according to Bloomberg data.

It had snapped an eight-session winning streak to settle at 85.76 a dollar on Tuesday.

The rupee opened eight paise higher at 85.68 against dollar. The Indian unit touched the day's low of 85.89. It touched an intraday high of 85.67 against the greenback shortly after open. From day's high, the domestic unit lost ground against the US currency as the month-end dollar demand weighed.

A rise in the US dollar index and crude oil prices also pressured the Indian unit. The DXY was 0.04% higher at 104.30 as of 3:38 p.m.

"The Reserve Bank of India's $77.53 billion in short-side forward positions signals potential dollar-buying intervention, which could cap the rupee's gains," Amit Pabari, managing director of CR Forex Advisors, said. "Additionally, geopolitical risks — from Israel's offensive in Gaza to US airstrikes on Iran-backed Houthi rebels — are driving demand for safe-haven assets like the US dollar."

The rupee is expected to be in the range of 85.50 to 85.95. Exporters are advised to take hedges above 85.90 levels and importers are advised to take hedges below 85.55, according to Ritesh Bhansali, director of Mecklai Financial Services.

"Markets remained cautious ahead of Trump's reciprocal tariffs next week, while US consumer confidence hit a 12-year low. Attention now shifts to Fed officials' comments and Friday's PCE inflation report," Bhansali said.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.