(Bloomberg) -- JPMorgan Asset Management increased its holdings of Indian local-currency sovereign bonds, viewing them as the best bet among peers in Asia.

The firm added bonds in April when the yield on the benchmark 10-year bond rose above 7.15%, Julio Callegari, chief investment officer of Asia fixed income, said in an interview. It took some profits off Chinese government notes in the month, he added.

“India is what we like the most for the local currency bonds,” Callegari said, citing high yields and the lack of volatility. “In the sovereign space onshore, there are not many places that offer carry” in Asia, he said.

JPMorgan Asset joins a slew of global investors, including Abrdn Plc and Zurich-based Vontobel Asset Management, in turning to Indian bonds ahead of their inclusion into JPMorgan's emerging-market debt gauge in June. Bonds eligible for inclusion are set to deliver their best monthly returns in nearly a year in May amid foreign inflows.

READ: Brandywine Global Cuts China Debt Holding to Buy India Bonds

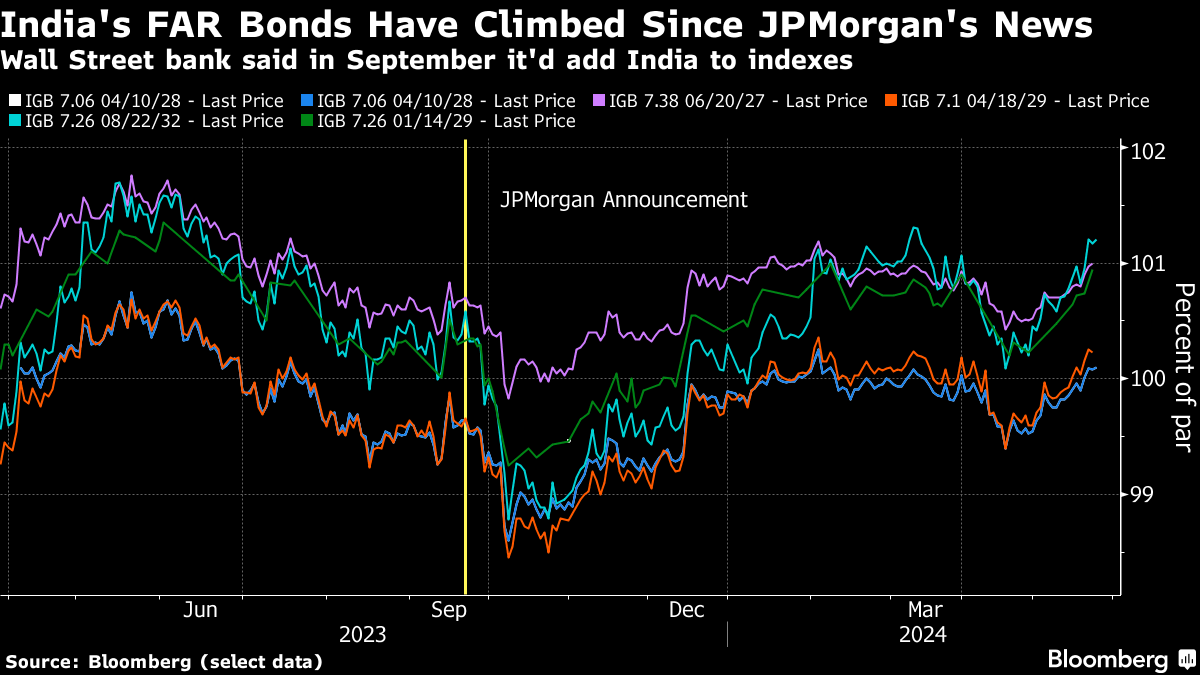

Indian sovereign bonds have seen about $8 billion of inflows into the so-called Fully Accessible Route — or FAR securities — since the JPMorgan announcement, though there were some outflows in April amid a global debt selloff. The FAR bonds have no restrictions for foreign investors.

The bond index's inclusion is expected to attract inflows of as much as $40 billion, as per analysts' estimates. Ten-year yields traded at about 7.04% on Monday.

India's relatively higher returns and a stable currency also help, said Callegari, as other higher-yielding Asian countries such as Indonesia may lag India in terms of stability.

Bloomberg Index Services Ltd. will also start including India in its emerging-markets index from January. Bloomberg LP is the parent company of Bloomberg Index Services, which administers indexes that compete with those from other providers.

--With assistance from Subhadip Sircar.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.