Idea Cellular Ltd. could double in value in the next three years on the back of its merger with Vodafone India Ltd., according to brokerage house CLSA's sales team.

The combined entity's market capitalisation could rise to $17.3 billion from $8.4 billion currently, CLSA Sales wrote in a note to clients.

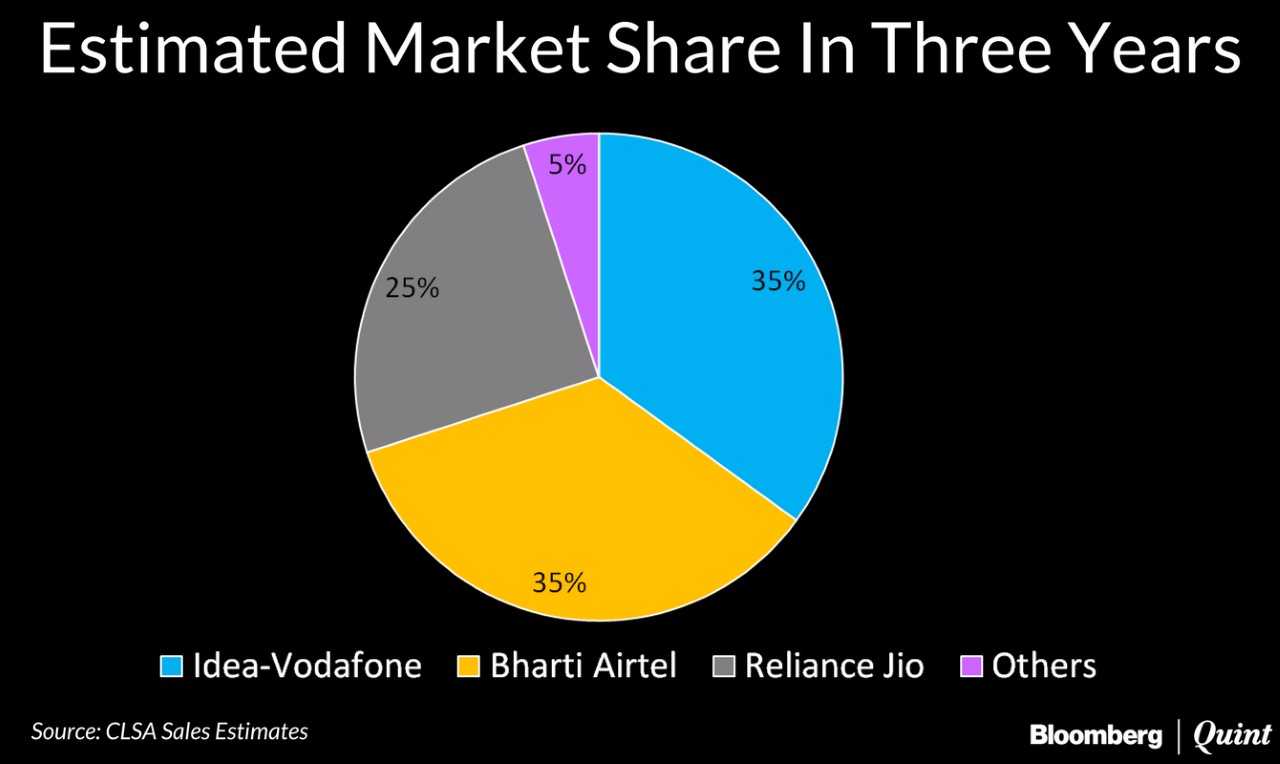

The firm expects the top three telecom companies to control 95 percent of the market share in the same time frame.

With 35 percent share of the market, the combined Idea-Vodafone entity is expected to generate $11 billion in revenue, which could translate to earnings before interest, tax, depreciation and amortisation of $4.6 billion.

The market will give the combined entity an enterprise value of $32 billion, or seven times its EBITDA, according to CLSA Sales' estimates. The combined entity's debt is expected to fall by $1 billion to $15 billion, as the operator will have merger synergies, sufficient spectrum, and no spectrum renewal costs.

Also Read: Reliance Jio Adds The Most Customers In April But Not All Are Active

Floor On Voice And Data Tariffs?

New regulations to put a floor on voice and data services could prevent new entrants from foraying into the market, CLSA Sales added. The Telecom Regulatory Authority of India is examining the suggestion to fix a minimum floor price for voice and data services, according to a PTI report.

Share prices of Idea Cellular rose as much as 3.9 percent to Rs 79.5, its biggest intraday gain in one month. 43 percent of the analysts tracked by Bloomberg have a sell rating on the stock. CLSA too has a ‘sell' rating on the stock with a target price of Rs 87.

Also Read: Reliance Jio Costs Rival Telecom Operators Rs 7,200 Crore

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.