Shares of Hindustan Petroleum Corp. and Bharat Petroleum Corp. declined after the oil refiners posted wider-than-estimated losses in the first quarter.

That came as marketing margins eroded amid volatility in global crude prices, as well as on account of a foreign currency loss, according to their exchange filings over the weekend.

HPCL Q1 FY23 (Consolidated, QoQ)

Revenue up 15% at Rs 1,21,496 crore (Bloomberg estimate: Rs 1,18,237.1 crore).

Operating loss widened to Rs 19,490.2 crore from Rs 5,543 crore.

Net loss at Rs 8,557.12 crore vs profit Rs 2,018.45 crore (Bloomberg estimate: Rs 7,860-crore profit).

BPCL Q1 FY23 (Consolidated, QoQ)

Revenue up 12% at Rs 1,38,424.5 crore (Bloomberg estimate: Rs 1,40,952.1 crore).

Operating loss widened to Rs 23,166.8 crore from Rs 13,152.9 crore.

Net loss at Rs 6,147.94 crore vs profit Rs 2,560 crore (Bloomberg estimate: Rs 4,640.7-crore loss).

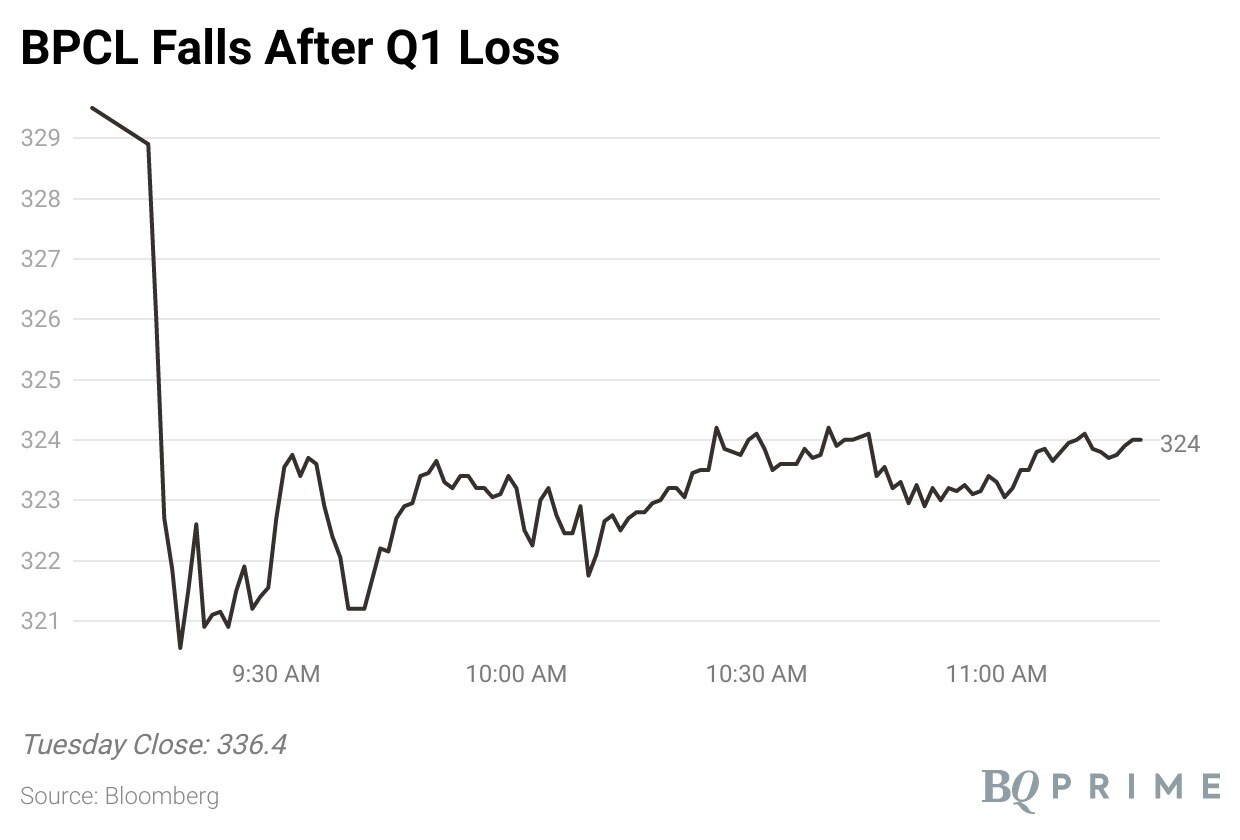

Shares of BPCL fell as much as 4.8% before ending 3.2% lower on Monday. Of the 38 analysts tracking the company, 28 maintain a 'buy', seven suggest a 'hold' and three recommend a 'sell', according to Bloomberg data. The 12-month consensus price target implies an upside of 24.1%.

Shares of HPCL fell as much as 6.2%, before closing 4.6% lower. Of the 37 analysts tracking the company, 26 maintain a 'buy', six suggest a 'hold' and five recommend a 'sell'. The 12-month consensus price target implies an upside of 23.7%.

Both stocks were downgraded to 'sell' by Kotak Institutional Equities, while Prabhudas Lilladher downgraded BPCL to 'hold'.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.