Honasa Consumer Ltd.'s share price jumped 10% to hit its upper circuit limit on Wednesday, following reports claiming that its co-founder and chief executive officer Varun Alagh has raised stake in the company.

Alagh, as per the news reports, has bought an additional stake worth Rs 4.5 crore in the beauty and personal care products company, which operates under the brand name of Mamaearth.

Earlier, NSE data showed Alagh had bought 1.45 lakh shares in the company for Rs 3.65 crore on Nov. 21. This was preceded by him buying 35,000 shares for Rs 92.7 lakh on Nov. 19. These deals, combined, made up for around 0.06% stake in the company.

As of the quarter ended Sept. 30, 2024, Alagh's overall shareholding in the company stood at 31.88%, according to BSE data.

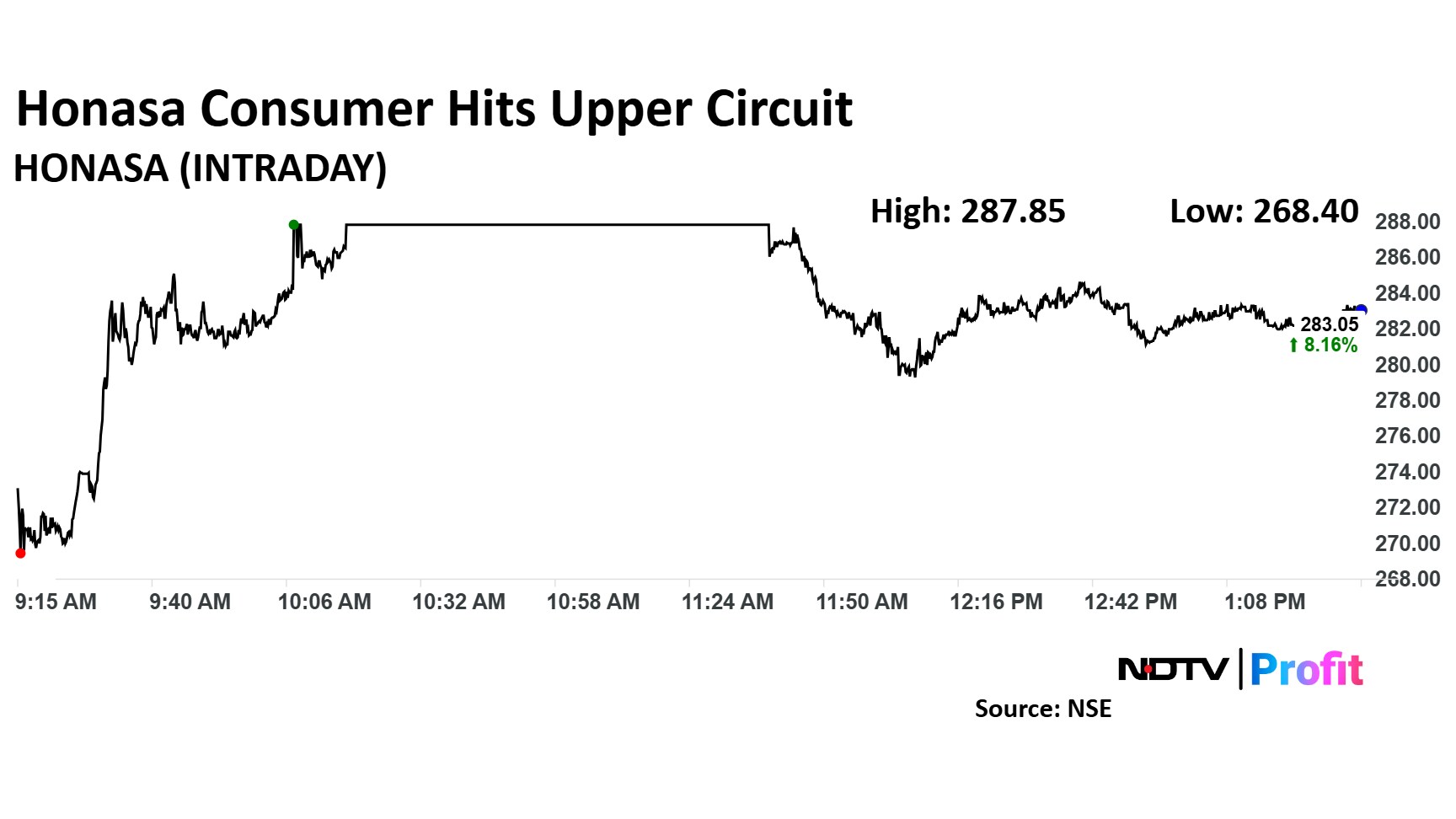

On Wednesday, Honasa Consumer's scrip rose as much as 9.99% to touch its upper circuit limit of Rs 287.85 apiece. Later, it pared gains to trade 6.5% higher at Rs 278.65 apiece, as of 2:44 p.m. This compared to a 0.05% advance in the NSE Nifty 50 Index.

The stock has fallen 36.8% on a year-to-date basis. Its total traded volume so far in the day stood at 2.9 times its 30-day average. The relative strength index was at 37.8.

Out of the 12 analysts tracking the company, six maintain a 'buy' rating, two recommend a 'hold,' and four suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies a downside of 27.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.