.png?downsize=773:435)

Hindalco Industries Ltd.'s share price rose over 2% on Friday after it's third-quarter net profit rose 60%, beating analysts' estimates.

The company retained positive stock ratings from brokerages, after it delivered better-than-expected results in the third quarter. JPMorgan, CLSA and Investec maintained their rating and target prices on the stock.

The aluminium producer posted a profit of Rs 3,735 crore in the quarter ended Dec. 31, according to an exchange filing on Thursday. This compares with the Rs 3,372-crore consensus estimate of analysts polled by Bloomberg.

While Hindalco Industries' US subsidiary Novelis Inc. saw the least revenue growth, the company's growth was driven by its India business. Hindalco's aluminium upstream and downstream segment drove the top line growth in Q3 FY25, with an annual revenue increase of 25%. Hindalco's copper segment also reported revenue growth of 15% on an annual basis.

CLSA will be looking out for commentary on cost, pricing, and hedging impact, and benefit of aluminum sales during the conference call, it said in a note. Hindalco Industries reported third quarter performance, largely in line with the brokerage's estimates.

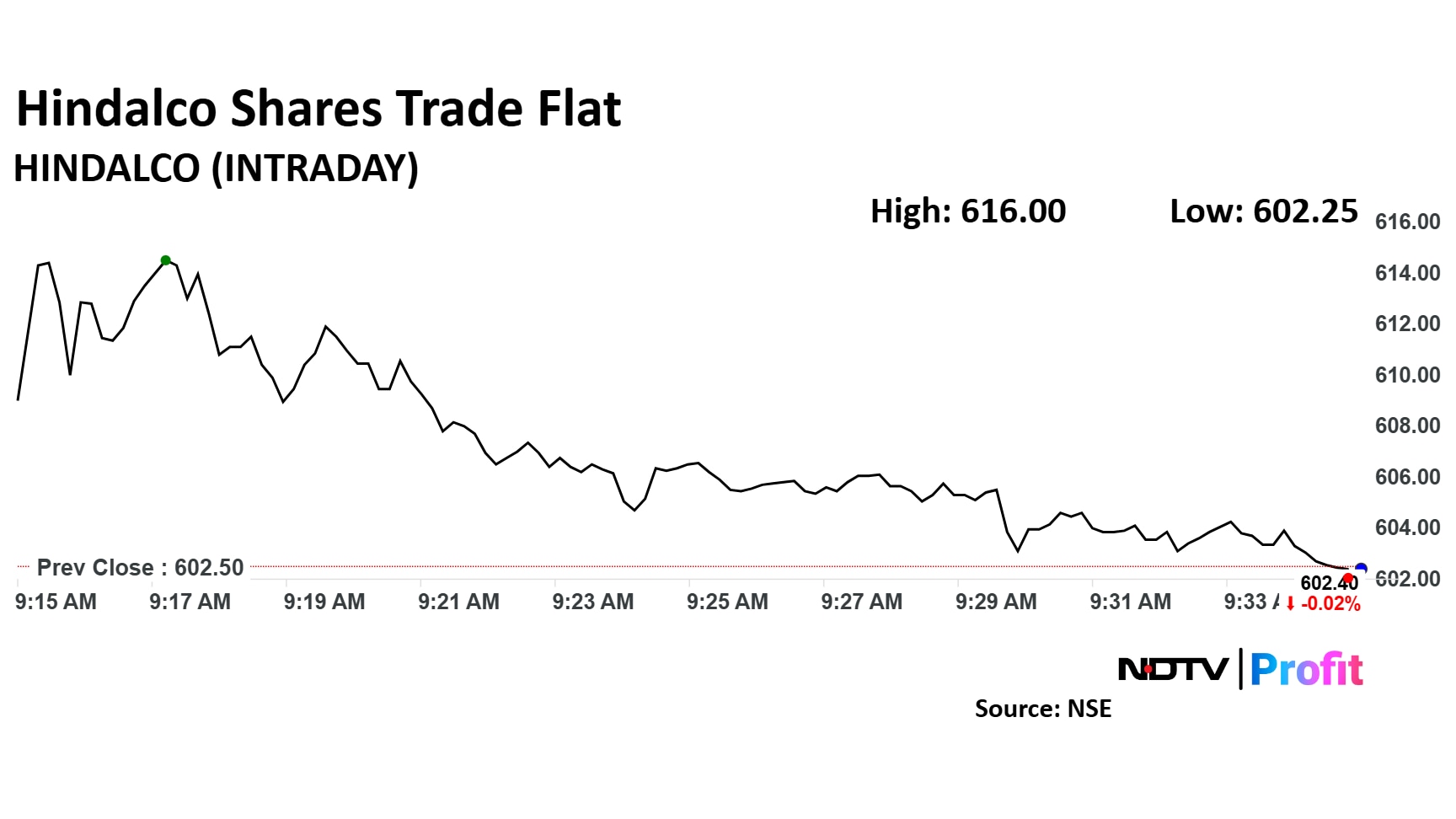

Hindalco Share Price

Hindalco stock rose as much as 2.24% during the day to Rs 616 apiece on NSE. It was trading 0.27% higher at Rs 604.1 apiece, compared to a 0.05% decline in the benchmark Nifty 50 as of 9:32 a.m.

It has risen 19.11% in the last 12 months. Total traded volume so far in the day stood at 5.2 times its 30-day average. The relative strength index was at 49.60.

Of the 29 analysts tracking the company, 25 have a 'buy' rating on the stock and four suggest a 'sell', according to Bloomberg data. The 12-month analysts' consensus target price on the stock is Rs 739, implying a upside of 20.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.