HDFC Bank Ltd.'s share price increased by nearly 1% on Monday following the bank's decision to reduce its Marginal Cost of Funds-based Lending Rate by 10 basis points across all tenures, effective from June 7. The new MCLR rates will range from 8.90% to 9.10%.

This move follows the Reserve Bank of India's (RBI) recent decision to cut the repo rate by 50 basis points to 5.50% on Friday. Additionally, the RBI announced a significant 100 basis points reduction in the Cash Reserve Ratio, to be implemented in four phases between September and November 2025, which is expected to inject approximately Rs 2.5 trillion into the banking system.

The RBI has also shifted its policy stance from 'Accommodative' to 'Neutral', indicating a more cautious approach to future monetary easing. This suggests that the current cycle of rate cuts may be limited.

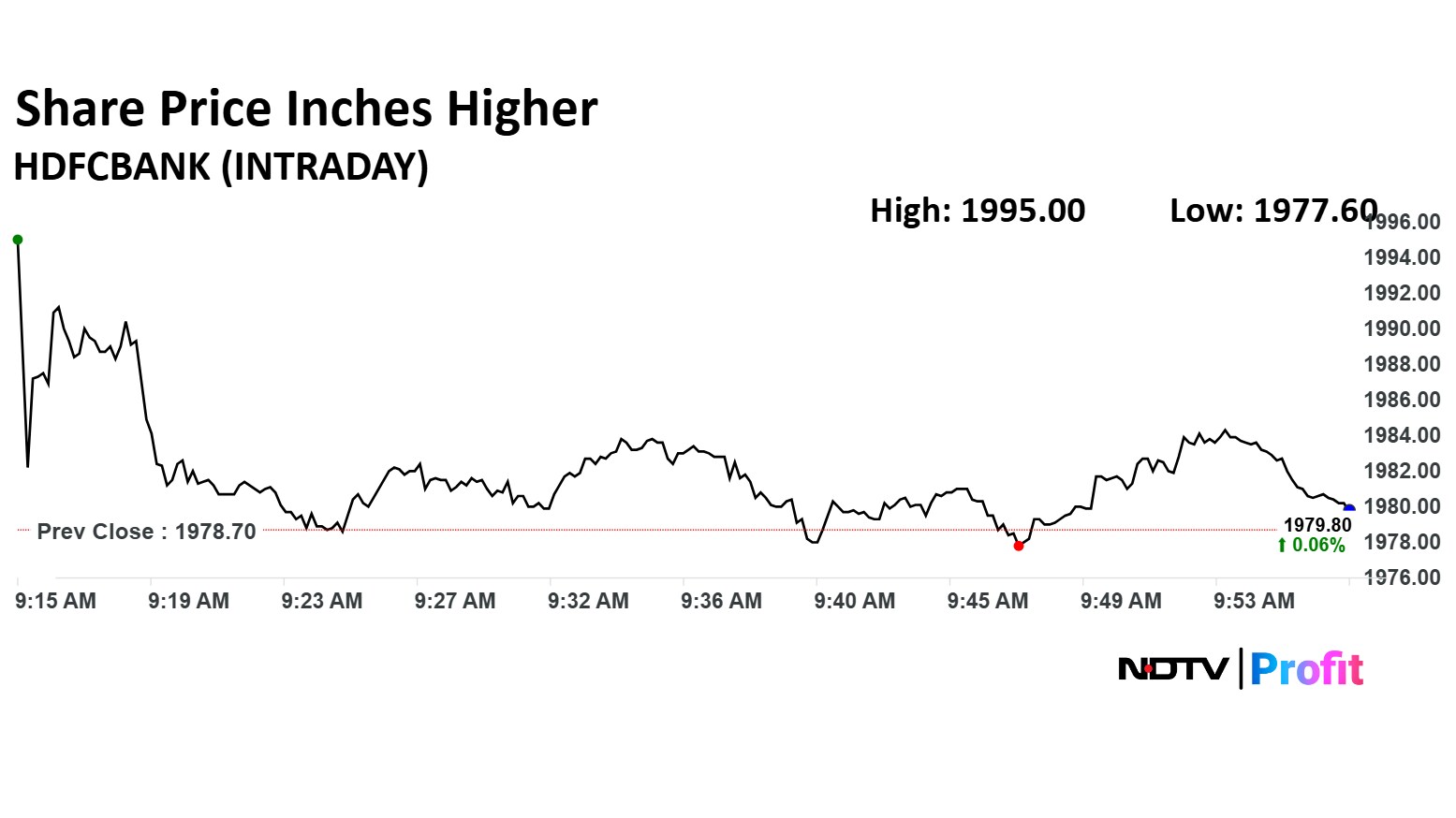

The scrip rose as much as 0.82% to Rs 1,995 apiece. It pared gains to trade 0.05% higher at Rs 1,979 apiece, as of 09:59 a.m. This compares to a 0.37% advance in the NSE Nifty 50 Index.

It has risen 26.80% in the last 12 months. Total traded volume so far in the day stood at 0.24 times its 30-day average. The relative strength index was at 64.

Out of 48 analysts tracking the company, 45 maintain a 'buy' rating and four recommend a 'hold,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 10.2% from the last regular trade.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.