.jpg?downsize=773:435)

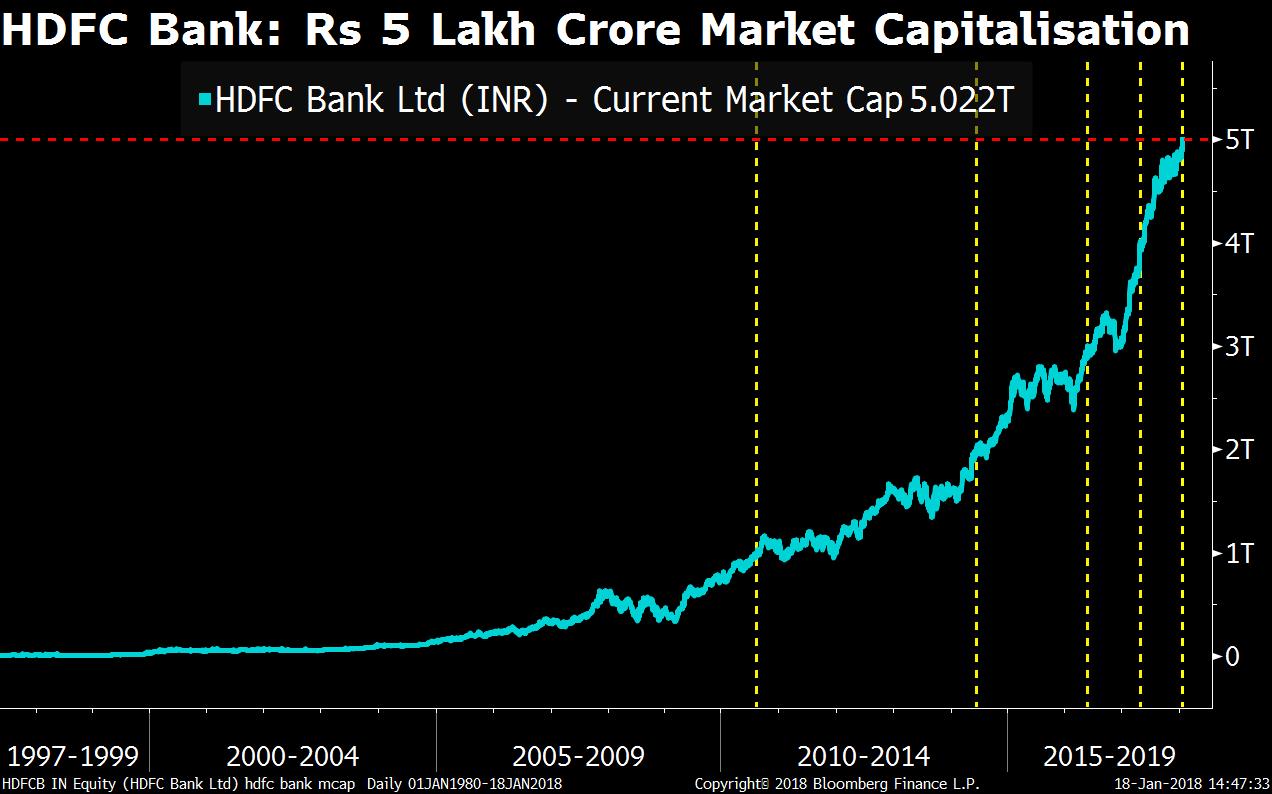

HDFC Bank Ltd. has become the third Indian company and first lender to cross a market capitalisation of Rs 5 lakh crore.

Mukesh Ambani-led Reliance Industries remained the most-valued company with a market cap of Rs 5.98 lakh crore, followed by the country's largest software exporter TCS with a market cap of Rs 5.58 lakh crore.

Indian bank shares rose on a report the government is considering allowing foreign investors to own larger stakes in the country's lenders. The Bankex Index, a gauge for 10 lenders, rose 0.7 percent to a new record high after earlier surging as much as 2.5 percent.

HDFC Bank has taken more than two decades to achieve reach the major milestone. However, the next four lakh crore just took seven years. The bank has reported annual profit growth of at least 20 percent every year since 1998, except for March and December quarter of last year due to cash ban.

While it crossed the Rs 1 lakh crore-mark back in August 2010, India's biggest bank by market capitalisation took 952 days to reach Rs 2 lakh crore-mark. The Rs 3 lakh crore-mark was achieved in 481 days. It climbed from Rs 3 lakh crore to Rs 4 lakh crore in just 228 days, while Rs 5 lakh crore was scaled in a record 184 days.

Ten years ago, Nifty Bank index's total market capitalisation was Rs 4.87 lakh crore. At that time, HDFC Bank contributed just 11-percent with Rs 55,625 crore market capitalisation.

Currently, the Nifty Bank's total market capitalisation has increased to Rs 16.4 lakh crore with HDFC Bank contribution at 31 percent. More than 90-percent of the analysts covered by Bloomberg have a ‘Buy' rating on the stock, with a return potential of over nine percent from the current market price.

Also Read: What Would An FDI Limit Hike Mean For Indian Banking Sector?

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.