- Havells India's Q1 standalone net profit fell 14% to Rs 352.3 crore

- Revenue declined 6% to Rs 5,437.8 crore due to unseasonal rains

- EBITDA dropped nearly 10% to Rs 520 crore with margin at 9.6%

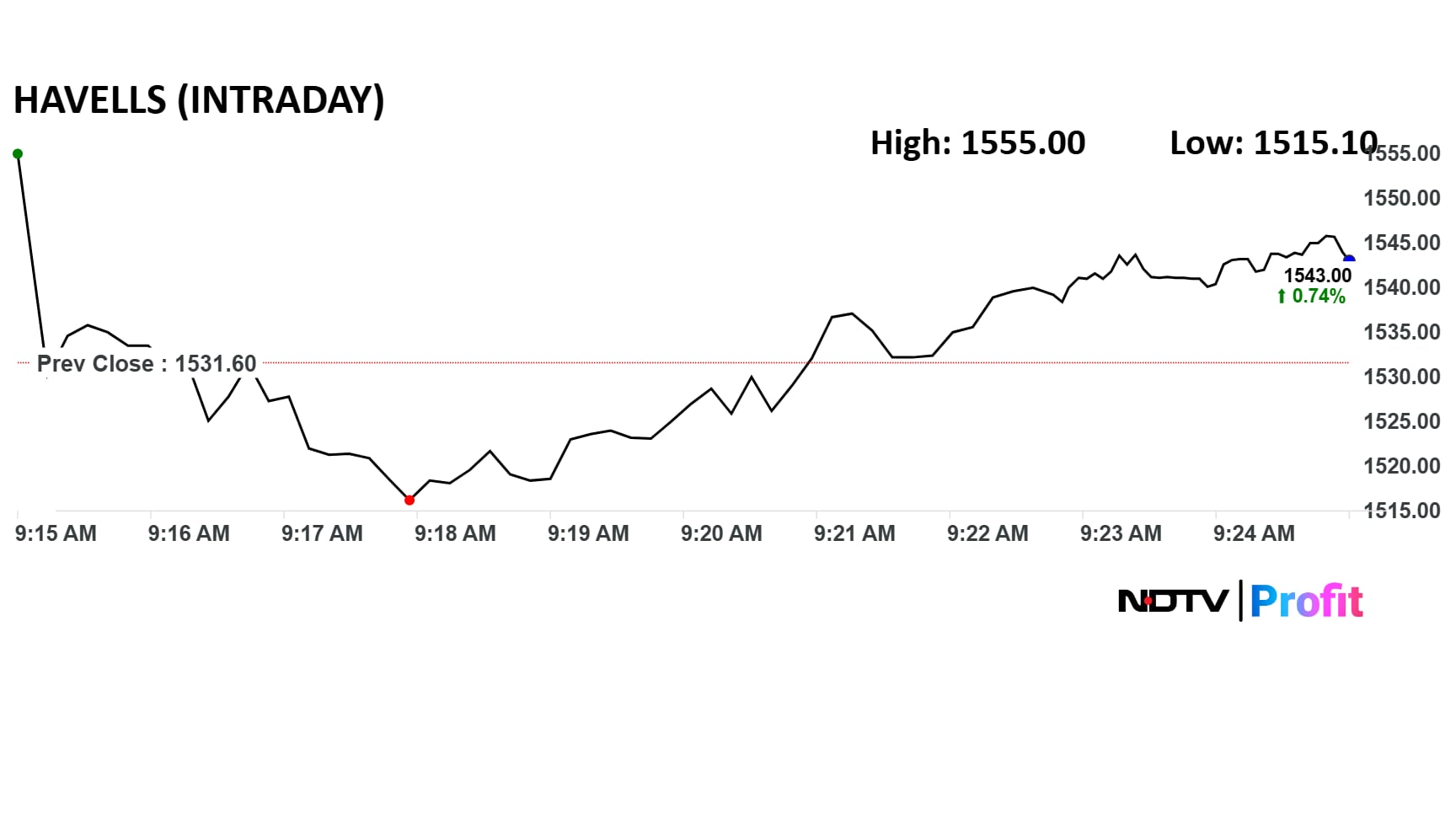

Havells India Ltd. shares rose marginally during early trade on Tuesday after the company reported its first quarter earnings.

The electrical goods manufacturer's standalone net profit for the quarter under review stood at Rs 352.3 crore, down 14% compared to Rs 411.2 crore in the year-ago period, according to an exchange filing on Monday. Analysts tracked by Bloomberg had estimated a profit of Rs 381 crore for the quarter.

Unseasonal rains and a curtailed summer adversely affected consumer sentiment, leading to a 6% decline in revenue from operations to Rs 5,437.8 crore, way below the estimated Rs 6,049 crore.

On the operating level, earnings before interest, tax, depreciation and amortisation fell nearly 10% to Rs 520 crore. Margin fell to 9.6% versus 9.9%.

Analyst Reactions

Macquarie said that while Havells India's core business was in line and the cables and wires segment continued to deliver, Lloyds disappointed.

Analysts said weak demand for cooling products presents a downside risk to earnings, but it is already captured in the current stock price.

The company is well-positioned to benefit from a gradual pick up in consumer demand in the ensuing festive season.

Havells India Stock Movement

Havells India swung between gains and losses in the first few minutes of trade.

Havells India shares swung between gains and losses in the first few minutes of trade. It was trading 0.7% higher as of 9:25 a.m. The benchmark NSE Nifty 50 was up 0.16%.

The stock has fallen 13% in the last 12 months and 8% on a year-to-date basis. The total traded volume so far in the day stood at 22 times its 30-day average. The relative strength index was at 49.

Out of the 43 analysts tracking 29 have a 'buy' rating on the stock, eight recommend a 'hold' and six suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price target of Rs 1,707 implies a potential upside of 11%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.