(Bloomberg) -- Emerging-market shares have value as bonds are losing their buffer because of US rates volatility, according to analysts at Goldman Sachs Group Inc.

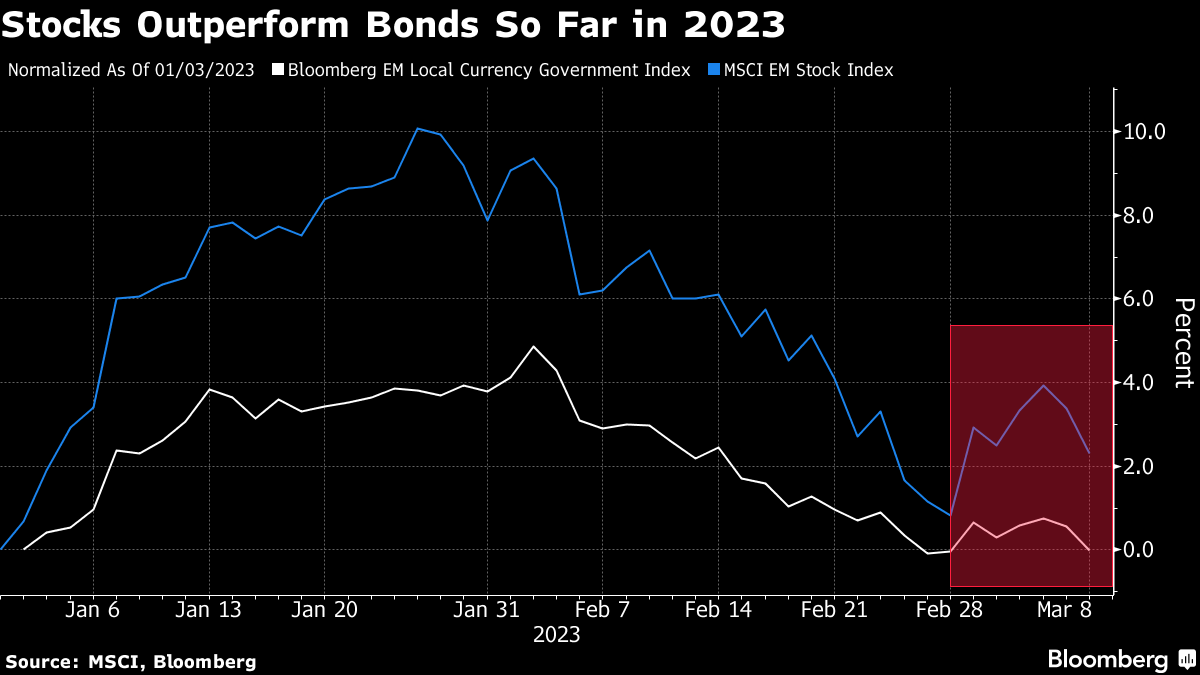

With rising nominal interest rates, local fixed income securities “no longer appear to have much cushion” with fluctuations in US rates, strategists led by London-based Kamakshya Trivedi wrote in a note dated Wednesday. MSCI Inc.'s index of developing market stocks has climbed 2.3% this year, compared with a 0.3% gain in the Bloomberg EM local currency government debt index.

“In the current market context, we expect equities to remain the favored asset class in nominal terms given the resilience of emerging-market currencies and duration,” the analysts said. China's reopening and a modest economic growth target of around 5% for the year will likely benefit stocks more than bonds, they said.

Emerging-market local bonds proved to be resilient last year, Goldman noted. The Bloomberg EM bond index declined 8.4% in 2022, compared with a 22% drop in MSCI EM stock index.

However, “this buffer has all but eroded at the headline level,” as a larger increase in US rates will add pressure on EM duration more than in recent months, according to the note.

Read: Powell Unveils Hawkish Tilt as Officials Ready for March Meeting

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.