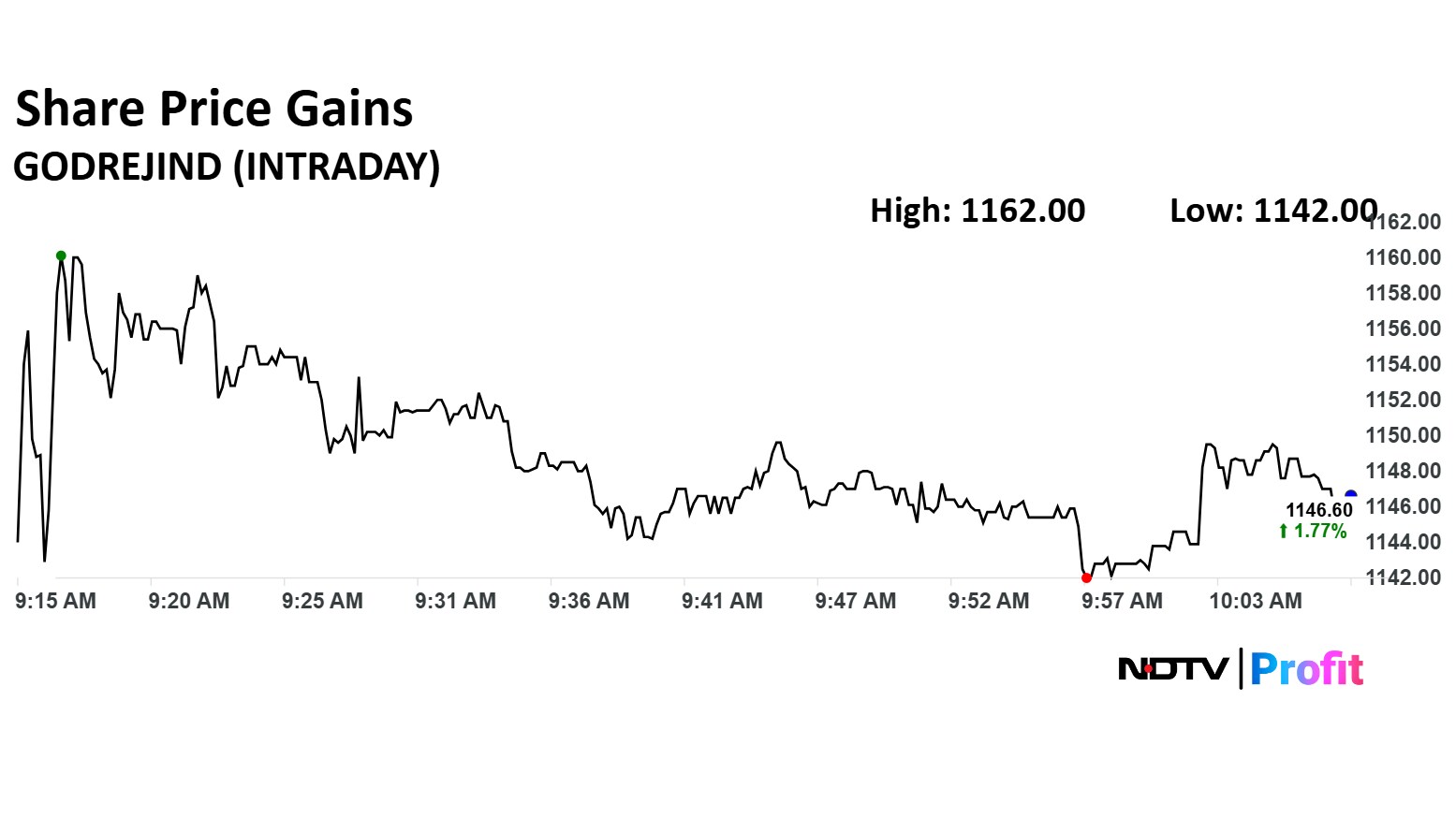

Godrej Industries Ltd. saw its share price rise by 3.13% following the announcement of its fourth-quarter results

The company's Ebitda increased by 29.4% to Rs 593.5 crore, up from Rs 458.5 crore in the same quarter last year. Revenue grew by 26.5%, reaching Rs 5,780 crore compared to Rs 4,567 crore year-on-year. The Ebitda margin expanded slightly to 10.3% from 10%. Notably, Godrej Industries reported a net profit of Rs 183 crore, a turnaround from a loss of Rs 311.8 crore in the previous year.

The home care segment experienced growth, with a 14% increase. Meanwhile, Household insecticides also delivered double-digit growth, driven by favorable seasonal conditions and strong market-share gains. Both air fresheners and fabric care products saw strong double-digit volume growth.

In the personal care segment, there was a 4% uptick, although personal wash volumes declined during the quarter. Products like Magic Handwash and Godrej Expert Rich Crème packs continued to grow in double digits, contributing to the overall positive performance.

The scrip rose as much as 3.13% to Rs 1,162 apiece. It pared gains to trade 1.63% higher at Rs 1,145.10 apiece, as of 10:10 a.m. This compares to a 0.25% decline in the NSE Nifty 50 Index.

It has risen 43.64% in the last 12 months. Total traded volume so far in the day stood at 4.7 times its 30-day average. The relative strength index was at 54.

Only one analysts is tracking the company and they maintain a 'buy' rating according to Bloomberg data. There is no 12-month consensus price target for the stock.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.