Jefferies maintained their 'buy' rating on GMR Infrastructure Ltd., with the target price set at Rs 92. The positive outlook is on the back of the improved earnings visibility that the tariff order has provided for the Delhi Airport.

The Airport Economic Regulatory Authority has released the tariff order for the fourth control period. This covers the financial years 2025 to 2029, for GMR's Delhi Airport or DIAL.

The final tariff for the airport services is in line with expectations and this implies an increase of up to 148% in the revenue per passenger. This increase is intended to compensate the recent capital expenditure at DIAL.

Improved Profitability Expected

Jefferies expects the tariff order to improve the visibility of GMR's profitability. The brokerage estimates that GMR Infrastructure's Ebitda will grow by 40% year-on-year in financial year 2026. The company is also projected to become profitable after several years of losses.

AERA has accepted DIAL's proposal for a variable tariff plan. This means that the User Development Fee or the UDF will now be charged to both departing and arriving passengers. Earlier, it was only applicable to departing passengers.

The UDF has also been divided into separate fees for domestic and international passengers, with different rates for economy and business class international travelers.

Its also noted that to support Delhi Airport's goal of becoming a major international hub, landing charges for wide-body aircraft operating direct flights to new international destinations have been waived.

Changes To User Development Fees

The user development fee for domestic departing passengers will remain unchanged at Rs 129 per passenger. A new UDF of Rs 56 per passenger will be introduced for arriving domestic passengers.

For international passengers departing from Delhi Airport, the UDF will be Rs 650 for economy class and a different rate for business class. Arriving international passengers will be charged Rs 275.

AERA has justified the different UDF rates for economy and business class international passengers based on the "user pays" principle.

Potential For Further Tariff Increases

Jefferies notes that GMR's tariff proposal to AERA included both the return on recent capital expenditure and the recovery of past under-recoveries.

While the current tariff order accounts for the capital expenditure, the brokerage notes that it does not include potential increases related to a favourable ruling from the Telecom Disputes Settlement Appellate Tribunal for later periods.

AERA has stated that it is still disputing the TDSAT order in the Supreme Court. However, Jefferies' industry checks suggest that AERA might allow for a mid-term revision of the tariff if the Supreme Court's judgment is in favour of DIAL. In this case, DIAL can approach AERA for further tariff adjustments.

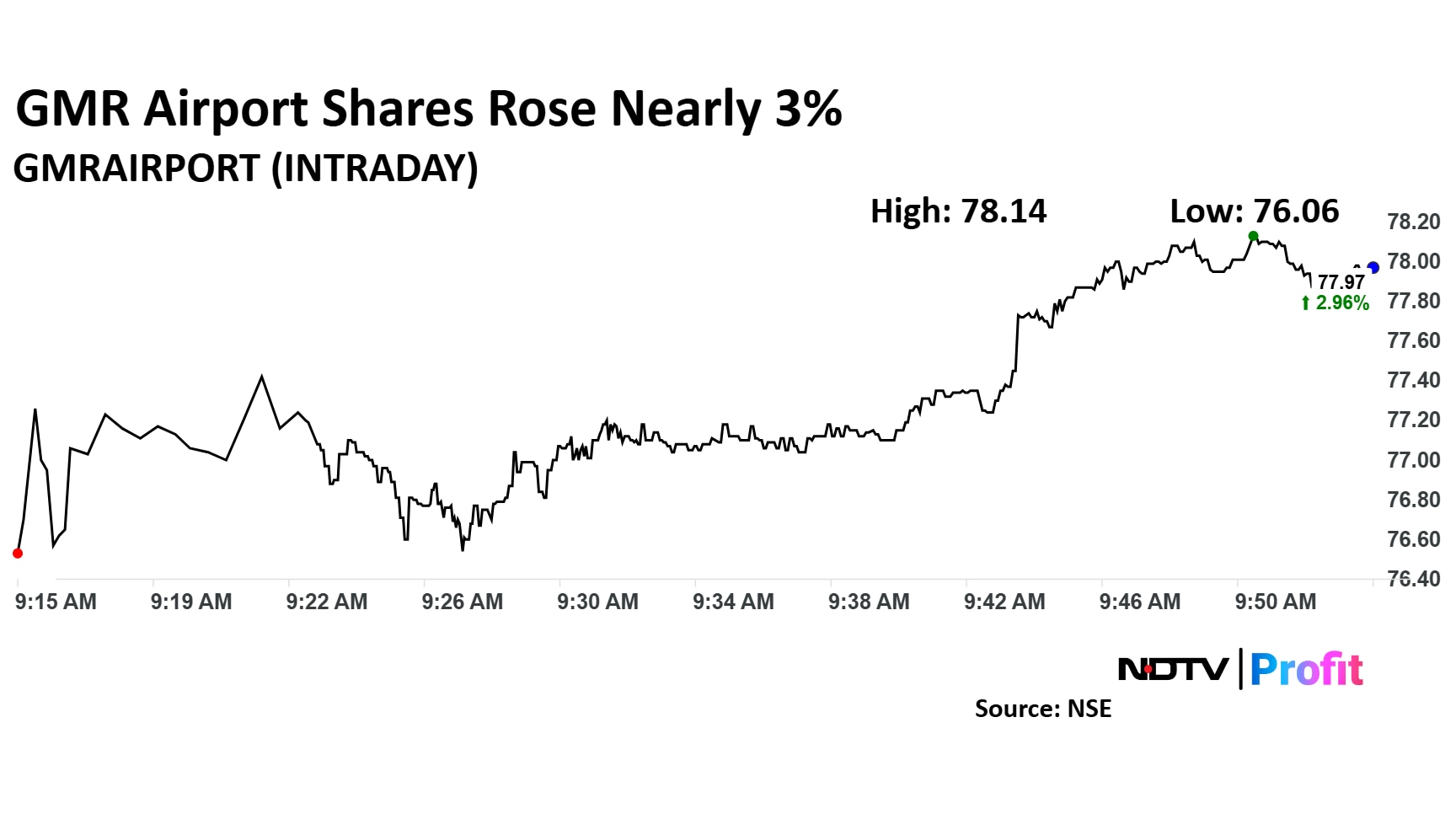

GMR Airport Share Price

GMR Airport stock rose as much as 2.40% during the day to Rs 77.55 apiece on the NSE. It was trading 1.73% higher at Rs 77.04 apiece, compared to a 0.06% decline in the benchmark Nifty 50 as of 9:52 a.m.

It had declined 6.74% in the last 12 months and 0.76% on a year-to-date basis. The total traded volume so far in the day stood at 2.7 times its 30-day average. The relative strength index was at 62.3.

Two out of three analysts tracking the company have a 'buy' rating on the stock and one recommends a 'hold', according to Bloomberg data. The 12-month analysts' consensus target price on the stock is Rs 81, implying an upside of 5.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.