Ambit Capital Pvt. has initiated coverage of GMM Pfaudler Ltd., a key player in the niche glass-lined equipment industry, with a 'buy' rating on its stock.

The brokerage set a 24-month target price of Rs 2,300 per share for GMM Pfaudler's shares, which suggests a potential upside of 89% as compared to the last closing price.

Among the key catalysts for the company is an uptick in end-user capital expenditure driving 11% YoY revenue growth in FY26, Ambit Capital said in a note.

Between fiscal 2025 and fiscal 2028, the revenue is estimated to rise at 10% compound annual growth rate and earnings per share at 48%. The earnings before interest, taxes, depreciation and amortisation is expected to rise by 21% CAGR during the same period, as per the note.

In fiscal 2024, GMM Pfaudler had logged a revenue of Rs 3,446.5 crore and net profit of Rs 174.1 crore. As per Ambit Capital's estimate, the revenue and profit are likely to slip to Rs 3,199.9 crore and Rs 96.4 crore, respectively, in fiscal 2025.

The growth and margins "will revive in FY26/27E", according to the brokerage.

The company's stock trades at 30 times the price-to-earnings ratio estimated for fiscal 2026, and a 25-30% discount to its sectoral peers, the note stated. The 25-35% valuation discount "should narrow with earnings uptick", it added.

Ambit Capital further pointed out that GMM Pfaudler holds over 40% market share in niche glass-lined process equipment, stemming from "superior tech know-how, long customer ties and technocrat promoters".

The company carried out over 10 acquisitions in the last decade, driving scalability and diversification across geographies, products and end-users, it added. GMM Pfaudler's track record of scale-up and margin turnaround of target "provides edge", it added.

The brokerage, however, noted that its target price of Rs 2,300 faces risks in case of "continued sluggishness in end-user capex" and "failure in acquisition turnaround".

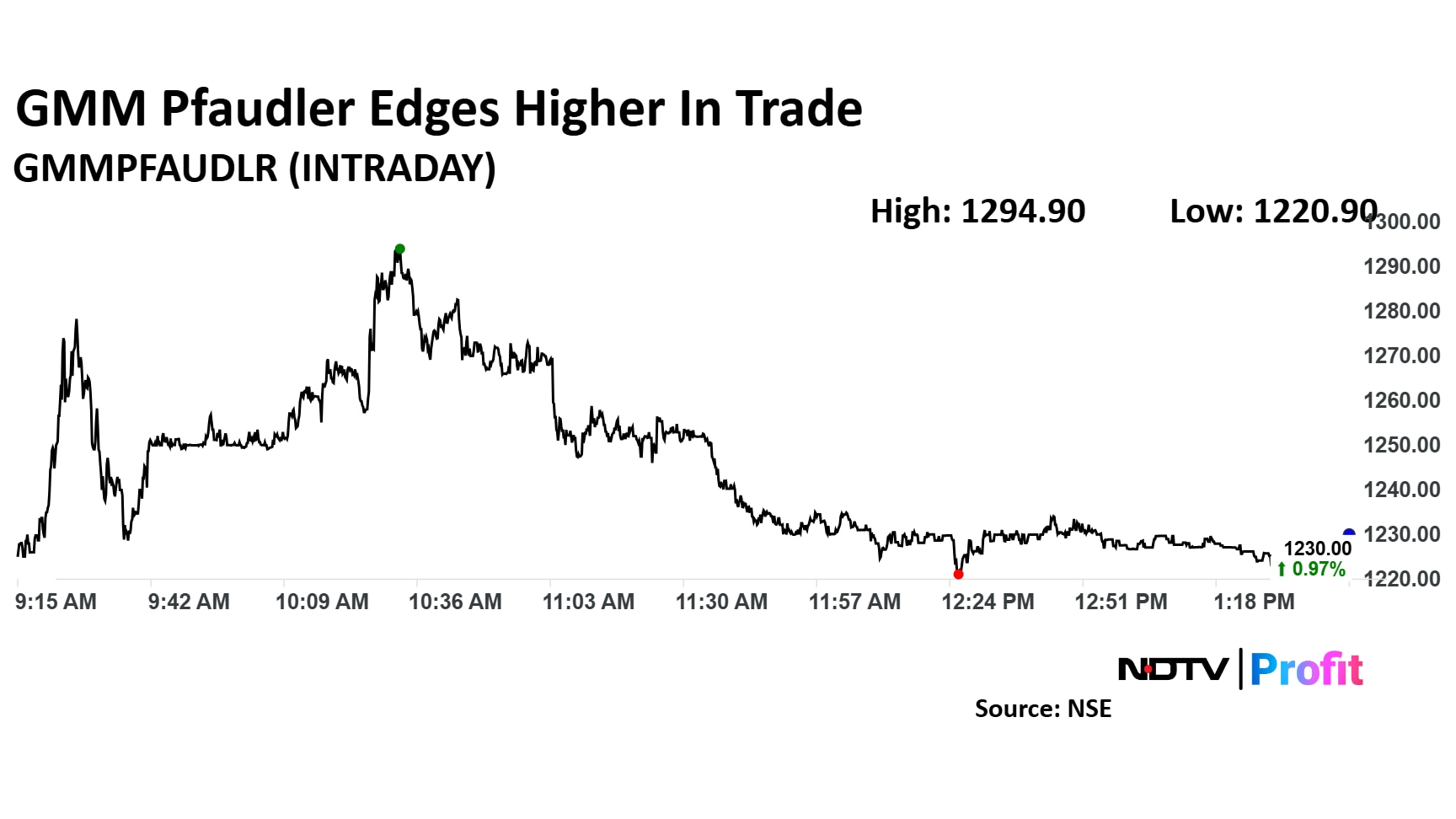

GMM Pfaulder Share Price Today

Shares of GMM Pfaudler were trading 0.79% higher at Rs 1,227.75 apiece on the NSE, compared to a 0.14% decline in the benchmark Nifty 50 at 1:43 p.m.

The company's stock has declined by around 20% over the past 12 months.

Among the three analysts tracking the stock, two have a 'buy' rating and one recommends a 'hold', according to Bloomberg data. The average of 12-month analysts' price target implies a potential upside of 43.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.