Glenmark Pharmaceuticals Ltd. shares fell 3.53% on Monday following the release of its fourth quarter results, which fell short of market expectations despite showing year-over-year improvements.

The firm reported a 6.3% increase in consolidated revenue, reaching Rs 3,256 crore compared to Rs 3,063 crore in the same quarter last year. However, this figure was below Bloomberg's estimate of Rs 3,365 crore, indicating slower-than-expected growth.

The company's earnings before interest, taxes, depreciation, and amortisation grew 11% year-on-year to Rs 561 crore from Rs 504 crore. Despite this improvement, it missed Bloomberg's estimate of Rs 598 crore. The Ebitda margin also increased to 17.2% from 16.5%, but fell short of the anticipated 17.8%.

Glenmark Pharma reported a net profit of Rs 4.7 crore, a turnaround from the loss of Rs 1,218 crore in the same period last year. However, this result was substantially below Bloomberg's estimate of Rs 344 crore.

The quarter included exceptional items amounting to Rs 373 crore, down from Rs 447 crore in the previous year.

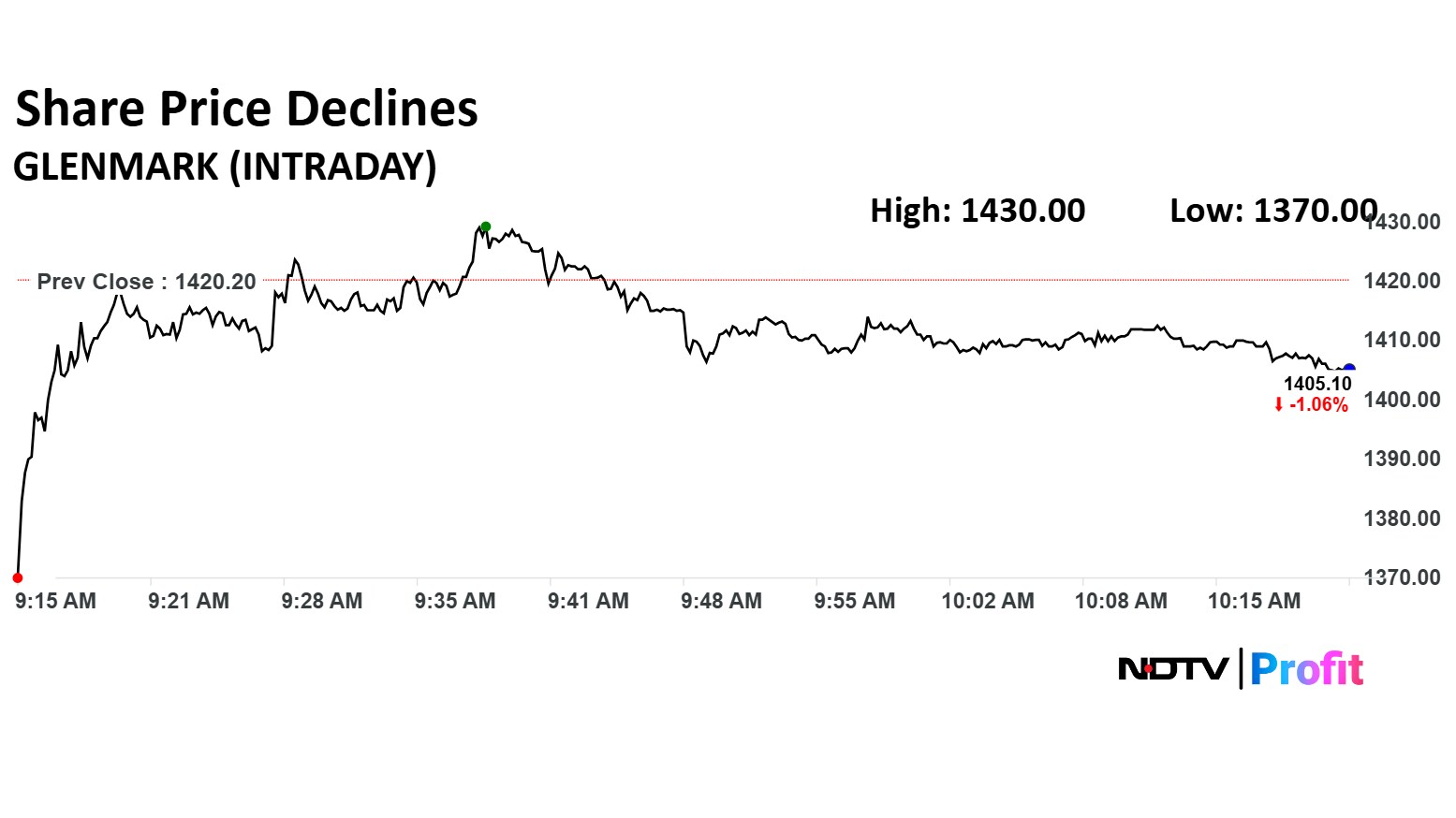

The scrip fell as much as 3.53% to Rs 1,370 apiece. It pared losses to trade 0.94% lower at Rs 1,406.90 apiece, as of 10:21 a.m. This compares to a 0.60% advance in the NSE Nifty 50 Index.

It has risen 25.68% in the last 12 months. Total traded volume so far in the day stood at 6 times its 30-day average. The relative strength index was at 46.

Out of 12 analysts tracking the company, eight maintain a 'buy' rating, three recommend a 'hold,' and one suggests 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 13.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.