Gensol Engineering Ltd.'s shares hit a fresh record low on Monday, locked in the lower circuit for the 13th consecutive session. The stock has fallen below Rs 90 for the first time.

The stock has been sliding consistently since 24th February, reaching multi-month lows after ratings agencies flagged concerns over delays in servicing term-loan obligations. Allegations of data falsification have further weighed on sentiment.

On Friday, the Indian Renewable Energy Development Agency Ltd. filed a complaint with the Economic Offences Wing against Gensol Engineering, as the Enforcement Directorate seeks a lookout circular against the Jaggi brothers.

Ireda's complaint relates to alleged falsification of documents and dilution of promoter holdings without its approval, according to a stock exchange filing.

While Ireda clarified that Gensol's account remains under stress but has not yet been classified as a non-performing asset, it has launched an internal review. Its investigation and risk committees are "closely" monitoring the situation.

This development follows a similar move by Power Finance Corporation Ltd., when it registered a complaint with the EOW regarding falsified documents. PFC's action marked the first major executive-level complaint against Gensol as regulatory scrutiny intensifies.

According to an ongoing SEBI investigation, Gensol raised Rs 975 crore in loans to procure 6,400 electric vehicles but acquired only 4,704 units worth Rs 567.7 crore. Over Rs 200 crore remains unaccounted for, raising serious concerns about potential fund misuse.

Credit rating agencies ICRA and Care Ratings downgraded Rs 2,050 crore of Gensol's debt to default status in February, covering over Rs 1,640 crore in long-term borrowings and more than Rs 400 crore in short-term debt. The downgrades stemmed from delays in loan servicing and allegations of data manipulation.

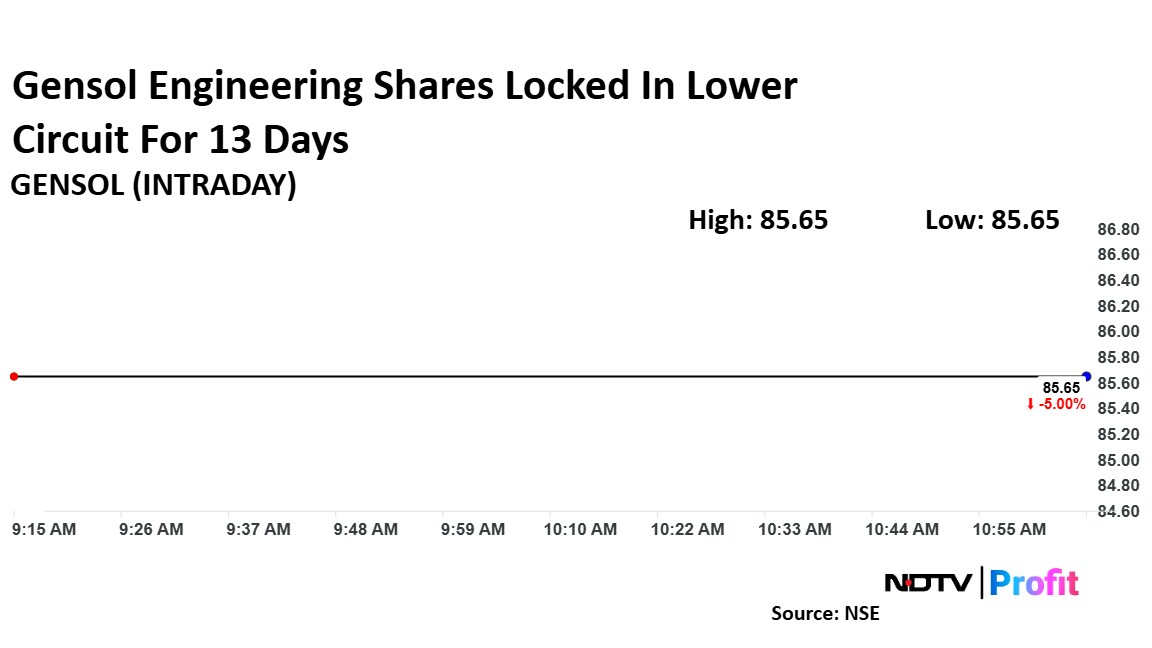

Gensol's Declining Stock Price

Gensol's stock has remained under heavy pressure since February. On Monday, the shares were locked in the 5% lower circuit at Rs 85.65 per share, compared to a 0.96% rise in the NSE Nifty 50. The stock's lower circuit limit was revised to 5% last month.

Over the past year, Gensol shares have plunged 90.92% and they are down 88.91% year-to-date. This month alone, the stock has declined by 51.12% while it has dropped 81.07% since its listing. Trading volumes remain subdued at just 0.1 times the 30-day average, while the relative strength index stands at 7.6, indicating extreme oversold conditions.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.