Major Indian indices continued to trade within a tight range for yet another session. The Nifty 50 index retreated 0.2 percent to close at 8,924. Its March futures added another 1.5 percent to open interest indicating addition of short positions.

The Nifty Bank index advanced 0.3 percent with an addition of 1 percent in its futures open interest reflecting long build up. Foreign institutional investors (FII) bought index futures worth Rs 292 crore on a net basis.

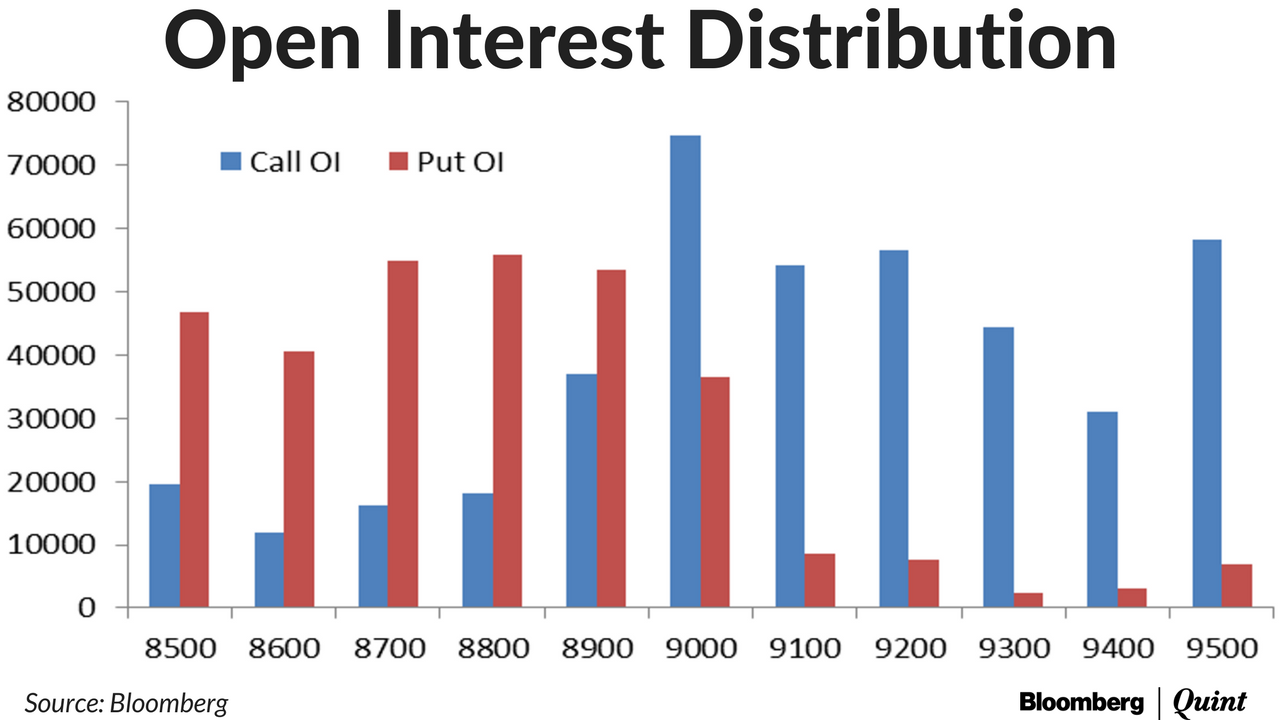

The India Volatility Index (VIX) gained 1.4 percent to close over 14 for the first time in four weeks. Maximum open interest still remains with the 9,000 call and 8,800 put but the 8,700 put is close behind with further accumulation witnessed in the past 3 days. This broadly indicates a near term range for the Nifty.

FIIs add 23,463 index put contracts against 1,823 index call contracts on a net basis. This shows FIIs are bracing for a fall in the indices in the near term.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.