(Bloomberg) -- The Indian central bank's tight grip on the rupee is boosting the allure of the currency for carry trades, according to Fidelity International.

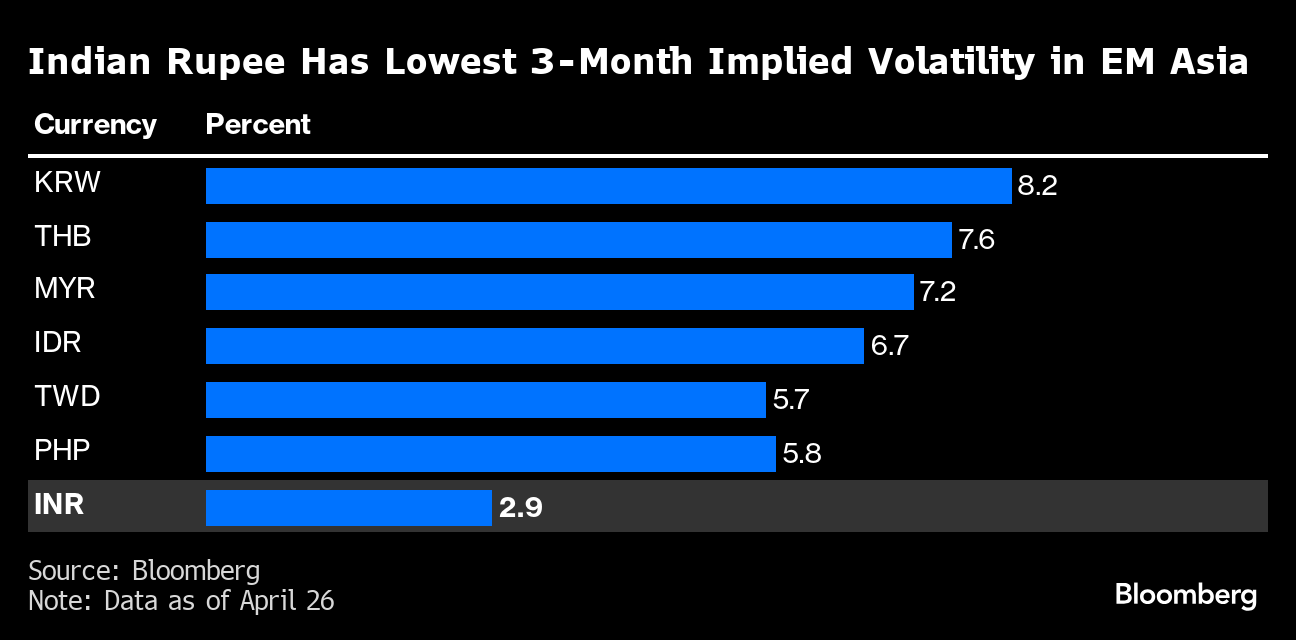

The rupee rewards investors with a high yield than regional peers, and together with low volatility, makes it “arguably one of the most attractive currencies on the planet,” Paul Greer, a money manager at Fidelity in London, said in an interview.

The Indian rupee is among the most stable Asian currencies, thanks to repeated interventions from the Reserve Bank of India, as it seeks to slow its decline near a record low. That strategy has its risks as traders may face losses in case of a sudden policy shift.

“When I look at the Indian rupee, I don't think about it as an appreciation trade,” said Greer. “Because RBI has been so tight on both sides of the range, the carry-to-volatility ratio is what many investors are attracted to.”

Even while the rupee fell to a record in April, it remains the best-performing Asian currency this year. The currency is down just 0.2% against the dollar, while the Indonesian rupiah and Thai baht have declined more than 5%.

Underpinning the appeal of the rupee is that the RBI has kept interest rates unchanged, while some of its Latin American counterparts have been easing policy. The policy divergence has lured overseas funds into India, also driven by the inclusion of Indian bonds into JPMorgan Chase & Co.'s global index.

Read more: HSBC Says India Bonds Set for $100 Billion of Foreign Flows

India's near-record foreign exchange reserves of $643 billion have also given the RBI firepower to intervene and curb rupee swings. The yield on benchmark 10-year bond at about 7.20% is the highest among major Asian markets, luring foreign investors.

“The real benefit of India is the carry, which is why a lot of people like it,” Greer said. “Over the coming months and quarters, many investors will be looking to build or add to exposure in this particular market.”

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.