Share price of Eicher Motors Ltd. has been fluctuating in Thursday's trade after the company posted its financial results for the final quarter of fiscal 2025, posting a rise in net profit despite shrinking margins.

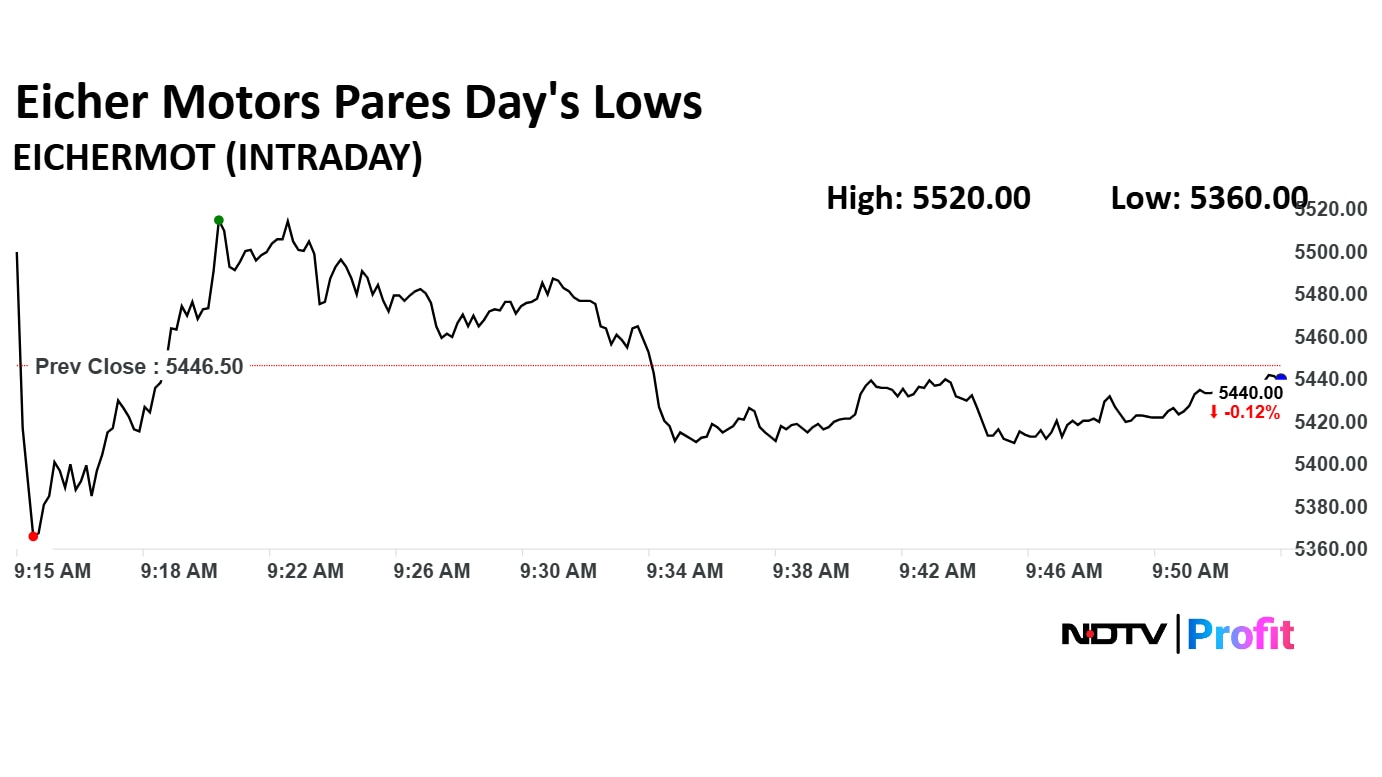

Eicher Motor's share price fell as much as 1.59% through Thursday's trade, but had also risen as high as 1.35% to Rs 5,520 apiece.

Consolidated net profit of the Chennai-based company rose 27.3% year-on-year to Rs 1,362 crore in the three months ended March 31, on the back of revenue that increased 23% to Rs 5,241 crore, according to an exchange filing on Wednesday.

Brokerage firms Citi and Morgan Stanley both agree that Eicher's volume growth is healthy.

Morgan Stanley highlighted that the Ebitda margin of 24% missed their estimate by 100 bps and Bloomberg consensus by 240 bps, marking the second consecutive quarter of margin underperformance. Citi also noted margin pressure, but pointed out that stronger other income helped profit exceed expectations.

Eicher's management is focusing on volume growth over margin expansion. The company is increasing marketing efforts and rolling out product enhancements to drive sales. Citi views this positively, expecting tax cuts and steady rural demand to support further growth in fiscal 2026. Morgan Stanley, however, is more cautious. While it agrees with the growth-first strategy, it believes the stock is already priced for both high growth and high margins.

Eicher Motors Q4 FY25 Results (Consolidated, YoY)

Revenue up 23% at Rs 5,241 crore (Estimate: Rs 5,159.9 crore).

Ebitda up 11.4% at Rs 1,258 crore (Estimate: Rs 1,303.3 crore).

Margin down 250 basis points at 24% (Estimate: 25.25%).

Net profit up 27.3% at Rs 1,362 crore (Estimate: Rs 1,252.3 crore).

Eicher Motors Share Price Today

The scrip fell as much as 1.59% to Rs 5,360 apiece. It pared losses to trade 0.18% higher at Rs 5,456.50 apiece, as of 09:57 a.m. This compares to a 0.39% decline in the NSE Nifty 50 Index.

It has risen 2.91% on a year-to-date basis, and 17.36% in the last 12 months. Total traded volume so far in the day stood at 6.9 times its 30-day average. The relative strength index was at 50.52.

Out of 40 analysts tracking the company, 20 maintain a 'buy' rating, 13 recommend a 'hold' and seven suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 0.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.