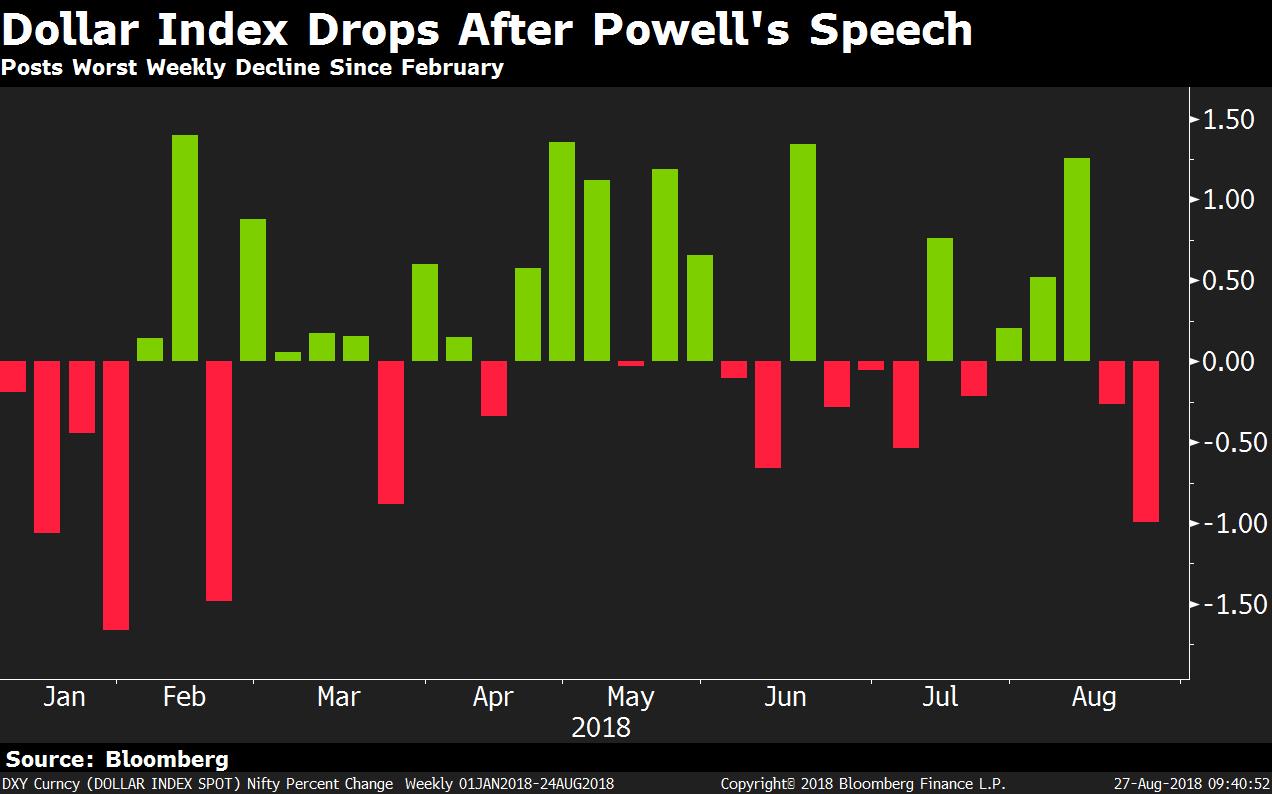

The dollar index fell for the second week in a row on Friday, its worst weekly decline since February, after Federal Reserve Chair Jerome Powell said steady rate hikes are the best way to protect the U.S. economic recovery for now.

The index, which measures the greenback's strength against a basket of six major currencies, was down close to 1 percent last week and is trading around the 95-mark.

Powell, however, said the Fed funds rate was getting closer to neutral and there is no sign of inflation moving beyond the central bank's target. Gradual interest rate hikes remain appropriate and there is no risk to the economy overheating, he said, adding he was prepared to do "whatever it takes" to prevent inflation from becoming unanchored in either direction. The strong momentum in the economy is expected to continue, the Fed chair said at the Kansas City Federal Reserve's annual monetary policy symposium in Jackson Hole.

“Powell undermined the threat of an inflation overshoot and this caused the U.S. 10-year spread to narrow to under 20 basis points and the dollar index to weaken. There is still considerable uncertainty around hikes in 2019 and regarding the nominal neutral rate,” Abhishek Goenka, founder and chief executive officer at India Forex Advisors, said.

The market will await summary economic projections to build a view on hikes in 2019 as two hikes for this year are already priced in. This will determine the overall trend for the dollar index.Abhishek Goenka, CEO, India Forex Advisors

The greenback took a hit after minutes from the Fed's meeting hinted at a further rate hike and revealed concerns over escalating trade wars that could harm the U.S. economy. The latest round of U.S.-China trade talks wrapped up on Thursday with no signs of progress.

The dollar index, Goenka said, is expected to find support at 94.80 in the short term. “A break above 95.70 could result in a fresh attempt at 97.00.”

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.