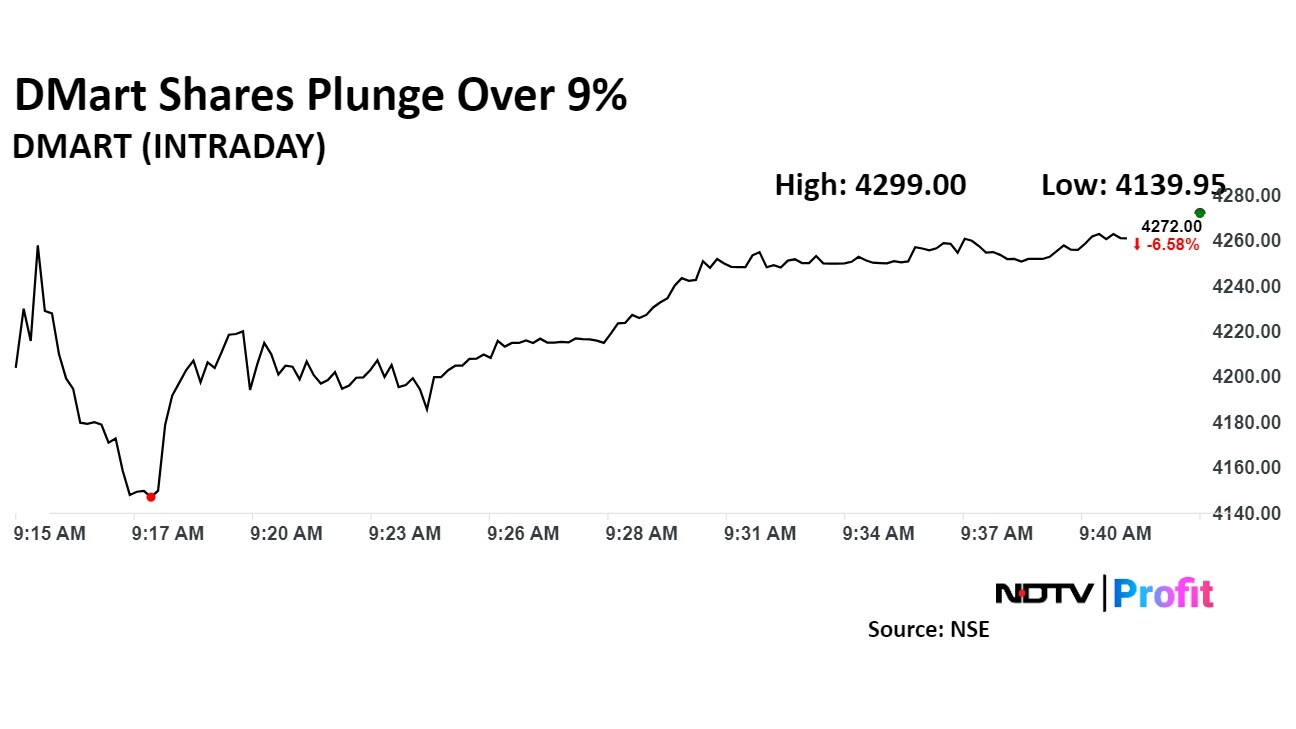

Following a disappointing September quarter, shares of Avenue Supermart Ltd. declined over 9% on Monday. The DMart operator posted a 5.8% year-on-year rise in net profit for the second quarter. However, the profit missed analysts' expectations, reinforcing pre-result concerns from brokerages.

On top of this, Trent Ltd. surpassed DMart to become the top Indian retailer in market cap realisation, after the latter's shares tumbled. The market cap of DMart fell 7.8% to Rs 2.74 lakh crore as of 10:05 a.m. The Westside retailers' market cap stood at Rs 2.95 lakh crore.

Avenue Supermart Q2 FY25 Key Highlights

Net Profit at Rs 659.44 crore, up 5.8% YoY (estimate: Rs 812 crore).

Revenue at Rs 14,444.50 crore, up 14.4% YoY (estimate: Rs 14,597 crore).

Ebitda at Rs 1,093.77 crore, up 8.8% YoY.

Ebitda margin at 7.6%, down from 8% last year (estimate: 8.3%).

Analysts pointed out that sluggish store expansion and rising competition from quick commerce platforms like Blinkit are putting pressure on Avenue Supermarts' performance. With the quick commerce sector gaining momentum, the company faces increasing pressure to stay competitive.

To address this, analysts recommend that Avenue Supermarts accelerate its store expansion and strengthen its digital grocery platform, DMart Ready, to keep up with rivals like Blinkit.

Avenue Supermarts Share Price Today

Avenue Supermarts Share Price Today

Avenue Supermarts' share price fell as much as 9.46% during the day before paring loss to trade 7.58% lower at Rs 4,226 apiece, compared to a 0.56% advance in the benchmark Nifty 50 as of 9:50 a.m.

The stock has risen 10.28% in the last 12 months and 4.17% on a year-to-date basis. Total traded volume so far in the day stood at 20 times its 30-day average. The relative strength index was at 24.26, indicating that the stock is oversold.

Nine of the 27 analysts tracking DMart have a 'buy' rating on the stock, eight recommend a 'hold' and 10 suggest a 'sell', according to Bloomberg data. The average of 12-month analysts' price target implies a potential upside of 10%.

Brokerages On DMart

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.