The shares of Dalmia Bharat Sugar and Industries Ltd. rose on Wednesday to hit a five-month high after its fourth-quarter profit more than doubled.

The company recorded a consolidated net profit of Rs 206 crore for the quarter ended March, compared to Rs 91 crore in the same quarter of the previous fiscal year, according to its stock exchange notification.

Revenue increased by 35.6% year-on-year for the three months ended March, reaching Rs 1,017 crore. The surge in revenue was on the back of 43.15% jump in distillery revenue to Rs 345 crore in comparison to Rs 241 crore. Revenue from the sugar segment rose by 32.42% at Rs 878 crore in comparison to Rs 663 crore posted in the same period of the previous fiscal.

Operating income, or earnings before interest, taxes, depreciation, and amortisation, rose 63.02% year-on-year to Rs 194 crore. The Ebitda margin expanded by 320 points to 19.07%. The rise in Ebitda comes as other expenses fall by 15% and cost of materials reduces by 2%.

The strong performance was also due to record-high average sales realizations and strong revenue from operations. Sugar sales for the quarter ended March stood at 1.5 LMT, with the exports contributing 0.1 LMT, which is approximately 9% of the total volume.

In addition, the company also benefited from favourable market environment and achieved an average sugar net selling price of Rs 38.9 per kg. This is 5% higher than the average selling price in the same period last year.

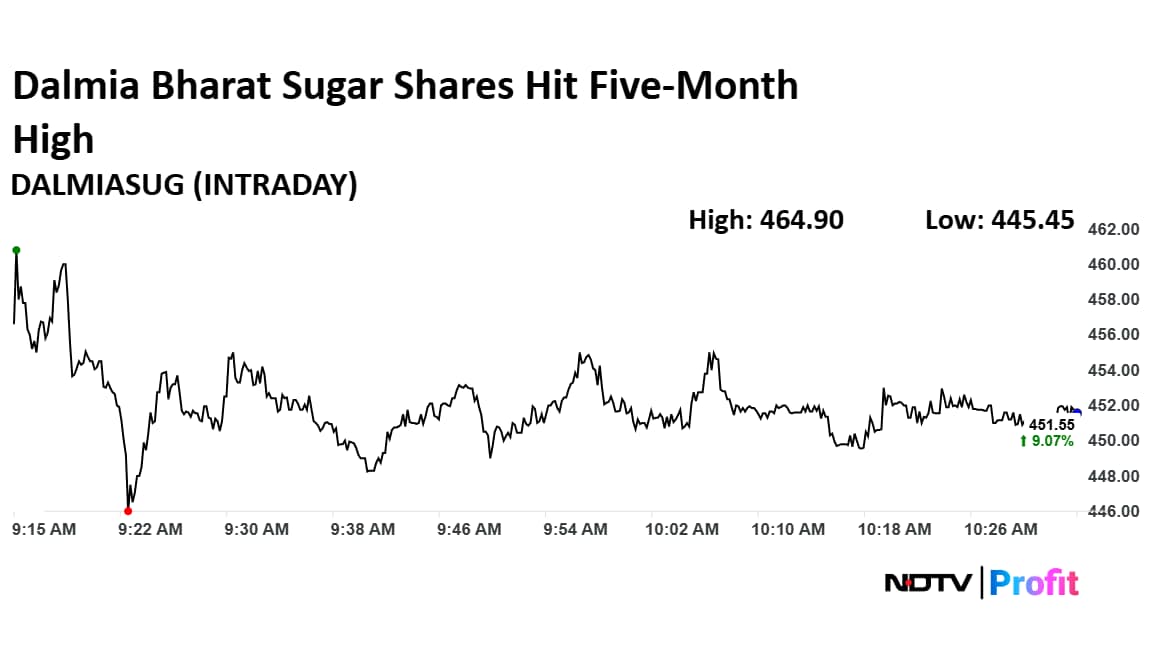

Dalmia Bharat Sugar Share Price Rises

The shares of Dalmia Bharat Sugar rose as much as 12.29% to Rs 464.90 apiece, the highest level since Dec. 11. The stock pared gains to trade 9.15% higher at Rs 451.90 apiece, as of 10:33 a.m. This compares to a 0.60% advance in the NSE Nifty 50 Index.

It has risen 18.84% in the last 12 months and 24.16% year-to-date. Total traded volume so far in the day stood at 33 times its 30-day average. The relative strength index was at 43.32.

The one analysts tracking the company maintains a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an upside of 32.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.