CreditAccess Grameen Ltd. shares soared after the company released its interim business update. As of February 2025, the gross loan portfolio grew 2.4% against December last year. The Karnataka portfolio grew 1% versus December 2024. Over 1.5 lakh new borrowers were added during January 2025 and February 2025.

The portfolio at risk, excluding Karnataka, stood at 7.3% against 8% earlier. And the total portfolio at risk was at 7.5% against 6.8% previously.

Collection efficiency in Karnataka is improving now and the situation is expected to normalise over one to two months. Loan growth looks healthy in most states, and Karnataka's loan growth slowed on poorer asset quality, the company said.

In Karnataka, delinquencies rose in January and February owing to operational uncertainties. The situation is gradually stabilising and should normalise in the next one to two months, it said.

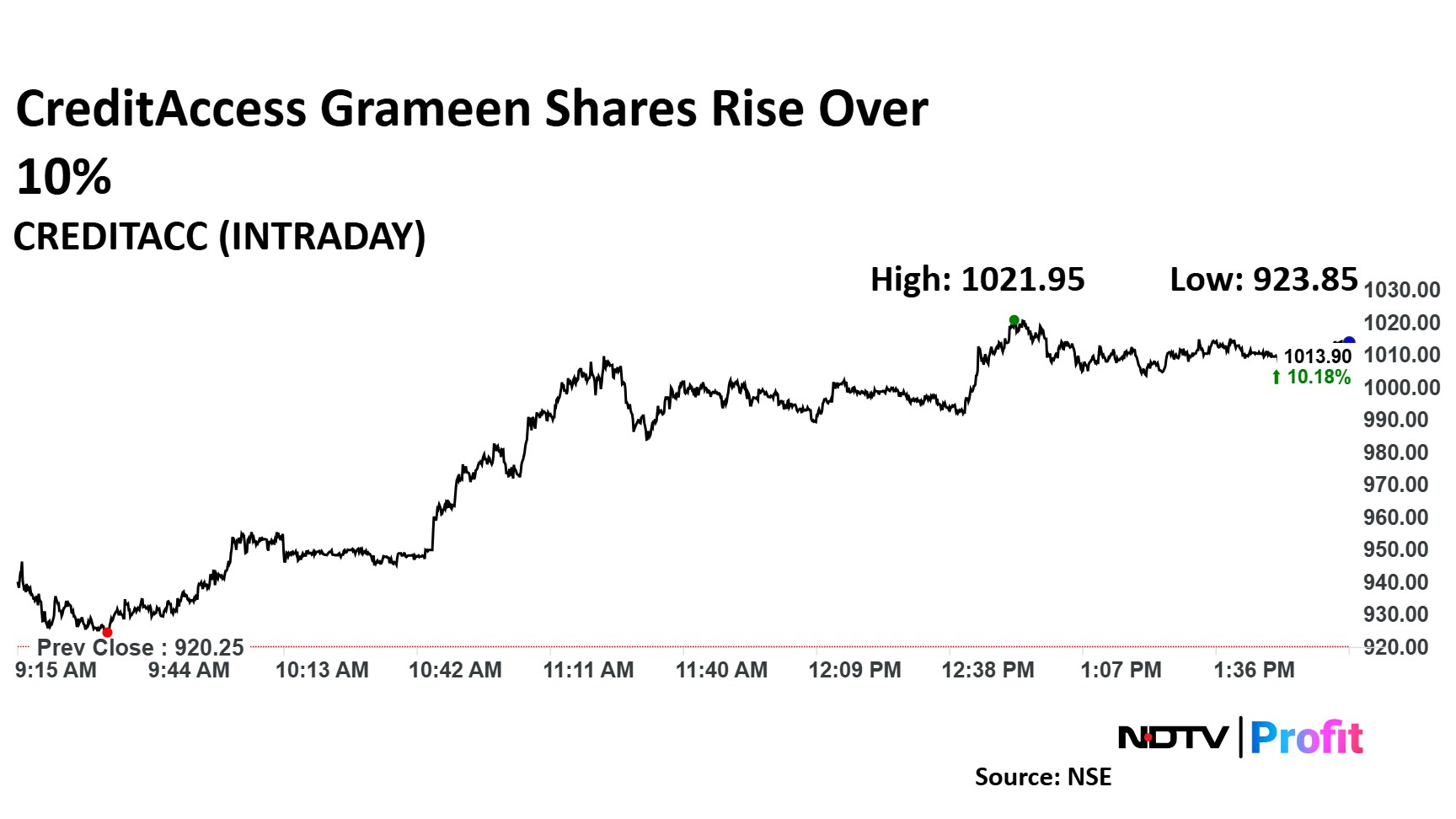

CreditAccess Share Price

CreditAccess Grameen stock rose as much as 11.05% during the day to Rs 1,021.9 apiece on the NSE. It was trading 10% higher at Rs 1,012.2 apiece, compared to a 0.80% advance in the benchmark Nifty 50 as of 2:42 p.m.

It had fallen 26.83% in the last 12 months. Total traded volume so far in the day stood at three times its 30-day average. The relative strength index was at 56.4.

Thirteen of the 18 analysts tracking the company have a 'buy' rating on the stock, three recommend a 'hold' and two suggest a 'sell', according to Bloomberg data. The 12-month analysts' consensus target price on the stock is Rs 1,025.7, implying an upside of 1.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.