Investors should focus on long-term structural themes to offset high valuations and the volatile macroeconomic environment in India. That's the advice Credit Suisse has for 2018.

Indian equities are unlikely to see any sharp or prolonged correction, thanks to strong fund flows, Jitendra Gohil, the head of India equity research for Credit Suisse, wrote in a note to clients. Investors can potentially outperform the market in the medium term, if they build their portfolios around five themes that have been shaping up in India, the brokerage said.

Here are the five themes identified by Credit Suisse:

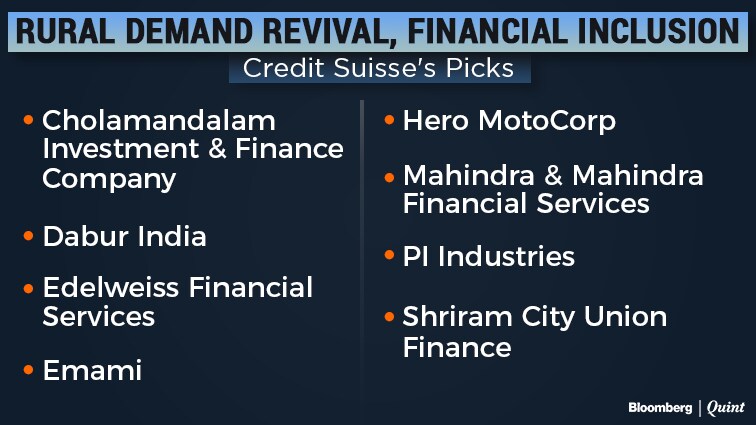

1. Rural Demand Revival, Financial Inclusion

Rationale: Credit Suisse is positive on demand revival in rural and semi-urban areas, which is further supported by improving access to finance. It believes that the government could take measures in the rural economy ahead of the 2019 general elections.

Also Read: Consumer Stocks Rally Likely To Continue In 2018. CLSA Tells Why

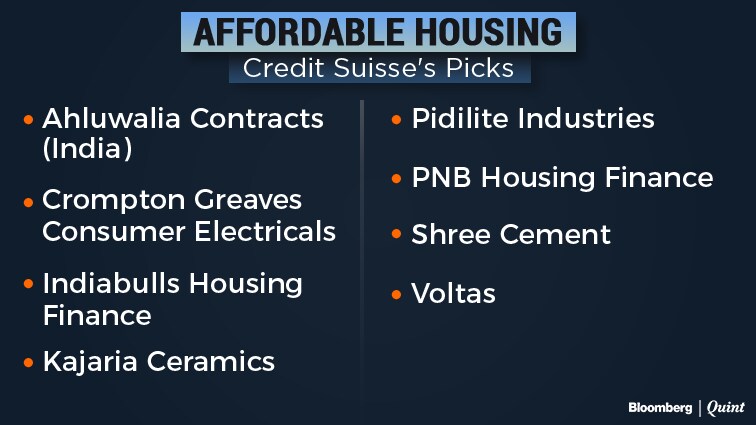

2. Affordable Housing

Rationale: Credit Suisse expects the government to accelerate spending on affordable housing and help create job opportunities in the construction sector.

3. Infrastructure Focus To Continue

Rationale: Accelerated spending along with policy support and international financing could potentially transform India's infrastructure landscape.

Stocks for the theme:

- Dilip Buildcon Ltd.

- KEC International Ltd.

- Larsen & Toubro Ltd.

- Sadbhav Engineering Ltd.

- Tata Steel Ltd.

- VA Tech Wabag Ltd.

Also Read: L&T Wins Rs 2,100 Crore Contracts From HPCL, Reliance Industries

4. Energy Sector Continues To Attract Attention

Rationale: The government is likely to provide a favorable policy framework to attract more investment and improve energy infrastructure in India for curbing imports and moving toward energy independence.

Stocks for the theme:

5. NPA Resolution To Accelerate

Rationale: Public sector bank's recapitalisation plans along with progress on resolution of most stressed accounts would aid non-performing asset resolution to accelerate.

Stocks for the theme:

Also Read: India Takes Step to Fix Bank System With $12.6 Billion Bond Plan

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.