- CLSA initiated coverage on Coforge with an outperform rating and Rs 2,346 target price

- Coforge shares rose nearly 4% to Rs 1,611 on NSE amid positive broker commentary

- The company has strong leadership, good governance, and high ESG scores, says CLSA

Coforge shares have risen nearly 4% in trade so far after bullish commentry from brokerages. CLSA has initiated coverage on Coforge, issuing an 'outperform' rating by highlighting the company's 'able leadership' and strong execution under the current management.

The brokerage firm issued a target price of Rs 2,346, which implies an upside of over 50% from yesterday's closing price of Rs 1,547.

The brokerage firm stressed that Coforge, one of India's top ten IT firmsm has an able leadership, well incentivised with ESOPs and a strong track record. The company has also seen strong execution under current Chief Executive Officer Sudhir Singh.

Additional positives for Coforge include a strong governance framework and high ESG scores. CLSA believes the company is well-positioned to gain from structural IT demand, even though the industry has faced a myriad of macro issues in the recent past.

“With its industry-leading order book, consistent strategy and strong leadership, Coforge is on track to deliver healthy growth,” CLSA wrote in the report.

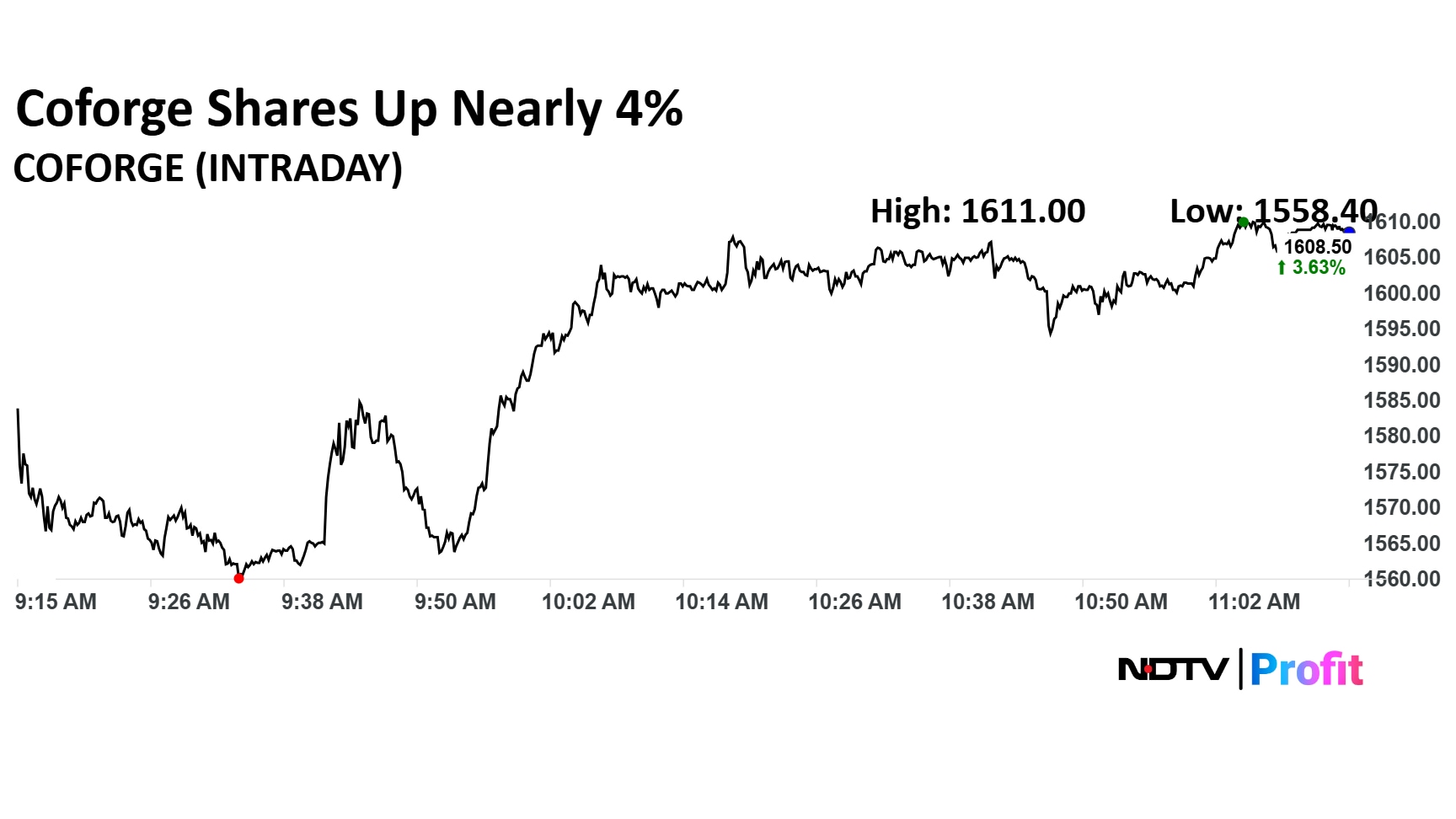

Coforge Share Price

Coforge stock rose as much as 3.79% during the day to Rs 1,611 apiece on the NSE. It was trading 3.70% higher at Rs 1,609 apiece, compared to an 0.15% advance in the benchmark Nifty 50 as of 11:36 a.m.

It had declined 77.14% in the last 12 months and 83.43% on a year-to-date basis. The total traded volume so far in the day stood at seven times its 30-day average. The relative strength index was at 41.08.

Twenty eight out of the 39 analysts tracking the company have a 'buy' rating on the stock, four recommend a 'hold' and seven suggest a 'sell', according to Bloomberg data. The 12-month analysts' consensus target price on the stock is Rs 1,895, implying a upside of 18.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.