- Coal India approved Rs 10.25 interim dividend per share for FY 2026 second interim payout

- Q2 revenue fell 15.8% to Rs 30,187 crore, below Bloomberg's Rs 30,394 crore estimate

- Net profit dropped 50.2% to Rs 4,354 crore due to lower income and higher inventory

Coal India's board has approved Rs 10.25 interim dividend per share alongside the release of its second-quarter result. It's the second interim dividend for the financial year 2026.

Audit Committee of Coal India at its meeting held on Oct 29 recommended Rs 10.25 per equity share with the face value of Rs 10. The board has fixed Nov 4 as the record date for the purpose of determining the eligibility of shareholders for the dividend payout.

Coal India will complete the payment of the second interim dividend by Nov 28.

Coal India Q2 Earnings Key Highlights (QoQ)

Revenue down 15.8% to Rs 30,187 crore versus Rs 35,842 crore (Bloomberg Estimate: Rs 30,394 crore).

Ebitda down 46.4% to Rs 6,716 crore versus Rs 12,521 crore (Bloomberg Estimate: Rs 8,409 crore).

Margin at 22.2% versus 34.9% (Bloomberg Estimate: 27.7%).

Net profit down 50.2% to Rs 4,354 crore versus Rs 8,743 crore (Bloomberg Estimate: Rs 5,692 crore).

The decline in net profit was led by lower operating income and higher inventory build-up.

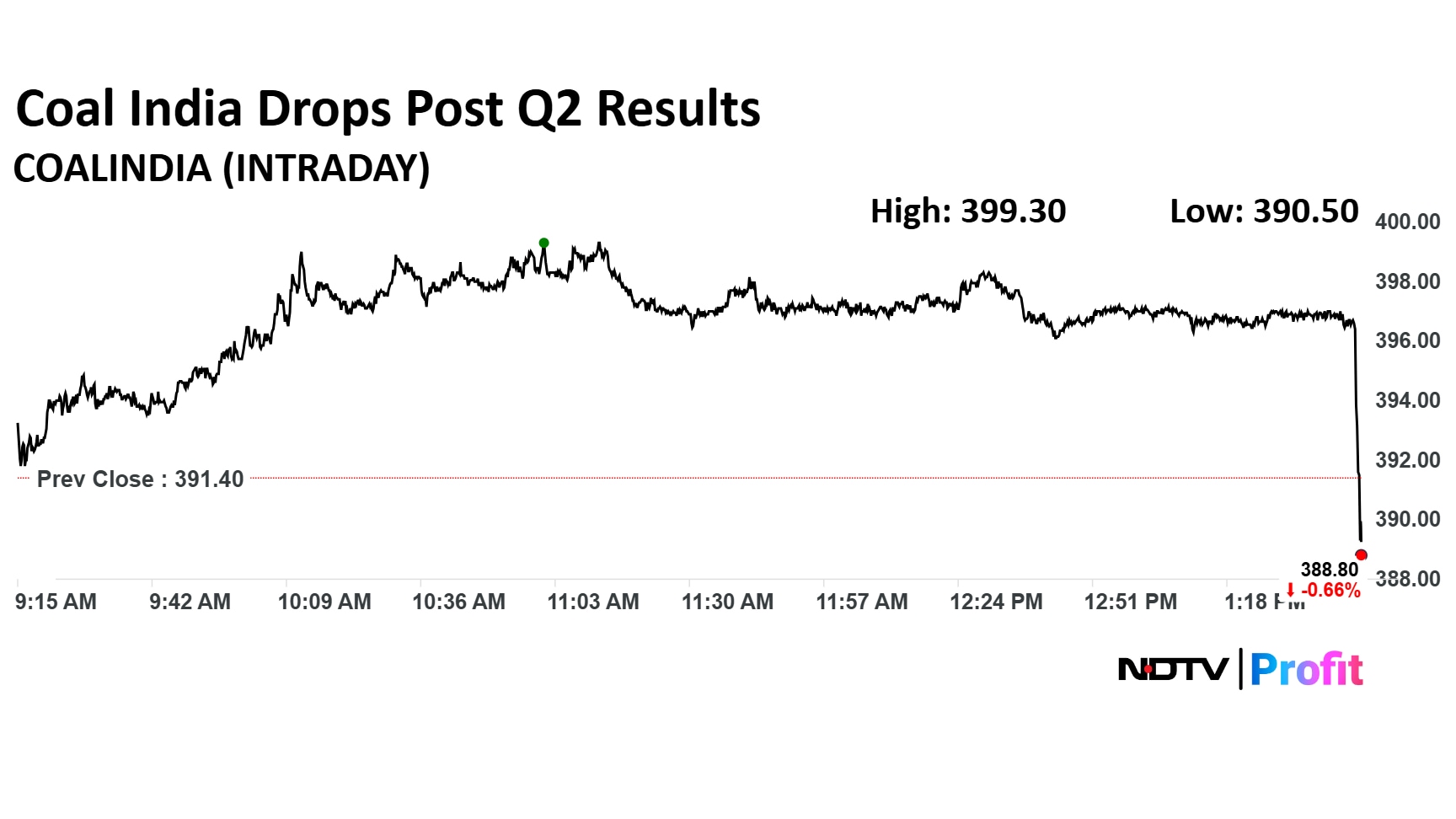

Stock Price Movement

Coal India share price declined 2.49% to Rs 390.50 apiece, the lowest level since Oct 15. It was trading 2.01% down at Rs 383.25 apiece as of 2:07 p.m., as compared to 0.40% advance in the NSE Nifty 50 index.

The stock declined 13.96% in 12 months, and 0.14% on year-to-date basis. Total traded volume so far in the day stood at 4.9 times its 30-day average. The relative strength index was at 42.62.

Out of 25 analysts tracking the company, 16 maintain a 'buy' rating, five recommend a 'hold' and four suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 6.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.