.jpg?downsize=773:435)

India's macros are a concern even as the country's most popular stock benchmark touched a fresh all-time high. That's according to brokerage CLSA's India Strategist, Mahesh Nandurkar.

The S&P BSE Sensex climbed 1.2 percent to 36,699.53 driven by refining stocks, as a decline in crude oil prices lowered their costs.

The optimism was also fuelled by the promising start to the first-quarter earnings season with Sensex members Tata Consultancy Services Ltd. and IndusInd Bank Ltd. reporting a good set of numbers. While the private lender reported stable asset quality, India's largest software exporter's profit grew more than 6 percent.

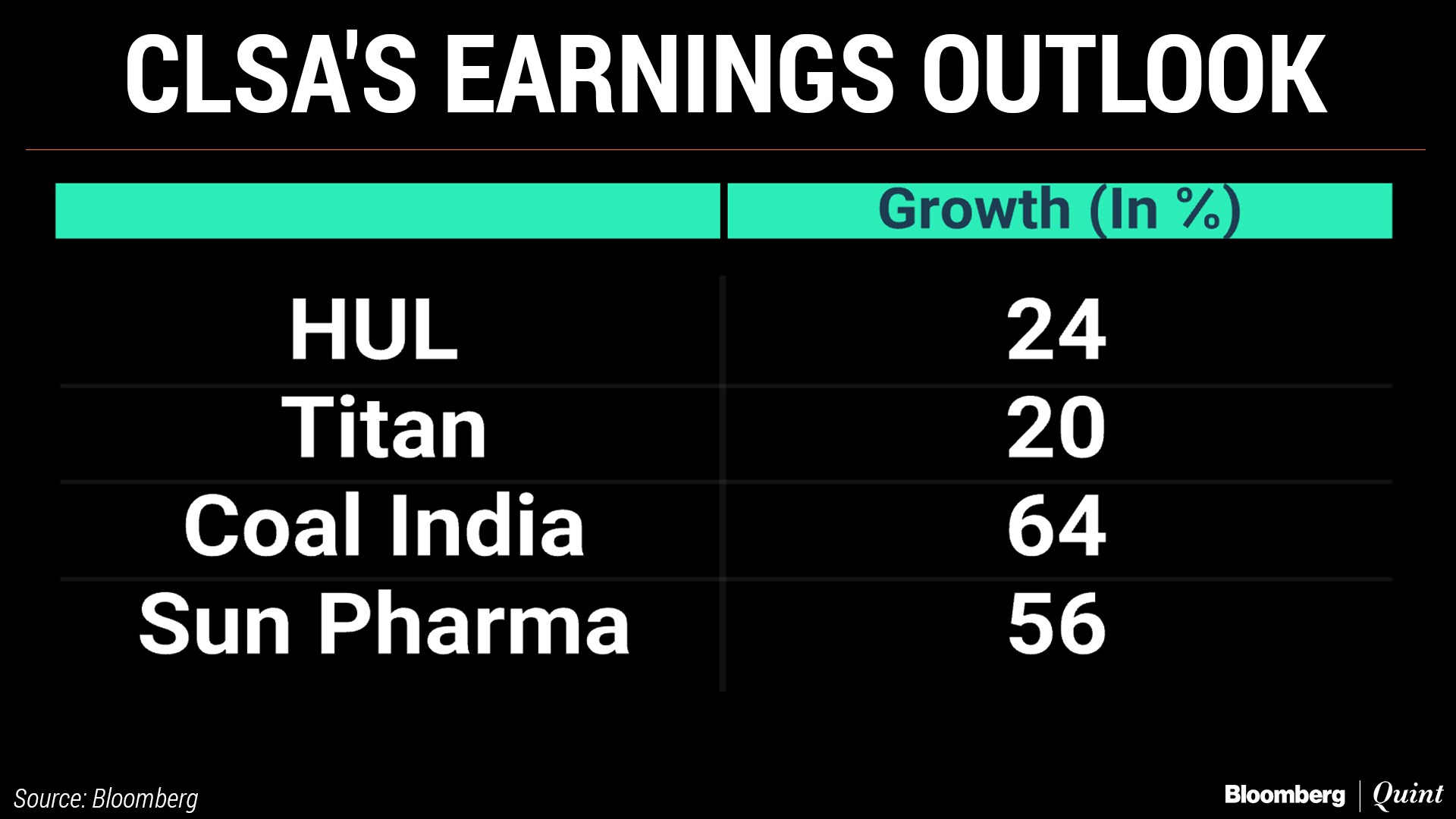

India Inc.'s earnings will grow by 18-20 percent in the first quarter of the current financial year, according to Nandurkar, after several quarters of muted growth.

“We are expecting more than 20 percent earnings growth for the [pharma] sector.”

Here are the key highlights from the conversation and CLSA's report.

- Seeing improvement in corporate earnings.

- Good earnings expected from auto, consumer and media sectors.

- Earnings decline expected for telecom and cement.

- IT and pharmaceutical sectors likely to benefit from forex tailwinds.

- Bullish on pharmaceutical and healthcare stocks with a double overweight rating.

- Believe real estate has bottomed out and should improve in second half of FY19.

- Expect financials to report weak numbers, around 90 percent earnings declined, year-on-year.

- Oil public sector units' profits likely to double, YoY.

- Expect Bharti Airtel Ltd. and Idea Cellular Ltd. to report loss.

- Expect profit decline for Adani Ports & SEZ Ltd. due to market-to-market loss on foreign debt.

- Profit for cement companies expected to decline 37 percent, YoY.

- Short duration debt markets look more attractive.

- Would not rule out 10-year yield touching 8 percent.

- Expect more than one rate hike this year.

- Have seen some slowdown in domestic inflows.

- Emerging market funds seeing some outflows including from India.

- Large-cap stocks have been the point of attraction for FIIs.

- Expect another two to four rate hikes by the U.S. Federal Reserve over the next 12-18 months.

- Valuation of tobacco stocks looks attractive.

- Evidence of revival in U.S. BFSI space positive for IT companies.

- Maintain neutral stance on IT.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.