(Bloomberg) -- Traders are ignoring the risk of a higher-than expected peak in US interest rates that may result in a painful selloff in both bonds and equities, according to Citigroup Inc.'s head of Asia Pacific trading strategies.

Stocks across markets from the US to Europe, Hong Kong to Korea look overpriced and set to fall in the next three-to-four months, with the dollar primed to rise alongside rate hike expectations, according to Mohammed Apabhai. Fair value on the S&P 500 will drop below 3,500 this year — a decline of about 15% from current levels — and the Hang Seng Index is expected to give back its year-to-date gains and fall further, he said.

“To be bullish on equities here you'll need to see the dollar fall another 10% from here and that will be difficult if the Fed is going to be raising rates in a way that the market doesn't expect,” he said in an interview in Hong Kong. “What I'm advocating is to continue selling on equity rallies.”

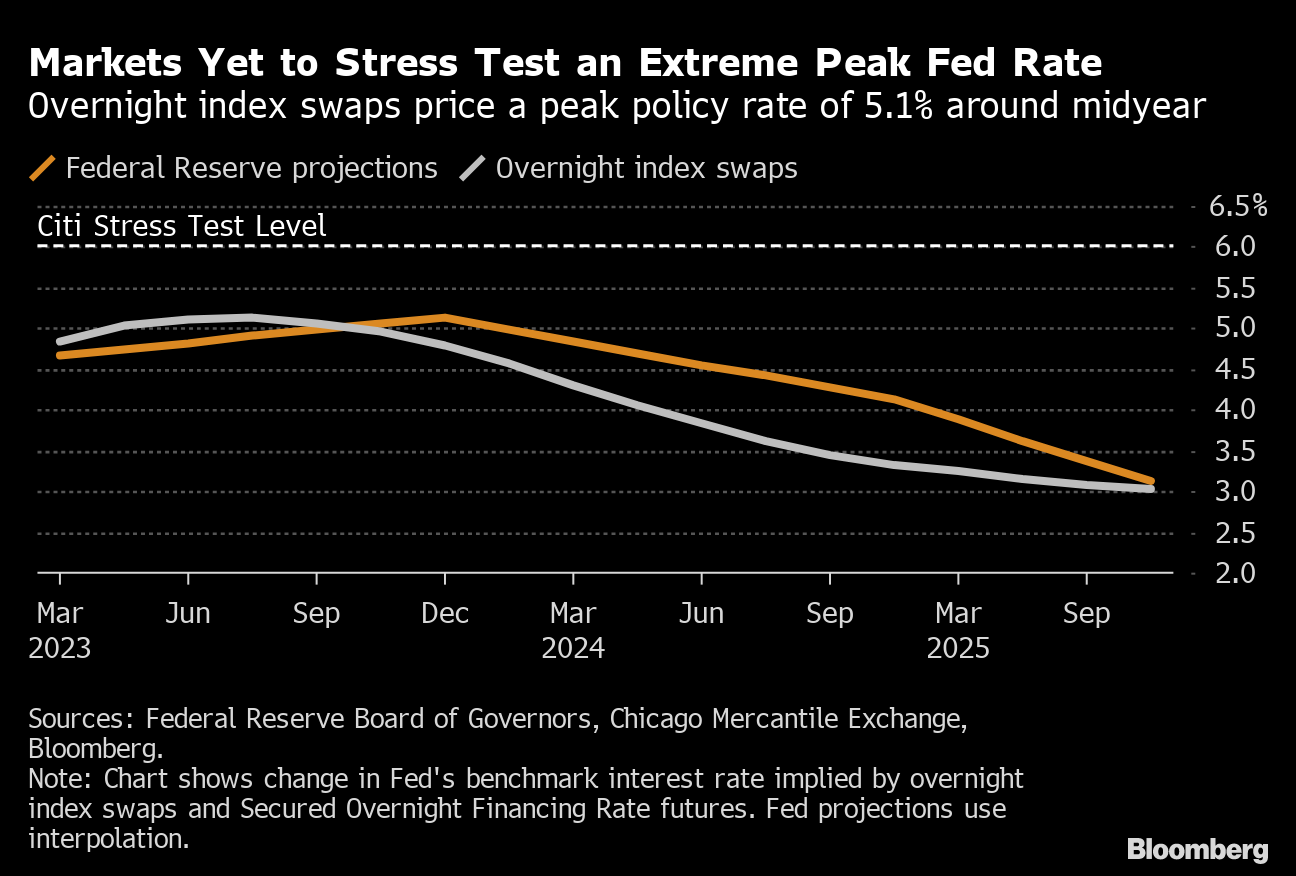

The Hong Kong-based strategist said one risk the market hasn't priced in yet is US interest rates at 6%.

Bond traders have reacted to a slew of recent hawkish commentary from Federal Reserve officials, but have only priced in peak rates of just over 5% later this year, a level in line with policy maker projections. Investors are still wagering that a US recession will lead to a Fed pivot to rate cuts by the end of 2023.

“I think the forward curve market is frankly incorrect,” Apabhai said. “If anything the rates market is too dovish, but the low in rates is likely to come after an extreme point on the hawkish side. The market has not stress tested that possibility yet.”

Bond Traders Quickly Come Around to Fed's View on Peak for Rates

Although Apabhai is a bond bull, he said it's premature to buy Treasuries until 10-year yields are back above 4.25%. He sees a step up in the pace of quantitative tightening which would turbocharge the dollar and weigh on emerging-market assets.

“We don't think opportunities in Chinese bonds or Asian EM bonds are looking as attractive as they were when you thought the dollar was going to be weaker,” he said. “Bearishness in the dollar is over.”

Chinese securities face additional pressure from the rise in geopolitical risk, he added.

“At the moment we have a lot of contradictions that are sitting in the market,” Apabhai said. “The adjustment process could be a painful one for rate, bond and equity markets.”

--With assistance from .

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.