Ceat Ltd. share price surged almost 12% to a fresh life high in early trade on Monday. The surge followed brokerages' forecasts of improvement in the company's market share after it acquires Camso's off-highway construction equipment tyre and tracks business from the Michelin Group for $225 million.

Ceat's board gave its approval for entering into definitive agreements with associate companies in Michelin for the acquisition through one or more subsidiaries to be incorporated by the company, Ceat said in its exchange filing on Friday.

With the acquisition, the company expects to gain the ability to widen its product base into tracks and construction tyres. It will also result in "immediate access to a global customer base", including international original equipment manufacturers and premium international off-highway tyre distributors, Ceat said.

Margins from this acquisition are expected to be higher than current business, Kumar Subbiah, chief financial officer at Ceat, told NDTV Profit in a televised interview.

The acquisition enhances the off-highway tyre scale, and will nearly double the OHT revenue, Emkay Research said in a note, while retaining its 'buy' rating. The deal also enhanced Ceat's capabilities and complements its existing wide range of agriculture tyres, it said.

The brokerage has a target price of Rs 3,650 per share for the Ceat stock, implying an upside of 18% from the previous close.

The Michelin deal will help Ceat further bolster its presence in the global OHT segment, Motilal Oswal said in a note. Management has "strategically focused" on increasing its share in segments and reduce reliance on the truck segment, it said. The brokerage maintained 'buy' on Ceat at Rs 3,096 per share target.

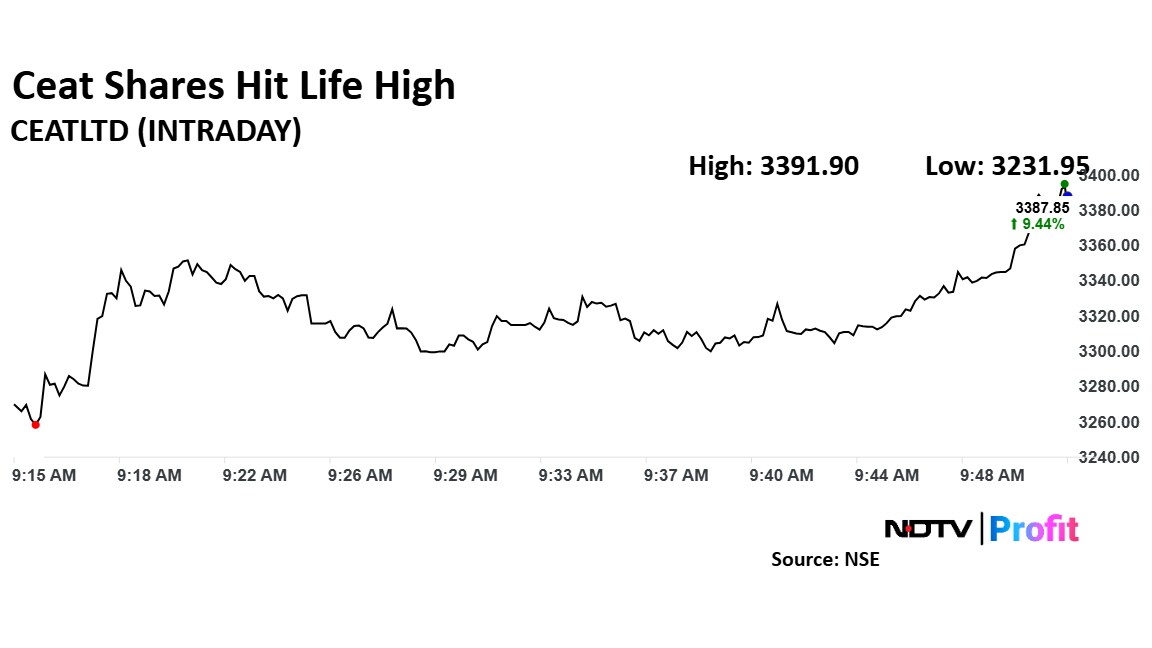

Ceat's stock rose as much as 12.06% in early trade today to a life high of Rs 3,469 apiece on the NSE. It was trading 11.02% higher at Rs 3,437 apiece, compared to a 0.06% decline in the benchmark Nifty 50 as of 12:19 p.m.

It has risen 50% during the last 12 months and has advanced by 41% on a year-to-date basis. Total traded volume so far in the day stood at 37 times its 30-day average. The relative strength index was at 76, indicating that the stock is overbought.

Fifteen of the 23 analysts tracking Ceat have a 'buy' rating on the stock, three suggest a 'hold' and five have a 'sell', according to Bloomberg data. The average of 12-month analysts' price target implies a potential downside of 2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.