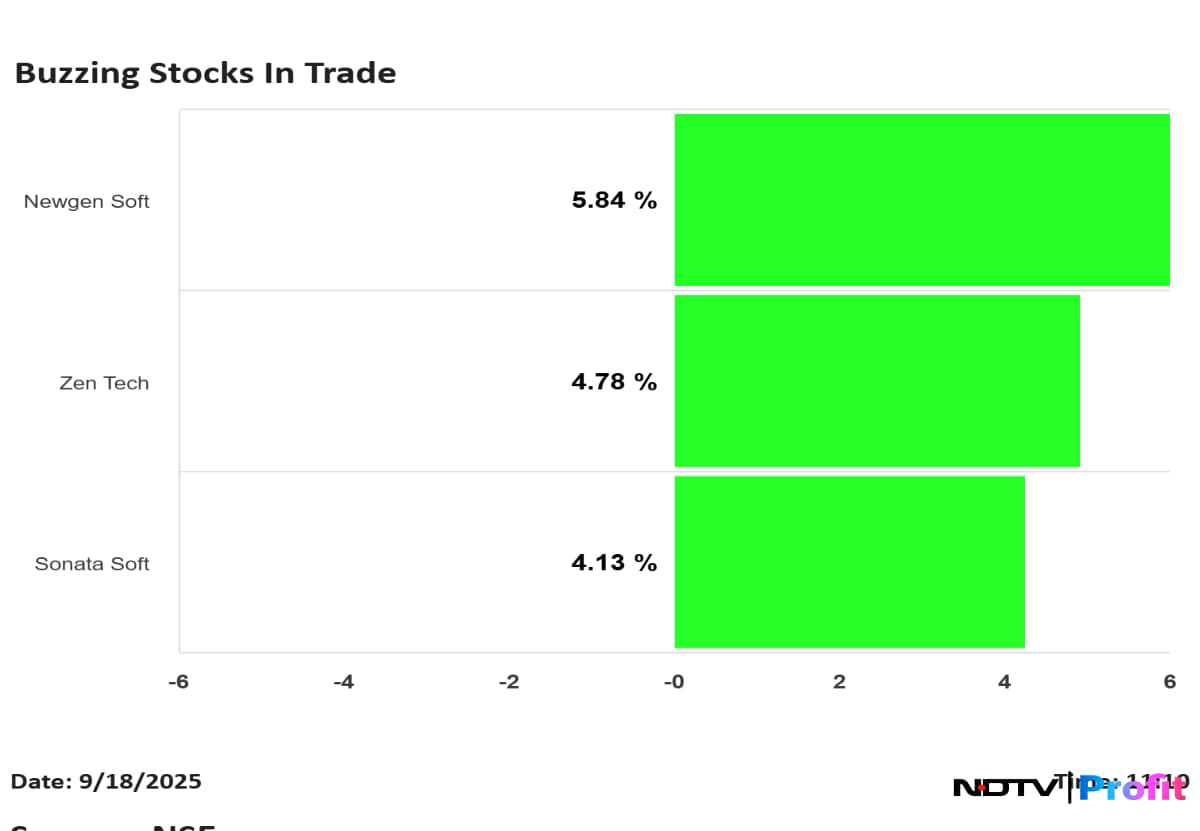

On Thursday, Sonata Software Ltd., Newgen Software Ltd., and Zen Technologies Ltd. made gains ranging between 5% and 8%, as these were the stocks buzzing in trade.

Sonata Software rose as much as 8.02% to trade higher at Rs 421.50 intraday. This marks the second day of gains for the stock, which closed 3% higher on Wednesday after hitting an intraday high of 5.25%.

Similarly, Newgen Software has gained 7.05% intraday to trade higher at Rs 947 apiece on Sept. 18; the stock closed 0.07% lower on Wednesday.

Both the technology stocks managed to outperform the Nifty IT index on Thursday, which was at an intraday high of 1.70%.

Overall, both benchmark indices, Nifty 50 and Sensex, traded nearly half a percent higher after the US Federal Reserve resumed its much-awaited rate-cut cycle after nine months, slashing the benchmark lending rates by 25 basis points. The key rates were readjusted to 4–4.25%.

Meanwhile, Zen Technologies Ltd's shares rose 5% intraday to trade at Rs 1,621.30.

The Fed is also likely to remain on the rate cut trajectory for the remainder of the calendar year, as its median projection shows half-a-percentage point or more of rate trimming in 2025.

For Sonata Software, out of 11 analysts tracking the company, eight maintain a 'buy' rating, three recommend a 'hold', and none suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 6.9%.

Meanwhile, for Newgen Software, out of eight analysts tracking the company, two maintain a 'buy' rating, three recommend a 'hold', and three suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 11%.

Out of seven analysts tracking the company, four maintain a 'buy' rating, three recommend a 'hold', and none suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 17.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.