BSE Ltd.'s share price hit the lowest level in one month on Tuesday as concerns continued to fuel about the impact of a bar on Jane Street Group. The Securities Exchange Board of India barred the US-based trading group from participating in any kind of market activity in Indian financial markets after accusing it of market manipulation.

Although Goldman Sachs is expecting limited impact on BSE, it has reduced the target price to Rs 2,300 from Rs 2,430 for the stock.

SEBI has also directed impounding Rs 4,844 crore from Jane Street, which the group has decided to contest in Securities Appellate Tribunal. Jane Street Group has denied allegation of the Indian markets regulator.

This is the first time SEBI has taken such an action against any foreign entity. It has also raised questions over market volumes and earnings for key market structure providers.

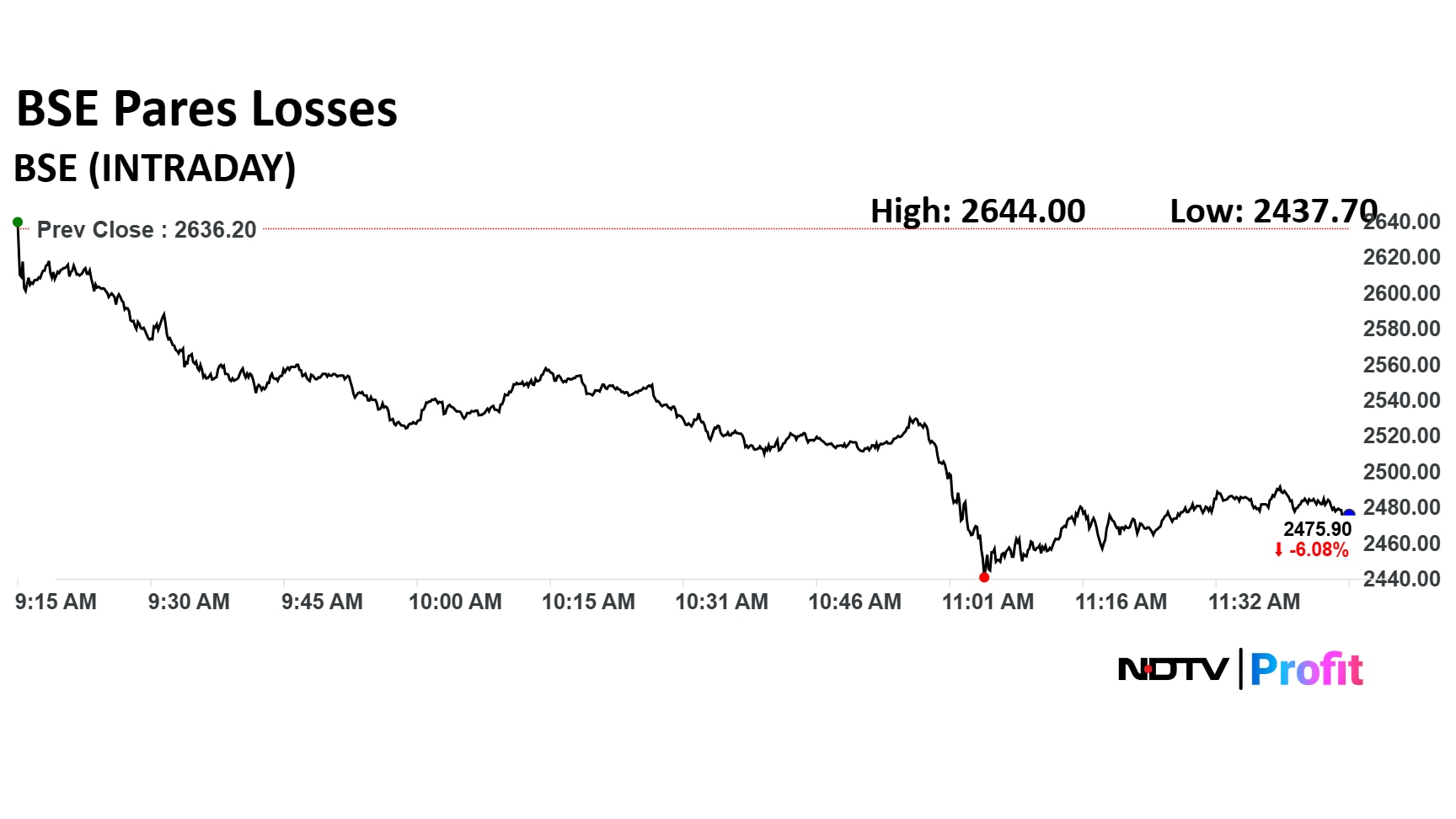

BSE Share Price Today

BSE share price declined 7.53% to Rs 2,437.70 apiece, the lowest level since May 29. The share price was trading 6.48% down at Rs 2,465.20 apiece as of 11:48 a.m., as compared to a 0.09% decline in the NSE Nifty 50.

The stock advanced 211.05% in 12 months and 39.12% on year-to-date basis. Total traded volume so far in the day stood at 2.0 times its 30-day average. The relative strength index was at 36.49.

Out of 14 analysts tracking the company, nine maintain a 'buy' rating, four recommend a 'hold' and one suggests 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 1.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.