Capital market-linked stocks BSE Ltd. and CDSL Ltd. witnessed a selloff on Thursday after a top SEBI official said it is planning to raise tenure and maturity for equity derivatives.

SEBI Chairperson Tuhin Kanta Pandey stated at an industry event in Mumbai that the market regulator is looking into the derivatives contract durations and will make changes after a consultative process.

Pandey said the SEBI is looking to improve tenure and maturity of equity derivative contracts and hinted that a consultation paper will come on the same. He also said that the cash market has deepened and the volume has doubled in three years.

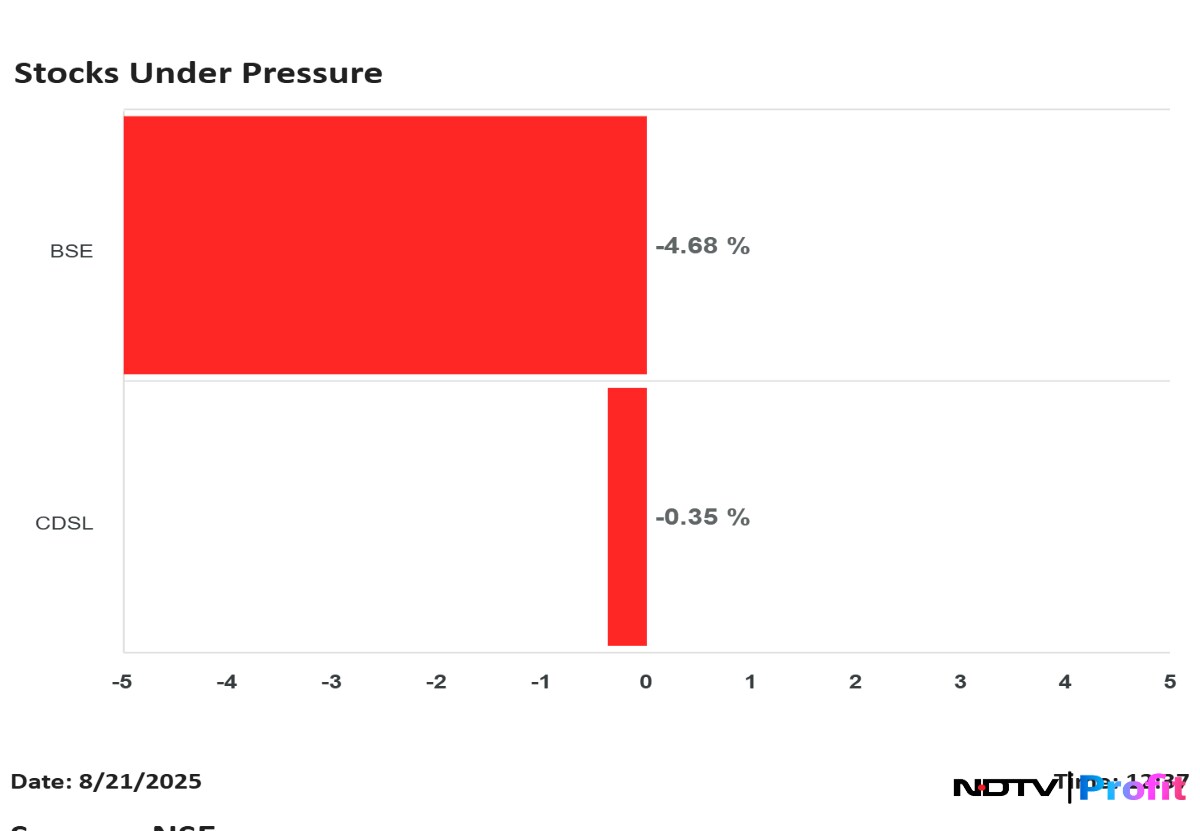

BSE share price declined nearly 6% to trade lower at Rs 2,372.40 apiece, while CDSL share price fell over 1% to trade lower at Rs 1,575.90 as of 12:34 p.m.

Derivatives trading contributes significantly to the income of capital market institutions.

Earlier in the same conference, it was intimated that the SEBI may pilot a pre-IPO trading platform where companies can trade with required disclosures, Pandey said.

"The IPO market is booming, but pre-listing information is often insufficient for investors," Pandey said at the FICCI Capital Market Conference 2025.

The pilot project will be a regulated platform. It will identify and remove unnecessary processes and pain points in fundraising, disclosures, and investor onboarding, he said.

It will explore emerging areas, products, and asset classes to boost both capital demand and supply.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.