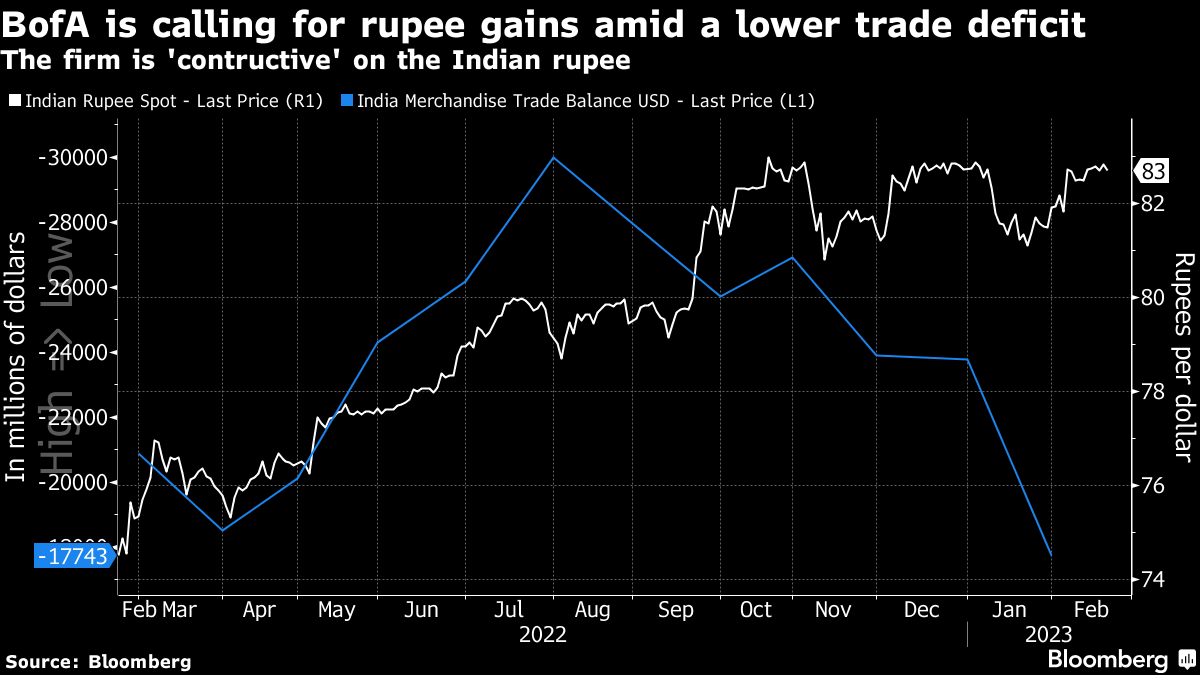

(Bloomberg) -- Bofa Securities Inc. is predicting more gains for the Indian rupee in the near term, joining Citigroup Inc., as the narrowest trade deficit in a year augurs well for the nation's external finances.

“The recent correction in rupee valuation and near-term improvement in current-account and capital flows tilt the risk-reward in favor of rupee appreciation,” Abhay Gupta, a strategist at BofA Securities, wrote in a note. The firm has turned ‘constructive' on the rupee.

The currency was the worst performer among emerging Asian peers last year, weighed by concerns over a wider current-account deficit and a stronger dollar spurred by rate hikes by the Federal Reserve. The outlook is now changing after a surprise drop in India's trade deficit prompted economists to cut their forecasts for the shortfall.

The rupee is up 0.1% against the dollar this year and is in the lower pack among Asian currencies, while its high-yielding counterpart, the Indonesian rupiah is up 2.6%. It is closing in on its record low of 83.2912 to a dollar seen in October.

Citigroup Inc. last week recommended a tactically bullish relative rupee exposure as it expects seasonal outperformance and the rupee's nominal effective exchange-rate to strengthen into the end of its fiscal year, it said in a note.

The “rupee's carry-to-vol is attractive within EM, RBI's reserves have recovered, REER index declined and INR volatility is lower,” Gupta wrote. “Debt inflows have started to trickle-in as India bonds still offer better carry compared to the region with low currency volatility.”

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.