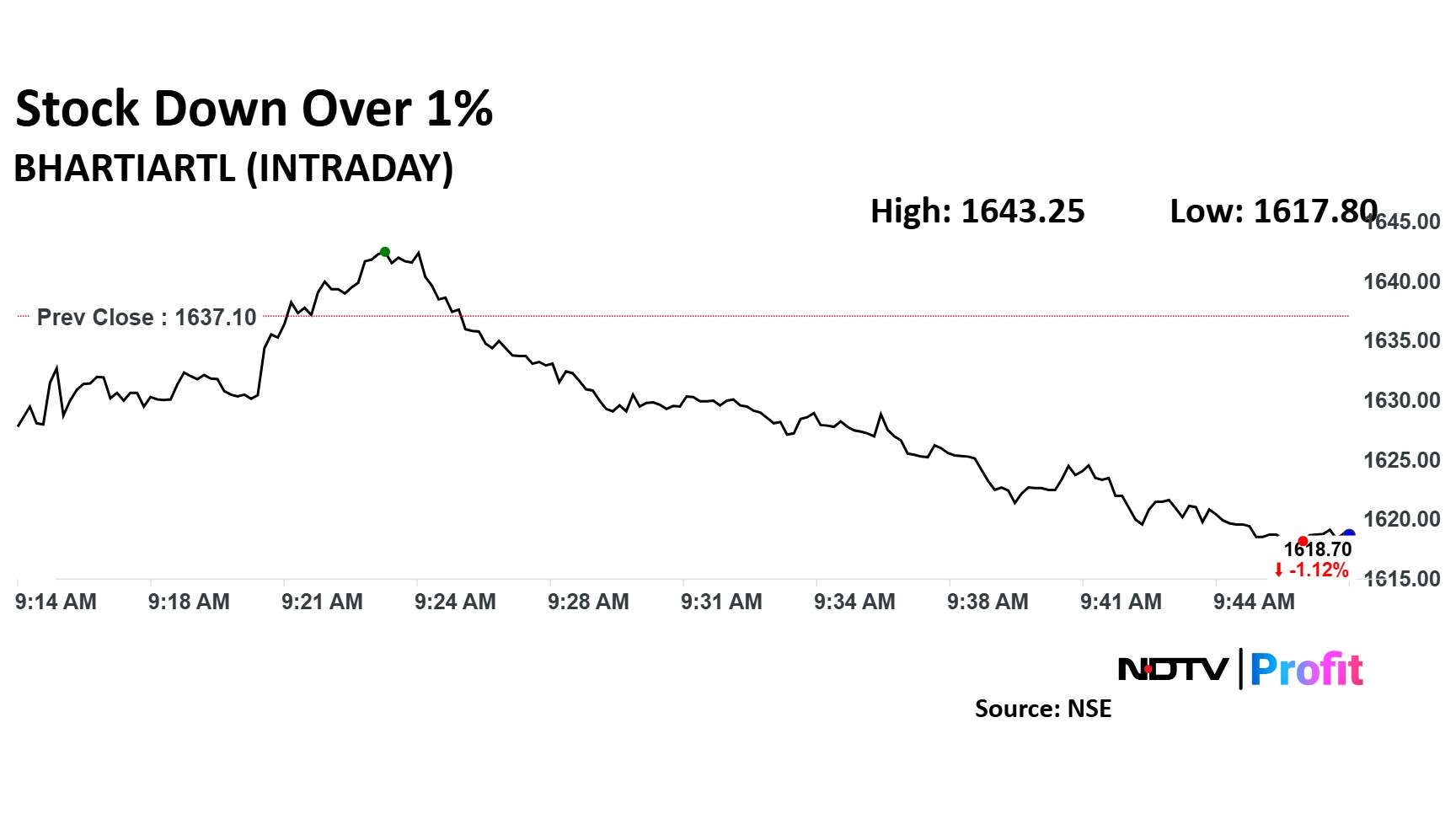

Bharti Airtel share price fell over 1% in early trading on Wednesday amid mixed response from brokerages following the company's quarterly earnings report.

But, despite a slight sequential decline in the net profit, the stock remains a favoured choice among analysts, who continue to recommend a 'Buy' rating, though with some reducing the target price marginally.

In its latest earnings report, Bharti Airtel reported a consolidated net profit of Rs 4,153 crore for the July–September period, down from Rs 4,159 crore in the previous quarter. Analysts had anticipated a profit of Rs 4,398 crore, indicating a slight miss. However, the telecom giant's revenue rose 8% to Rs 41,473.3 crore, surpassing the Bloomberg estimate of Rs 41,256 crore. Operating profit also increased by 9% to Rs 21,846.2 crore, with margins improving to 52.7%, up from 51.6% in the prior quarter.

Analysts' Insights

Brokerage firm Citi maintained a 'Buy' rating, albeit with a slight reduction in its target price from Rs 1,950 to Rs 1,900. They made minor adjustments to their segmental Ebitda and capex forecasts, noting changes in FY25-27 Ebitda estimates of 3-4%.

Brokerage firm Nuvama remained positive after Bharti Airtel's performance, stating that the company delivered a decent Q2. It noted that while the average revenue per user rose, the subscriber base decreased due to recent tariff hikes. Nuvama retained its 'Buy' call with a revised target price of Rs 1,900, reflecting an upside of 15.7%. It emphasised that Bharti's stable growth and strong free cash flow continue to strengthen its balance sheet.

Motilal Oswal also echoed this sentiment, maintaining a 'Buy' rating with the same target price of Rs 1,900. It highlighted strong performance in Q2 driven by tariff hikes in the Indian wireless segment and noted that Bharti Airtel's superior execution on premiumisation strategies positions it well for future growth.

Bharti Airtel share price fell as much as 1.11% to 1,619 apiece. At 10.10 a.m., the stock was trading 0.67% lower at Rs 1,626 per share.

It has risen 74.86% in the last 12 months. Total traded volume so far in the day stood at 0.18 times its 30-day average. The relative strength index was at 37.

Out of 33 analysts tracking the company, 26 maintain a 'buy' rating, five recommend a 'hold,' and two suggest 'sell,' according to Bloomberg data.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.