Bharti Airtel Ltd. recommended a final dividend of Rs 16 per fully paid-up equity share with a face value of Rs 5 each as well as for Rs 4 per partly paid-up equity share with a face value of Rs 5 each for financial year 2025.

The total amount to be disbursed as dividend is around Rs 9,751 crore. Retail investors who own up to 1.85% stake will receive a sum total of up to Rs 180 crore, according to an exchange filing on Tuesday.

Bharti Airtel's saw a 25% decrease in consolidated net profit for the fourth quarter of fiscal 2025, but surpassed analysts' expectations.

The telecommunication firm announced a net profit of Rs 11,022 crore for the quarter ended March 31, 2025. This exceeded the Rs 6,509-crore forecast by analysts monitored by Bloomberg.

Airtel Q4 FY25 Earnings Highlights (Consolidated, QoQ)

Revenue rose 6% to Rs 47,876 crore versus Rs 45,129 crore (Bloomberg estimate: Rs 48,502 crore).

Ebitda profit up 10% to Rs 27,009 crore versus Rs 24,597 crore (Estimate: Rs 26,803 crore).

Margin at 56.4% versus 54.5% (Estimate: 55.3%).

Net profit fell 25% to Rs 11,022 crore versus Rs 14,781.2 crore (Estimate: Rs 6,509 crore).

ARPU is at flat at Rs 245.

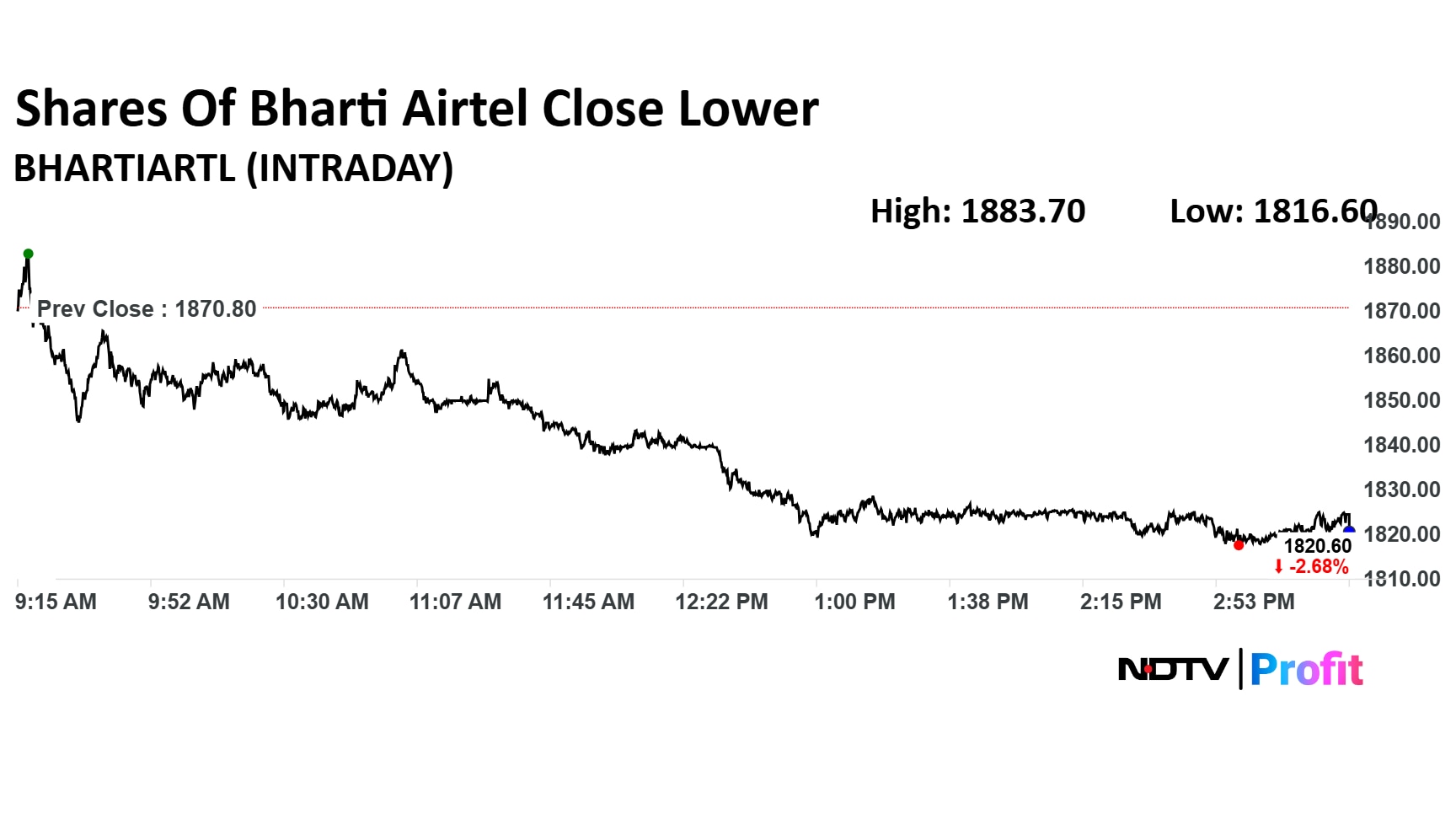

Share Price

Before the quarterly results were declared, Bharti Airtel's stock closed 2.68% lower at Rs 1,820.6 apiece on NSE, compared to a 1.39% decline in the benchmark index Nifty 50.

It has risen 41.58% in the last 12 months and 14.67% on a year-to-date basis.

Twenty-nine out of the 34 analysts tracking the company have a 'buy' rating on the stock, three recommend a 'hold' and two suggest a 'sell', according to Bloomberg data. The 12-month analysts' consensus target price on the stock is Rs 1,885.8, implying a upside of 3.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.