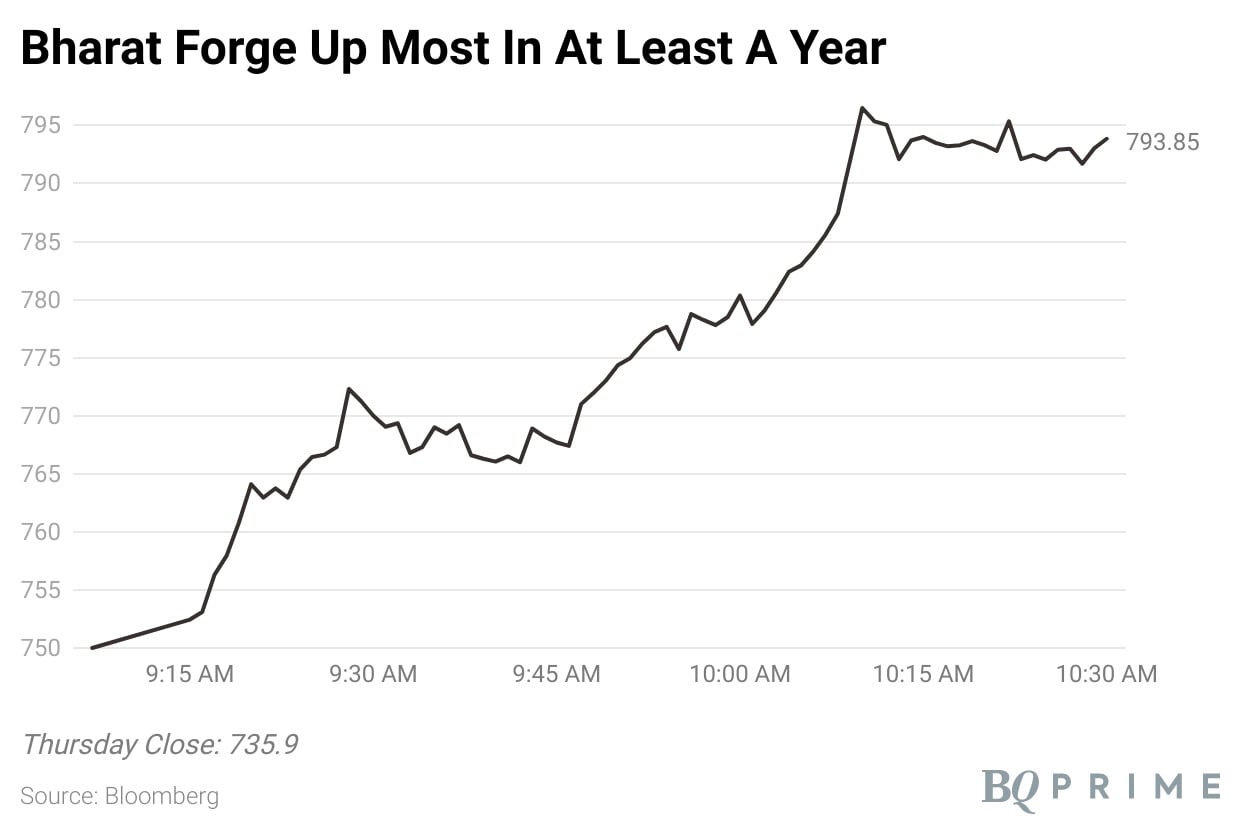

Shares of Bharat Forge Ltd. rose the most in at least a year even as the company's net profit missed analyst estimates in the first quarter.

Key Highlights (YoY)

Revenue up 28% at Rs 1,760 crore (estimate: Rs 1,660 crore).

Ebitda margin at 24.7%, up 1% quarter-on-quarter.

Profit up 46% at Rs 246 crore (estimate: Rs 249 crore).

"Underlying demand for commercial vehicles in the U.S. and EU remains steady (healthy order book) and cancellation rate remains low. Domestic industrial business is likely to be driven by new orders, while export (industrials) is expected to be supported by supply chain diversification related demand," JM Financial said in a note.

"We see long-term growth triggers in BHFC intact. Also, cost-optimisation initiatives and benefit of recent softening of commodity prices are likely to support margins," the research house said, reiterating its 'buy' rating. It has a target price of Rs 870 apiece, implying a potential upside of 18.2% from current levels.

JM Financial, however, listed prolonged supply constraints, significant correction in crude oil price and profit unsustainability at international subsidiaries as key risks.

CLSA upgraded the stock to 'outperform' from 'underperform' and raised the target price from Rs 713 to Rs 798, implying a potential upside of 8.4% from Thursday's close.

"Bharat Forge's earnings were better than our estimates as growth in export revenue and higher-than-expected realisations led to sequential expansion in gross and Ebitda margin. We increase our estimates based on better visibility on new orders and scale-up in non-auto business," it said.

Shares of the company rose 8.4%, the most in at least a year, to Rs 798 apiece before ending 7.3% higher on Friday.

Of the 32 analysts tracking the company, 25 maintain 'buy', two suggest 'hold' and five recommend 'sell'. The overall consensus price of analysts tracked by Bloomberg implies an upside of 3.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.