Shares of Bajaj Finance Ltd. rose nearly 5% on Friday to hit a fresh life high, after the board of directors promoted Rajeev Jain, currently the managing director, as vice chairman for a period of three years effective April 1.

Meanwhile, current deputy managing director Anup Kumar Saha will take over as managing director from April 1 for the remainder of his tenure until March 31, 2028.

Analysts expect the decisions to boost investor confidence and sentiment and end the long-standing uncertainty. The development mitigates concerns around management transition risk and fortifies medium-term growth visibility, Citi said on Friday. The brokerage also expects this will add credence to the company's strategic execution of 'BFL 3.0'. BFL 3.0 refers to the firm's goal of developing an AI-enabled tech architecture, to be the lowest cost operating model in financial services.

Rajeev Jain's continuity in Bajaj Finance will make "investment thesis for Bajaj Finance one of the strongest and clearest" among large-cap private financials, according to Morgan Stanley.

While Citi has maintained its rating, it raised its target price to Rs 10,200 from the earlier Rs 9,060 per share. Morgan Stanley has also increased its target price to Rs 10,500 from Rs 9,300, while maintaining its 'overweight' rating.

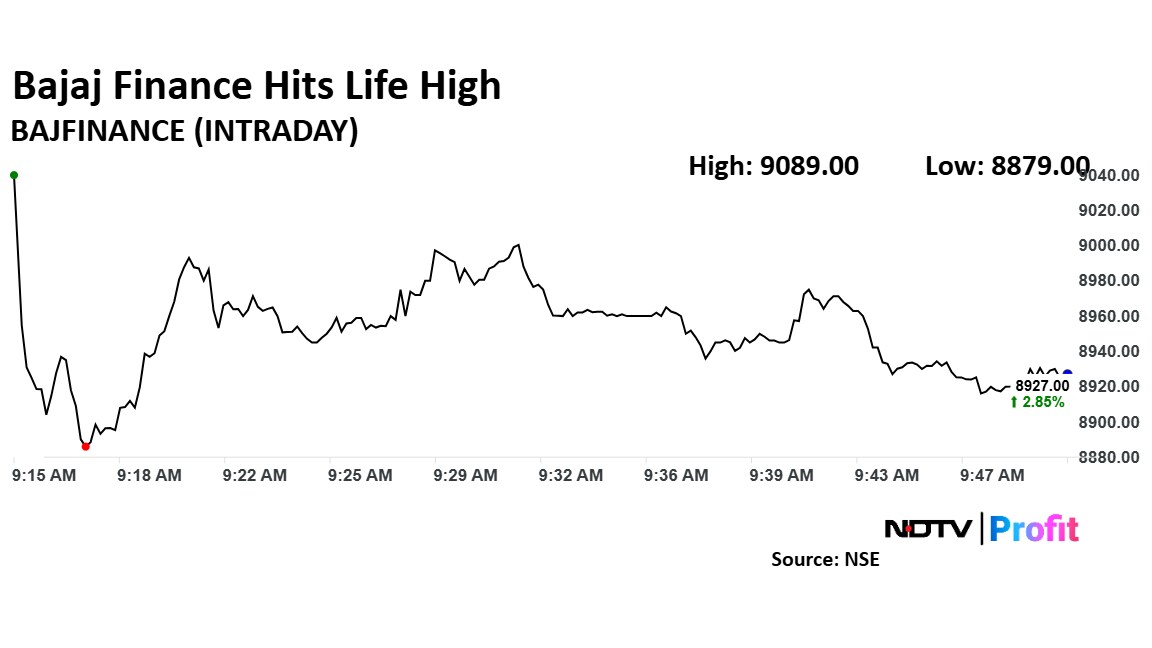

Bajaj Finance Share Price

Shares of Bajaj Finance rose as much as 4.72% to Rs 9,089 apiece to hit a fresh life high. It pared gains to trade 2.92% higher at Rs 8,932.95 apiece, as of 9:48 a.m. This compares to a 0.29% advance in the NSE Nifty 50.

The stock has risen 33.01% in the last 12 months and 28.81% year-to-date. Total traded volume so far in the day stood at 4.4 times its 30-day average. Relative strength index was at 69.

Out of 38 analysts tracking the company, 28 maintain a 'buy' rating, five recommend a 'hold' and five suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies a downside of 2.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.