.png?downsize=773:435)

Share price for Azad Engineering Ltd. rose over 4% in early trade on Monday to reach as high as Rs 1,873.90 apiece.

The company announced its Q4 results on Friday post market hours. It reported a 36.9% rise in revenue to Rs 126.9 crore, compared to Rs 92.7 crore in the year ago period.

Net profit grew 69% to Rs 25.2 crore, against Rs 14.9 crore in the same quarter last year. Ebitda also grew 45.8% to reach Rs 45.5 crore, compared to Rs 31.2 crore last year.

Margins also expanded to 35.9% from 33.7%. The company achieved its highest-ever annual and quarterly revenue figures.

"We are pleased to report that the company concluded the financial year with outstanding performance, delivering our highest-ever quarterly and annual results. We surpassed our given revenue and margin guidance, reflecting the effectiveness of our strategic initiatives and execution," said Rakesh Chopdar, chairman and chief executive officer at Azad Engineering.

"Our expansion plans continue to gain strong traction, with several key customers securing long-term capacity through our on-going capacity expansion. This has significantly strengthened our order book and reaffirmed our leadership position in the market," he added.

Azad Engineering had provided a revenue guidance of 25-30% for FY25. The company successfully surpassed this guidance, achieving an actual sales growth of 33% for the full fiscal.

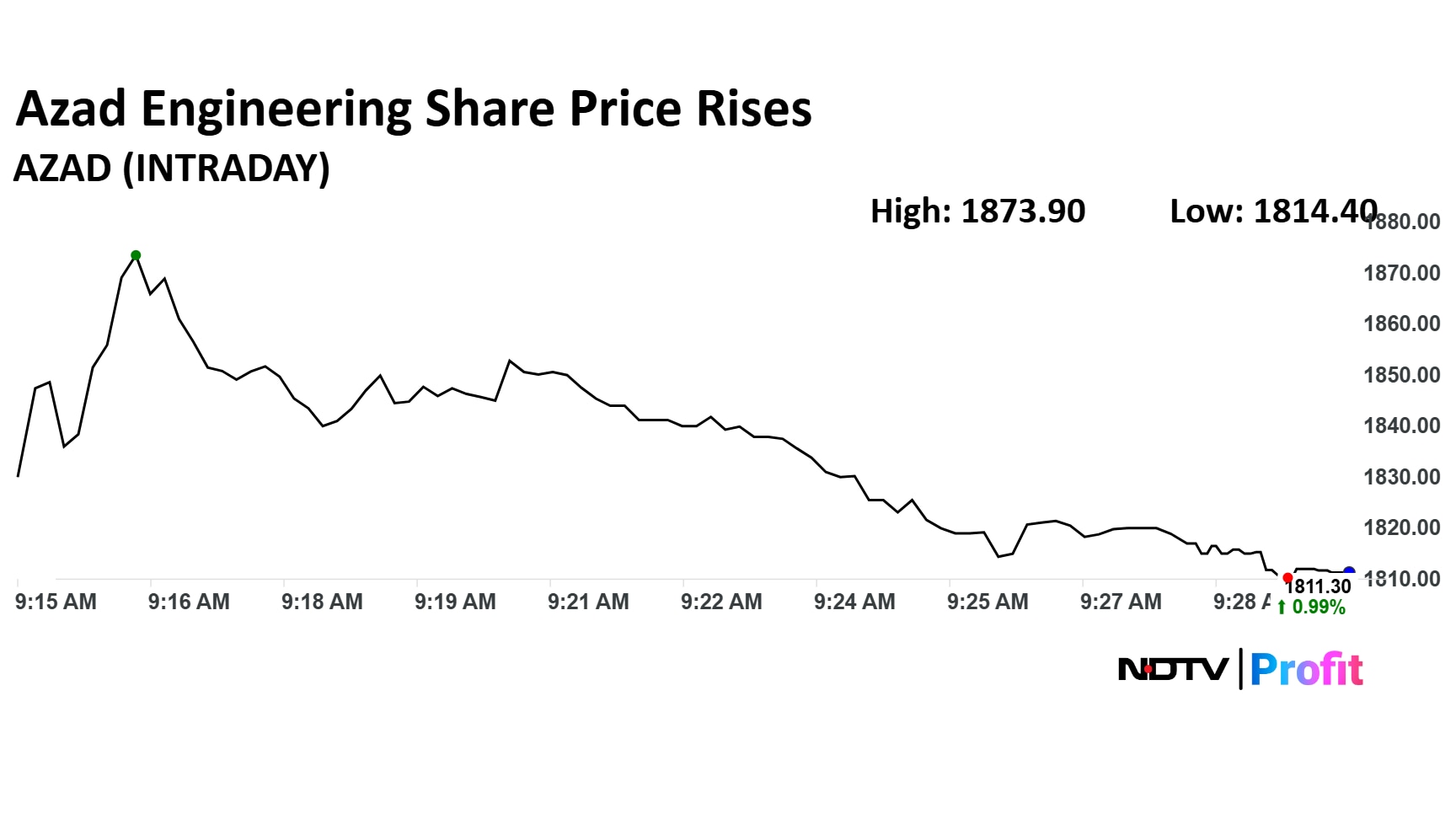

Azad Engineering Share Price Today

The scrip rose as much as 4.48% to Rs 1,873.90 apiece, the highest level since May 20, 2025. It pared gains to trade 1.57% higher at Rs 1,821.70 apiece, as of 9:30 a.m. This compares to a 0.71% advance in the NSE Nifty 50.

The stock has risen 5.47% on a year-to-date basis, and 26.68% in the last 12 months. Total traded volume so far in the day stood at four times its 30-day average. The relative strength index was at 51.75.

All three analysts tracking the company maintain 'buy' ratings, according to Bloomberg data. The average 12-month consensus price target implies an upside of 16.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.