AU Small Finance Bank Ltd. will raise up to Rs 1,500 crore via non-convertible debentures, according to an exchange filing on Friday.

The bank received in-principle approval from the board for issuance of unsecured, rated, listed, redeemable, subordinated, non-convertible lower tier II bonds in the nature of non-convertible debentures, for an amount aggregating up to Rs 1,500 crore. These will be categorised as tier II capital, as per the filing.

The issue is within the overall limit of Rs 6,000 crore approved by the shareholders at the Annual General Meeting held on July 26, 2024, for issuance of non-convertible debt securities or bonds or other permissible instruments, in one or more tranches for a period of one year from such approval.

The debentures are proposed to be listed on the Wholesale Debt Market segment of BSE Ltd.

The company's board has also approved the re-appointment of Kamlesh Shivji Vikamsey as an independent director (non-executive) for a second term of five years, with effect from April 25, 2025. The appointment is subject to approval of the shareholders.

Vikamsey joined the board in April 2022. He has vast experience of over 40 years in the areas of auditing, taxation, corporate and personal advisory services, business and management consulting services, due diligence and valuations, inspections and investigations and sustainability. He also held leadership and directorship positions in various companies or institutions nationally and globally, as per the filing.

The bank's standalone net profit during the quarter ended December fell 7.5% to Rs 528.4 crore, compared to Rs 571.2 crore in the previous quarter. The net interest income — the difference of interest earned and interest paid — for the quarter rose 2% to Rs 2,022 crore.

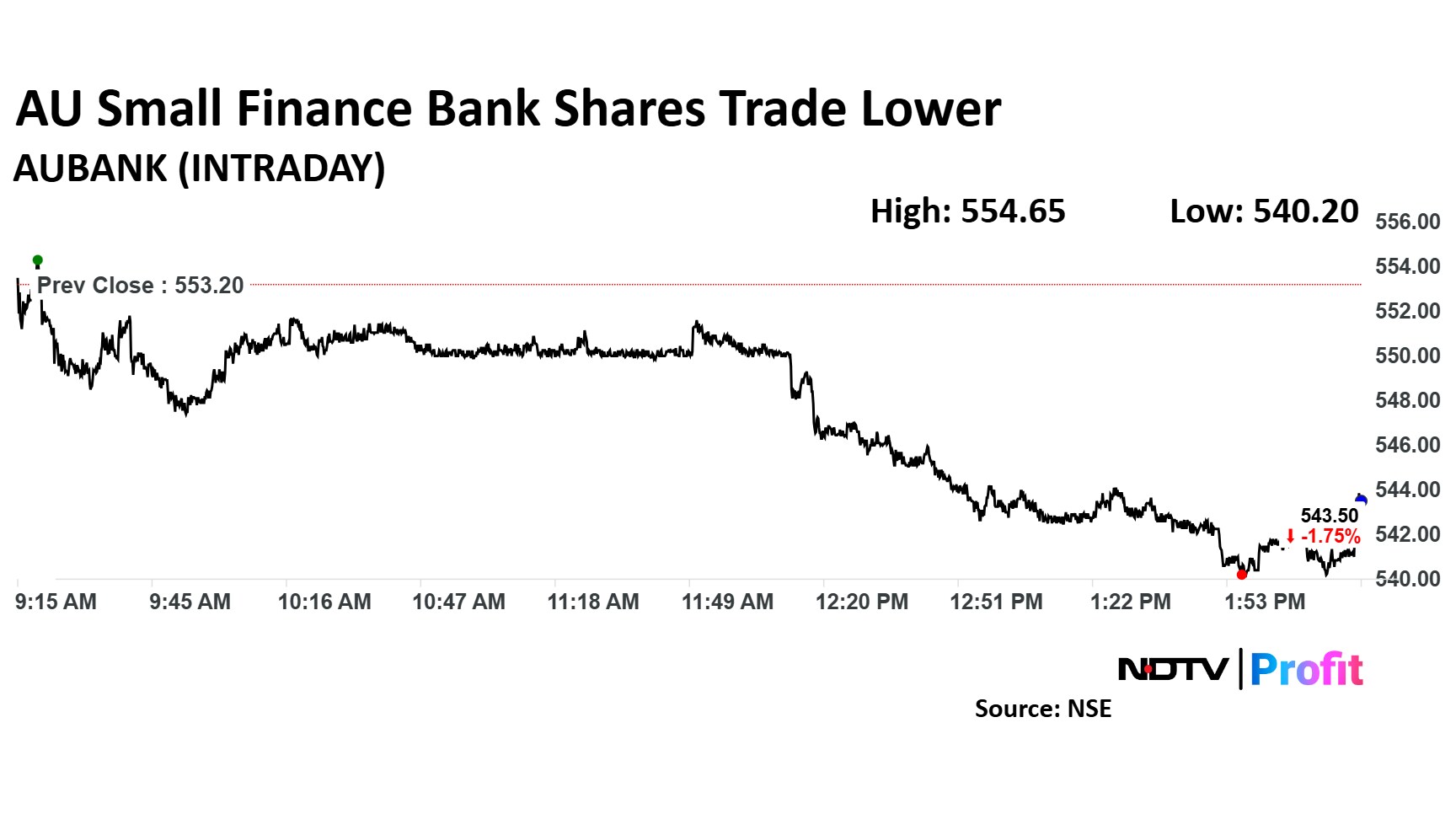

AU Small Finance Bank Share Price

Shares of AU Small Finance Bank fell as much as 2.35% to Rs 540.20 apiece, before paring loss to trade 1.75% lower at Rs 543.50 apiece, as of 2:25 p.m. This compares to a 0.09% advance in the NSE Nifty 50.

The stock has fallen 4.99% in the last 12 months. Total traded volume so far in the day stood at 3.62 times its 30-day average. The relative strength index was at 57.19.

Out of 28 analysts tracking the company, 18 maintain a 'buy' rating, four recommend a 'hold' and six suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 24.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.