Share price of automaker Ashok Leyland Ltd. dipped in trade on Monday, paring opening gains. The company had reported a 40% higher net profit in the final quarter of the previous fiscal.

Standalone net profit of the truck-maker rose 38.4% year-on-year to Rs 1,246 crore in the three months ended March 2025, even as revenue increased 5.7% to Rs 11,907 crore. Analysts polled by Bloomberg had estimated the bottom line at Rs 1,100 crore.

Ashok Leyland's board also approved a bonus issue of equity shares in 1:1 ratio on Friday. The board had further recently recommended a dividend of Rs 4.25 per share with a face value of Re 1 each for financial year 2025, according to a separate exchange filing.

While brokerages differed in their opinions on valuation, most agree the truck-maker is entering a stronger phase operationally, with improving margins and a clearer roadmap for long-term growth.

While CLSA upgraded the stock to ‘hold' from ‘underperform', Nomura maintained its ‘buy' rating, with Citi also maintaining a ‘buy' whereas Macquarie maintained a ‘neutral' rating.

Ashok Leyland Q4 FY25 (Standalone, YoY)

Revenue up 5.7% at Rs 11,907 crore (Estimate: Rs 12,065.5 crore).

Ebitda up 12.5% at Rs 1,791 crore (Estimate: 1,695 crore).

Margin up 100 basis points at 15% (Estimate: 14%).

Net profit up 38.4% at Rs 1,206 crore (Estimate: Rs 1,100 crore).

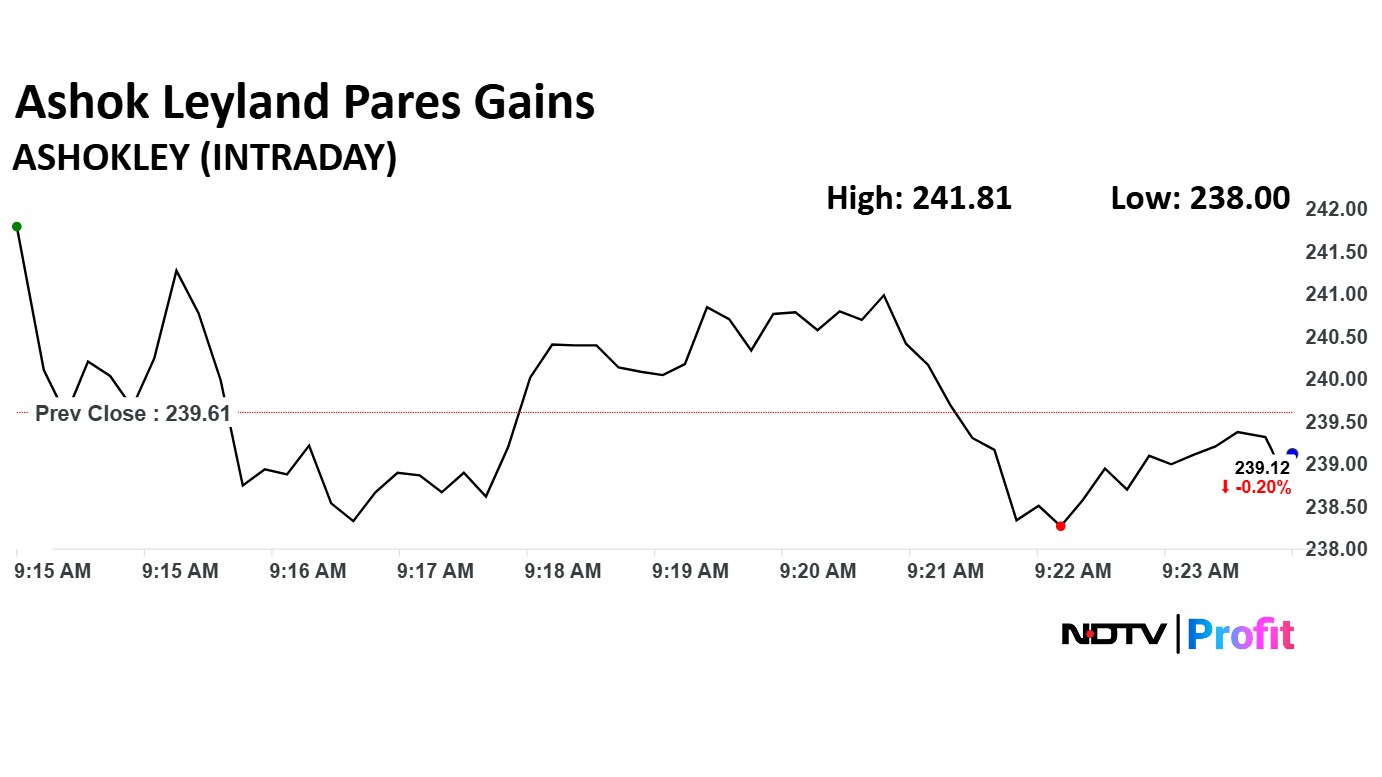

Ashok Leyland Share Price Today

The scrip rose as much as 0.92% to Rs 241.81 apiece. It pared gains to trade 0.45% lower at Rs 238.53 apiece, as of 09:22 a.m. This compares to a 0.69% advance in the NSE Nifty 50.

It has risen 10.09% on a year-to-date basis, and 15.12% in the last 12 months. Relative strength index was at 50.70.

Out of 44 analysts tracking the company, 34 maintain a 'buy' rating, seven recommend a 'hold' and three suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 9.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.