The impact from 10% tariff on pharma will be manageable with case for pass through by manufacturers, According to BofA. The brokerage picks Apollo Hospitals along with Divi's Labs as the sector is expected to see limited impact from tariffs.

Concerns about a flat March quarter are overdone, according to the brokerage. While a steep tariff is unlikely, there could be increased volatility in pharma in the near term, it said.

Weighing Looming Tariff Concerns

The impact from a 25% tariff on pharma including generics may seem significant for India pharma companies, according to BofA.

Based on the reciprocal tariff approach, a 10% tariff on Indian pharma imports could be a possibility, but BofA cites a few actions that could limit impact.

A pass through of the tariff in part or full to distributors and payers who capture higher stake in the Gx value chain, a capturing of higher profitability of the US Gx business could make the tariff impact much more manageable against the brokerage's initial calculation of 5% to 15%.

Tariffs: Better Generics Pricing For Longer

Tariffs on generics would mean increasing cost of supplies to the US, notes BofA. This could lead to manufacturers re-evaluating their generic portfolios.

This is premised on the fact that manufacturer margins on generics are less than 20%, limiting the ability to take on a higher tariff. A tariff hike could bring in the risk of manufacturers looking at portfolio optimisation, leading to wider drug shortages.

This would further support a continuation of a good pricing environment for much longer for generics. This, compared to the current assumption of limited visibility beyond next six months.

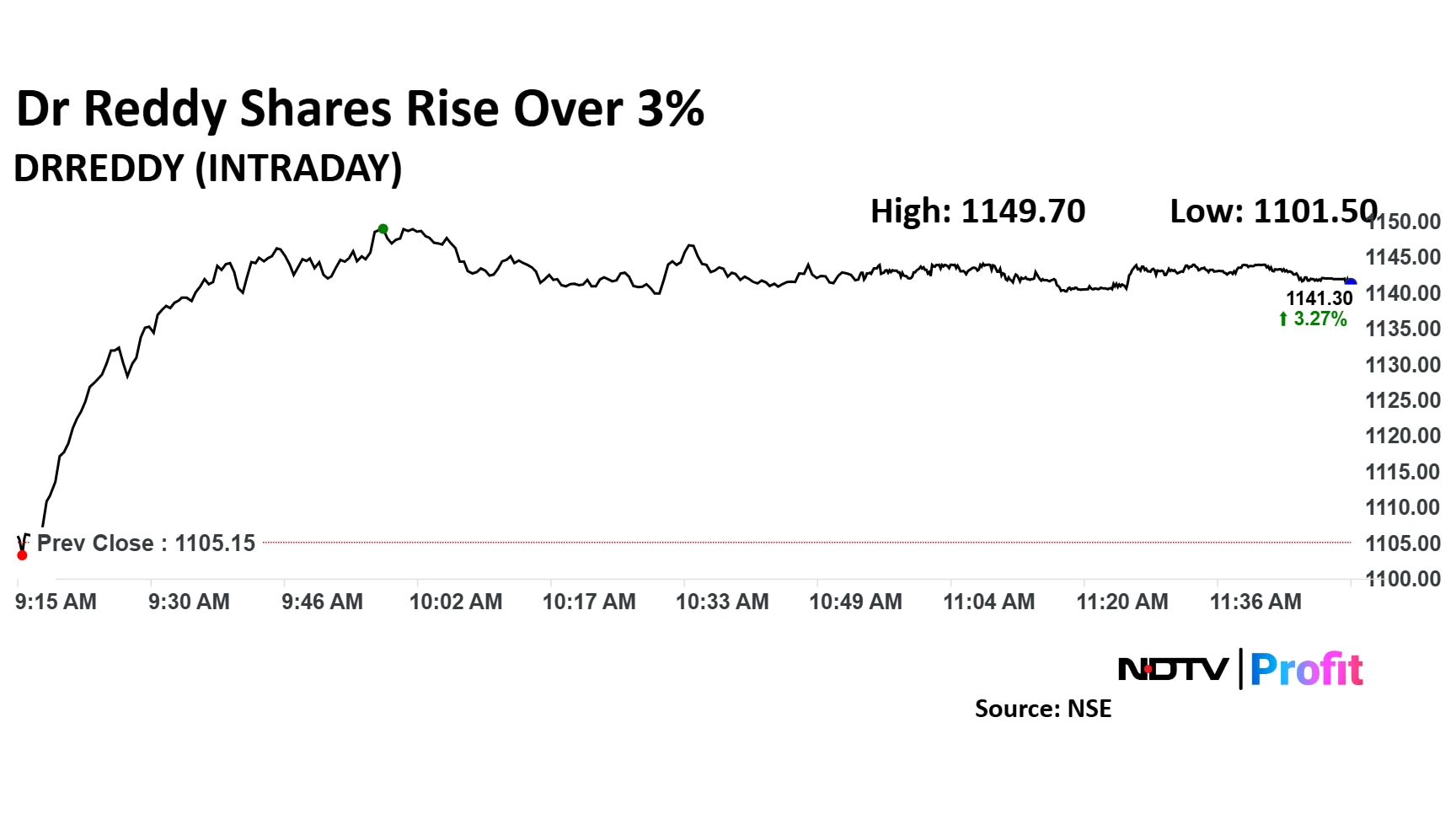

Dr Reddy's Share Price

Shares of Dr Reddy's Labs rose the most in trade today. The counter rose as much as 4.03% to Rs 1,149.7 apiece. The scrip was trading 3.33% higher at Rs 1,142 against a 0.49% advance in the Nifty 50 as of 11:51 a.m.

Fifteen out of the 40 analysts tracking the company have a 'buy' rating on the stock, 11 recommend a 'hold' and 14 suggest a 'sell', according to Bloomberg data. The 12-month analysts' consensus target price on the stock is Rs 1,346.6, implying an upside of 17.8%.

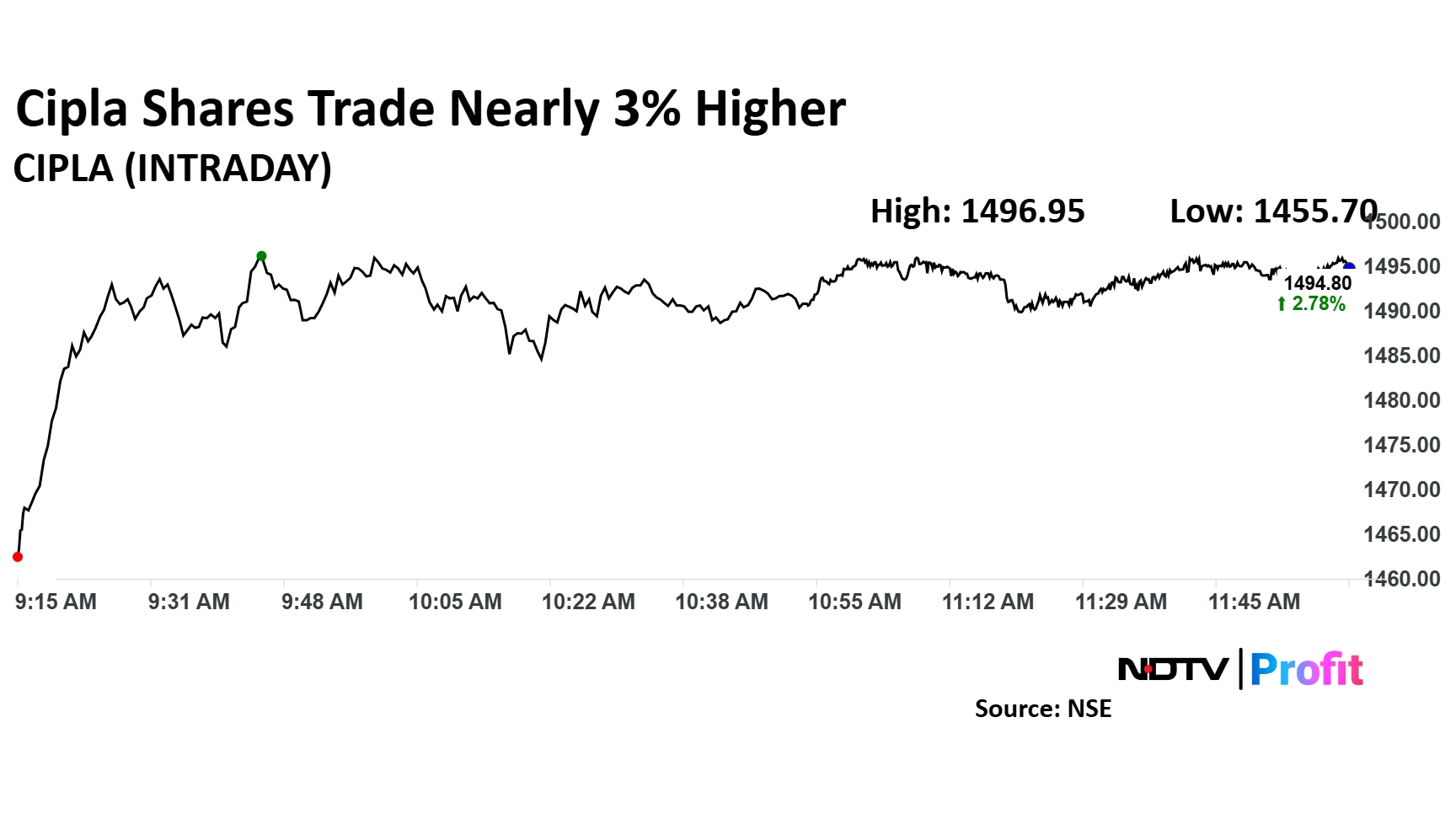

Pharma Stocks Trade In The Green

Pharma stocks like Cipla, Sun Pharma, Lupin and Mankind Pharma rose over 2% intraday. Trading nearly 3% higher, Cipla leads the pack followed by Sun Pharma and Lupin.

Cipla shares are trading 2.76% higher at Rs 1,494.4 apiece against a 0.47% advance in the benchmark Nifty 50 as of 11:59 a.m. The shares of Sun Pharma were trading 2.03% higher at Rs 1,710 apiece.

While shares like Apollo Hospitals, Divi's Labs and Alkem Lab were trading flat against a 0.53% advance in the benchmark Nifty 50 as of 12:01 p.m.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.