Shares of Amber Enterprises India Ltd. rose on Monday after SBI Securities issued a positive outlook on the stock, citing several growth drivers for the company. Amber, a leading player in the Indian Room Air Conditioner (RAC) industry, holds a significant 29% value market share in the sector and is expanding its footprint across various segments of the HVAC industry, SBI Securities said in its note.

SBI Securities has a 'Buy' recommendation for the stock for 12 months with a potential upside of 19.4%.

The note highlighted Amber's diversified product offering, which includes not only room air conditioners but also key components such as heat exchangers, plastic injection-moulded components, and motors. The company has shown strong performance in its consumer durables segment, with a 59% year-on-year growth in the first half of FY25, driven by robust demand for air conditioners.

In addition to its core RAC business, Amber is actively expanding into the electronics space. The company has ventured into the manufacturing of Printed Circuit Board Assembly (PCBA) and other electronic components, reducing its reliance on the RAC sector. This move is further supported by Amber's recent acquisition of a 60% stake in Ascent Circuits and the ongoing construction of a new PCB manufacturing facility in Chennai, which is expected to double its production capacity.

The company's growth potential is also bolstered by favorable government policies aimed at promoting the localisation of electronic components. Amber's joint venture with Korea Circuits will support its expansion into high-tech PCB manufacturing, in line with India's push for greater self-reliance in the electronics sector, the note said.

Further expanding its reach, Amber's subsidiary Sidwal Refrigeration provides cooling solutions to the railway and metro sectors, and is set to deepen its collaboration with Titagarh Rail Systems, a key manufacturer of passenger coaches in India. With a strong order book of over Rs 2,000 crore as of September 2024, the mobility segment is poised for further growth.

Despite its strong fundamentals, SBI Securities noted the potential risks posed by volatile raw material costs and external factors like unseasonal weather affecting AC demand. However, with earnings expected to grow at a compound annual growth rate of 69% from financial year 2024 to financial year 2026, the stock remains an attractive prospect for investors.

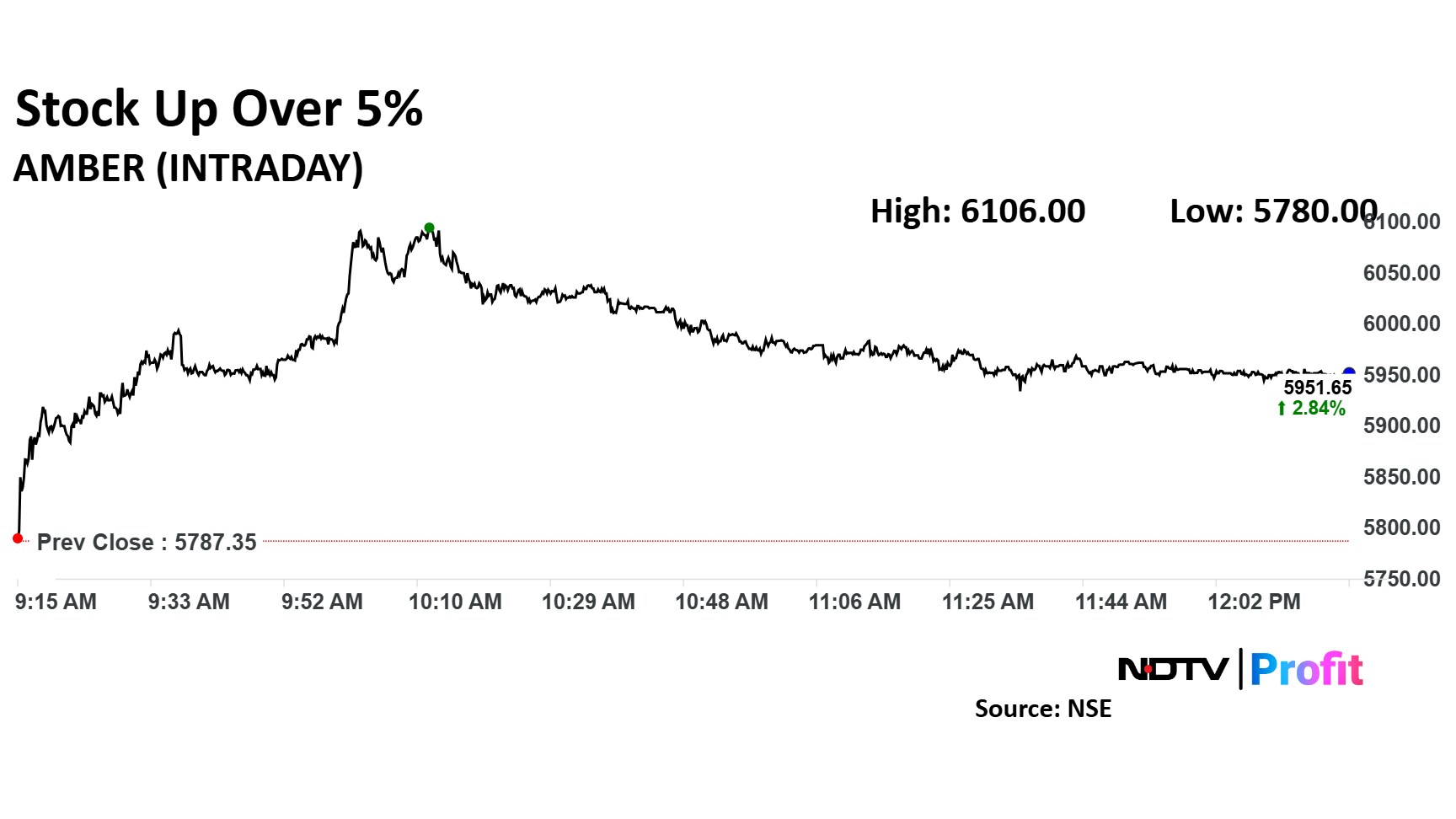

The scrip rose as much as 5.51% to Rs 6,106 apiece. It pared gains to trade 2.84% higher at Rs 5,951.85 apiece, as of 12:15 p.m. This compares to a 0.61% decline in the NSE Nifty 50 Index.

It has risen 84.02% in the last 12 months. Total traded volume so far in the day stood at 1.9 times its 30-day average. The relative strength index was at 50.

Out of 27 analysts tracking the company, 17 maintain a 'buy' rating, eight recommend a 'hold,' and two suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 12.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.