Asian stocks began the week with gains after signs of progress in U.S.-China trade negotiations, though sentiment was capped as investors voiced skepticism on the accord.

Shares in Seoul and Sydney opened higher and equity futures pointed higher in Hong Kong -- Japan will be shut for a holiday. The Singapore-traded SGX Nifty, an early indicator of NSE Nifty 50 Index's performance in India, fell 0.2 percent to 11,286.50 as of 6:55 a.m.

Short on time? Well, then listen to this podcast for a quick summary of All You Need To Know before the opening bell.

Here's all that could influence equities today.

- Oil extended last week's gains in Asian trading on hopes for a resolution to the trade war between the U.S. and China and after an attack on an Iranian tanker further ratcheted up tensions in the Middle East.

- U.S benchmark indices ended higher on Friday, led by banks and automakers, though there were plenty of gyrations along the way after an overnight session that saw futures whipsawed by headlines giving conflicting signs of progress on the negotiations.

- The pound retreated as European Union negotiators warned that Brexit plans from U.K. Prime Minister Boris Johnson are not yet good enough to be the basis for an agreement.

Get your daily fix of global markets here.

Earnings Reaction To Watch

Infosys (Q2, QoQ)

- Dollar revenue rose 2.5 percent to $3210 million.

- Revenue rose 3.8 percent to Rs 22,629 crore

- Net profit rose 6.2 percent to Rs 4,037 crore.

- EBIT rose 9.9 percent to Rs 4,912 crore.

- Margin stood at 21.7 percent versus 20.5 percent.

- Declared dividend of Rs 8 per share.

Bajaj Consumer Care (Q2, YoY)

- Revenue rose 2.6 percent to Rs 220.1 crore.

- Net profit rose 11.1 percent to Rs 56 crore.

- Ebitda rose 3 percent to Rs 61 crore.

- Margin stood at 27.7 percent versus 27.6 percent.

- Volume Growth at 2.65 percent.

Den Networks (Q2, YoY)

- Revenue rose 7.1 percent to Rs 332.4 crore.

- Net profit stood at Rs 14.7 crore versus net loss of Rs 28 crore.

- Ebitda fell 4.7 percent at Rs 48.4 crore.

- Margin stood at 14.6 percent versus 16.4 percent.

- Other income rose 9 times to Rs 42.4 crore.

- Finance cost fell 57 percent to Rs 6.3 crore.

ITI (Q2, YoY)

- Revenue rose 47.9 percent to Rs 419.5 crore.

- Net profit fell 5.3 percent to Rs 7.2 crore.

- Ebitda profit at Rs 43.2 crore versus Ebitda loss of Rs 77 crore.

Nifty Earnings To Watch

- Hindustan Unilever

Other Earnings To Watch

- Asahi Songwon Colors

- Delta Corp

- GTPL Hathway

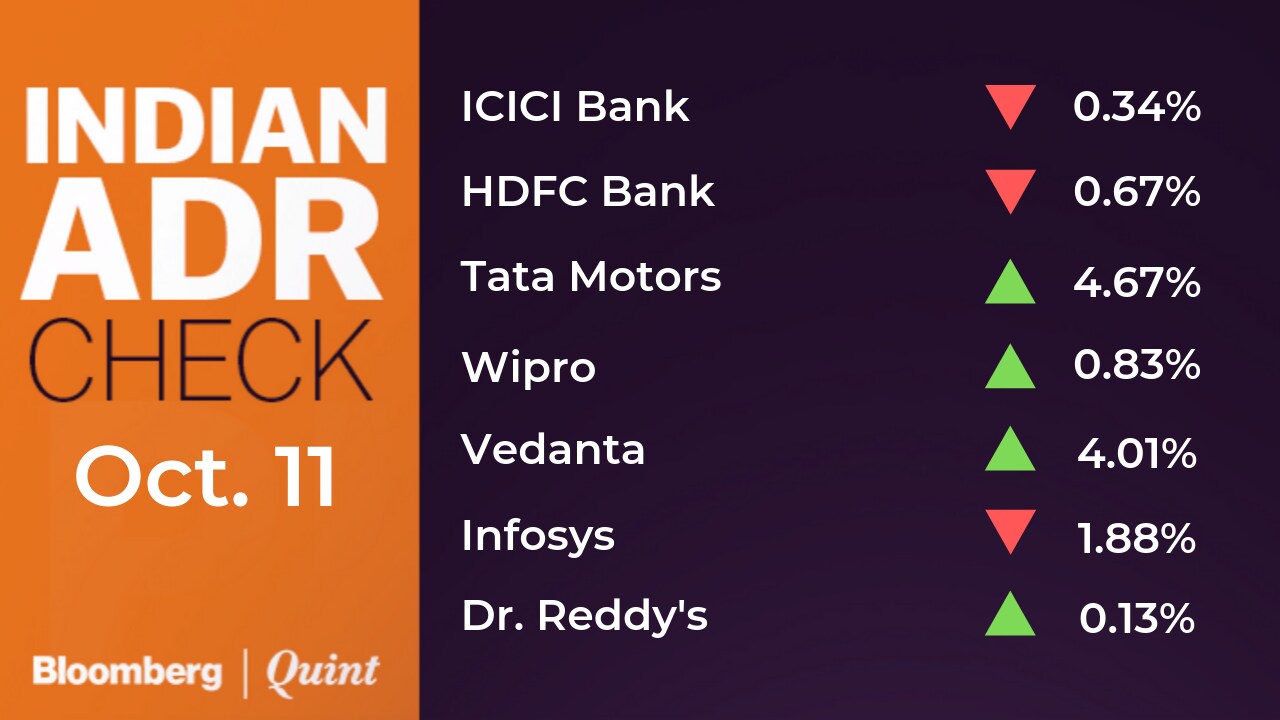

Indian ADRs

Stocks To Watch

- Adani Gas: Company inks pact with Total Holdings to acquire 37.4 percent shares in Adani Gas through a tender offer to public shareholders to acquire up to 25.2% shares subject to applicable regulations and purchase the residual shares from Adani Family. Adani Family and TOTAL SA shareholders shall ultimately hold 37.4 percent each and public shareholders shall hold remaining 25.2 percent.

Total Holdings SAS agrees to acquire 37.5% in Adani Gas.

October 14, 2019

Read: https://t.co/q7APlnwNIp pic.twitter.com/m2goVZ2CPn

- Cadila Healthcare received zero form 483 observations by U.S. Food and Drug Administration inspections at its API plant in Dabhasa. This inspection was a Current Good Manufacturing Practice audit and a pre-approval inspection.

- Reliance Capital said that existing management team of Reliance Securities has entered into a buying agreement for buying out the broking and distribution business from Reliance Capital, subject to regulatory approvals. Reliance Securities is 100 percent subsidiary of Reliance Capital. Besdies, the company clarified that it has not received any borrowing in last 18 months.

- Aurobindo Pharma: HDFC MF increased stake in the company to 7.12 percent from 5.11 percent on Oct. 9.

- S&P Global Ratings assigned its 'BB' rating on Muthoot Finance Ltd.'s U.S. $2 billion secured global medium-term note program, according to Bloomberg report.

- Goa Carbon said that its Goa plant will be shut temporarily from Oct. 12 onwards for maintenance work.

- Bank of Baroda Baroda Asset Management and BNP Paribas Asset Management said they have decided to merge their businesses in a bid to leverage each other's strengths to offer products for retail and institutional investors, according to PTI report. However, this is subject to regulatory and other legal approvals. Bank of Baroda and BNP Paribas Asset Management Asia have entered into binding agreements, the report added quoting the two entities' joint statement.

- GOCL Corporation received order worth Rs 375 crore from Coal India arm for supply of Bulk Explosives for a period of two years.

- Indraprastha Gas received letter of acceptance from Petroleum and Natural Gas Regulatory Board for Central Government's authorisation to the company for Ghaziabad GCD network. This letter has granted infrastructure exclusivity for laying building or expansion of the CGD Network till 2032.

- Allahabad Bank reduced Marginal Cost of Funds based Lending Rate by 5 basis points across various tenors with effect from Oct. 14. One-month MCLR stands at 7.9 percent and one-year MCLR stands at 8.35 percent.

- Lakshmi Vilas Bank: Care Rating revised rating of non-convertible debentures worth Rs 370 crore from ‘BBB-' to ‘BB+', with outlook changing from credit watch with developing implications to Negative.

- NMDC: Board approved raising up to Rs 5,000 crore via NCDs.

- MSTC has been appointed as a selling agent by Northern Coalfields for disposal of scrap for a period of two years.

- HCL Tech has completed the acquisition of Sankalp Semiconductors.

- NALCO: Government sold 92.9 lakh shares on Oct.10. Stake reduced from 52 percent to 51.5 percent.

- Steel Strips Wheels said that promoters have a stake of 61.1 percent in the company out of which 51.34 percent of the promoter shareholding are encumbered shares

- Emami said that promoters have a stake of 52.72 percent in the company out of which 61.95 percent of the promoter shareholding are encumbered shares.

- Jain Irrigation Systems long term facilities cut to ‘D' at India Ratings on delays in debt repayment, according to Bloomberg report.

- Quick Heal Technologies: Vijay Mhaskar resigned as Chief Operating Officer with effect from Oct. 11 on account of personal reasons.

- Altico, Mashreq move Reserve Bank of India against Fund Withdrawal by HDFC Bank (ET). HDFC Bank's fund transfer from, ECB account may be a violation of RBI rules.

- Jet Airways joint auditors BSR & Co LLP tender resignation before completion of term Committee of Creditors to meet on Monday, Oct. 14.

New Listing

- Shares of State-owned Indian Railway Catering & Tourism Corp. to start trading after IPO gets 112 times demand at Rs 320 apiece.

Key Data To Watch

- 12 p.m.: India Sept. Wholesale Prices Inflation YoY, Bloomberg estimate at 0.9 percent, prior 1.08 percent

- 5:30 p.m. : India Sept. Consumer Price Inflation YoY; Bloomberg estimate at 3.81 percent (prior 3.21 percent)

Brokerage Radar

Equirus on Coal India

- Initiated ‘Add' with a price target of Rs 205.

- Supposedly cheap but value to erode overtime.

- Can be a dividend play but growth unlikely.

- Multiple headwinds ahead; best of coal as fuel over.

- Volumes are set to decline in FY20; e-auction realisations at risk.

On Infosys

Kotak

- Maintained ‘Add' with a price target of Rs 840.

- Good quarter but with a softer outlook.

- Growth slackens in financial services and retail; executing well on strategic priorities.

- Difficult to argue for further rerating of multiple at a time when demand environment is moderating.

Citi

- Maintained ‘Buy' with a price target of Rs 900.

- Decent quarter – inline revenues, slightly better margins and lower attrition.

- BFSI vertical to be affected by seasonality; retail vertical to remain volatile.

- Macro is tough, continued momentum/execution should provide comfort.

Investec

- Downgraded to ‘Sell' from ‘Hold'; cut price target to Rs 730 from Rs 745.

- Weak organic revenue growth performance.

- Sustaining margin improvement on decelerating growth trajectory could be challenging.

- Believe any assumptions on Infosys being insulated from broader industry headwinds would be incorrect.

HSBC

- Maintained ‘Hold'; price target unchanged at 800.

- In-line with expectations on strong deal wins.

- Disappointing to see no meaningful upgrade on guidance.

- Banking and Retail verticals show signs of deceleration.

- Current FY20 valuations remain rich.

UBS

- Remained ‘Neutral', price target unchanged at 900.

- Earnings in line with expectations.

- Lack of revision in guidance caps upside.

- Guidance suggests softer exit growth rate for FY21.

Macquarie

- Maintained ‘Outperform' with a price target of 830.

- Guidance raise below expectations.

- Ex-retail growth was robust and in-line with expectations.

- See volatility in capital markets and weakness in European banks.

Trading Tweaks

- Century Textiles & Industries record date for demerger.

- Adani Green Energy, IL&FS Investment Managers, Kridhan Infra, Sadhana Nitro Chem, Zee Media Corporation, Sintex Industries to move into short term ASM Framework.

- Anant Raj, Axiscades Engineering Technologies, Skipper, Suzlon Energy to move out of short term ASM Framework.

- Reliance Capital price band revised to 10 percent.

- Dewan Housing Finance Corporation price band revised to 5 percent.

- Lakshmi Vilas Bank to move into ASM Framework.

- Indiabulls Integrated Services, Patel Engineering, Shyam Century Ferrous, Sintex Plastics Technology to move out of ASM Framework.

Who's Meeting Whom

- Tata Steel to meet Westwood Global Investment and AXA Investment Management on Oct. 17.

- CG Consumer Electricals to meet Jupiter AMS, Aberdeen Standard Investments and First Pacific Advisors from Nov. 12-20.

- Mahindra Logistics to meet HSBC on Oct. 16.

Insider Trading

- GFL promoter Inox Leasing & Finance acquired 50,000 shares on Sep. 30.

Money Market Update

- The rupee snapped a four-day losing streak to close at 71.02/$ versus 71.07/$ on Thursday.

F&O Cues

Futures

- Nifty October futures closed at 11311.7, premium of 6.7 points versus 19.7 points.

- Nifty October futures up 1.3 percent, adds 1.9 lakh shares in open interest.

- Nifty Bank futures closed at 28,138.6, premium of 96 points versus 93 points.

- Nifty Bank October futures open interest up 1.2 percent, adds 18,000 shares in open interest.

Options

- Nifty PCR at 1.13 versus 1.14 (across all series).

Nifty Weekly Expiry: Oct. 17

- Max open interest on call side at 11,400 (14.6 lakh shares).

- Max open interest on put side at 11,000 (11.8 lakh shares).

- open interest addition seen at 11400C (+6.7 lakh shares), 11,500C (5 lakh shares), 11,000P (+5 lakh shares).

Nifty Monthly Expiry: Oct. 31

- Max open interest on call side at 12,000 (23.8 lakh shares).

- Max open interest on put side at 11,000 (27 lakh shares).

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.