Japanese stocks rose after gains in the U.S. overnight, and futures on the S&P 500 Index edged higher.

Trading may be subdued on Tuesday with China and Hong Kong shut for holidays. The Singapore-traded SGX Nifty, an early indicator of NSE Nifty 50 Index's performance in India, rose 0.23 percent to 11,564 as of 7 a.m.

Short on time? Well, then listen to this podcast for a quick summary of All You Need To Know before the opening bell.

Here's all that could influence equities today:

- Oil recorded its weakest quarter since late last year as concerns over a global economic slowdown overshadowed an unprecedented attack on Saudi Arabia's key energy facilities.

- U.S. stocks advanced as investors weighed the latest turns in the trade war between the world's two largest economies.

- Investors remain focused on U.S.-China trade talks scheduled for next week, with little impact seen as yet from President Donald Trump's impeachment troubles.

Get your daily fix of global markets here.

Datawatch

- 10:30 a.m.: Markit India Manufacturing PMI for September, prior 51.4.

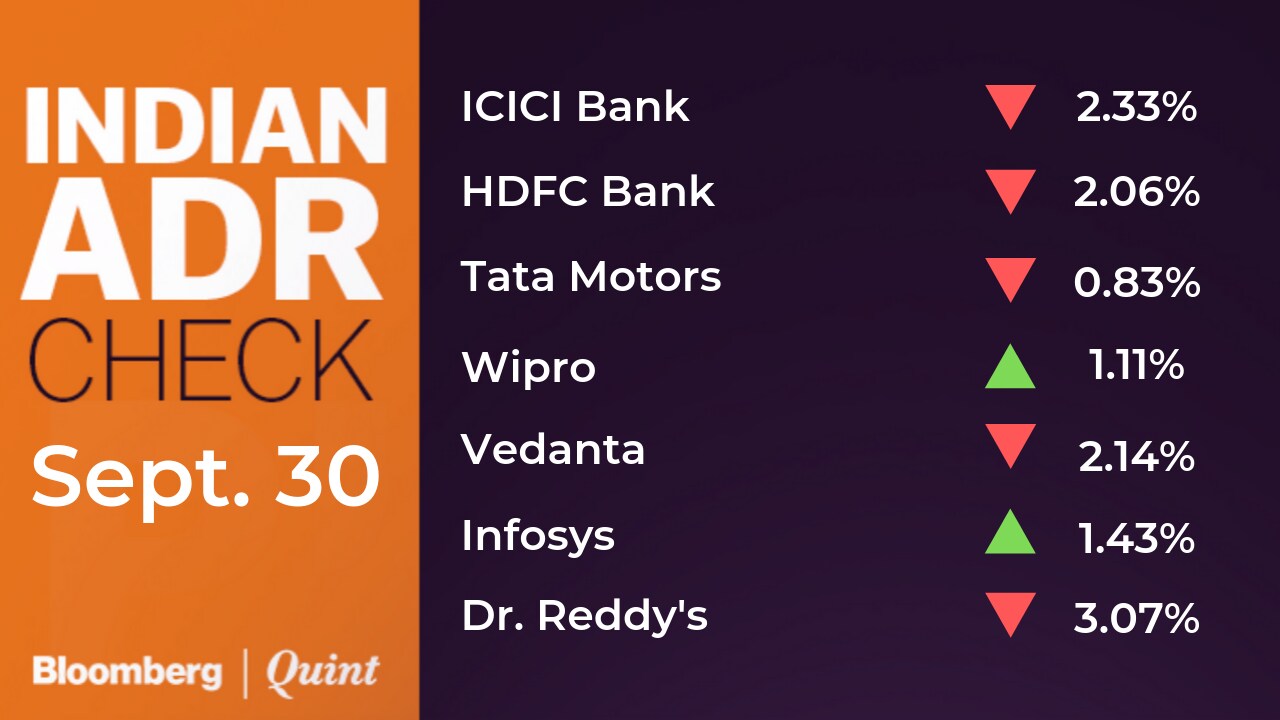

Indian ADRs

Stocks To Watch

- Automakers in focus as companies are set to announce September sales data.

- Reliance Industries: Saudi Arabia has assured the company that it will supply all the committed crude oil volumes in October as the world's largest oil exporter recovers faster than expected from the biggest attack ever on its oil industry, according to PTI report.

- ONGC, Oil India, GAIL, Ceramic, Fertiliser And City Gas Distributors in focus after India's oil ministry has cut the price of locally-produced natural gas, the first reduction after four straight hikes since October last year. The price of gas produced from domestic fields has been cut to $3.23 per metric million British thermal unit from $3.69 per mmBtu, the ministry's Petroleum Planning & Analysis Cell said. The new price will be effective from Oct. 1 till March 2020.

- Glenmark Pharma: Horizon Discovery signed a license agreement with the company for GS Knockout CHO Cell line to manufacture biotherapeutics, according to Bloomberg report.

- Lupin: Japan's PMDA completed inspection of the company's Goa facility with no critical or major observations. The company has completed the sale of Japanese arm's sale of injectables business and related assets to the Neopharma Group.

- Cadila Healthcare: To sell its right, title and interest in Zypitamag, along with applicable registrations and intangible assets relating to Zypitamag for U.S. and Canada markets to Medicure. The company will receive upfront payment of $5 million and deferred payment of $2 million to be made over the next four years. Medicure had previously acquired U.S. marketing rights with a profit-sharing arrangement with Cadila. With this acquisition, Medicure retains all profits, with full control of marketing and pricing negotiation for U.S. and Canada markets.

- National Peroxide said that it has temporarily closed down, its Kalyan plant from Sept. 30 for carrying out expansion of production capacity from 95,000 MT per annum to 150,000 MT per annum. The plant will remain under shutdown for an approximate period of 90 days. During the aforesaid period the Company will continue to service the key customers uninterruptedly from the inventory of finished goods accumulated for the purpose.

- Huhtamaki-PPL has entered into an agreement to acquire Mohan Mutha Polytech's business of flexible packaging for Rs 80 crore. The company said that the acquisition allows the company add manufacturing capacity in South India. Acquisition will be funded by debt and expected to be closed during quarter of December 2019.

- Motilal Oswal Financial Services' arm Motilal Oswal Home Finance has entered into an Assignment Agreement with Phoenix ARC Private Ltd for upfront sale of pool of Non-Performing Assets of the Company. The company said that pursuant to the said agreement the home finance arm has sold pool of non-performing assets of Rs. 540 crore (having Net Outstanding book value of Rs. 345 crore) and realized cash consideration of Rs. 260 crore from Phoenix ARC Trust. Phoenix ARC Private Ltd along with Motilal Oswal Finvest Ltd., a wholly owned subsidiary of the Company, had invested in security receipts of the Phoenix ARC Trust.

- CG Power & Industrial Solutions: KN Neelkant has resigned orally as Managing Director and Chief Executive Officer of the company which was recorded via video conferencing.

- Birla Corporation said that there was a fire incident at the company's Chanderia unit on Sept. 29. No loss or damage to plant and machinery was reported due to fire. As a measure of abundant caution, the company has suspended operations at one of its Kilns at the aforementioned site.

- NBCC signed memorandum of understanding with the Government for the development of National Sports University at Imphal for Rs 400 crore.

- IPCA Labs: Shareholders to consider issuing convertible warrants worth Rs 47.75 crore to the promoter group on Oct. 24.

- Union Bank of India: Government of India to infuse further Rs 5,552 crore in the Bank, taking the total amount of infusions to Rs 11,768 crore.

- Canara Bank: Repo Rate Linked Lending Rate of the bank for retail loans and Micro, Small and Medium Enterprises stands at 8.3 percent with effect from Oct. 1 The bank has received Rs 6,571 crore capital infusion from the Government of India.

- Andhra Bank, Corporation Bank, United Bank of India, Indian Overseas Bank: To link Repo Rate Linked Lending Rate as external benchmark rate for all new floating rate for personal, retail and MSME loans with effect from Oct. 1.

- IOL Chemicals and Pharma said that it has made pre-payment of loan worth Rs 23.64 crore. The principal amount of loan is reduced to Rs 88.13 crore as on Sept. 30.

- Tata Motors has confirmed that Jaguar Land Rover will suspend production at all U.K. manufacturing Plants for one week commencing Nov. 4.

- Maruti Suzuki acquired Gurugram land for Rs 52 crore, according to Bloomberg report.

- JMC Projects has secured new order worth Rs 560 crore, out which Rs 312 crore is for commercial real estate projects on Southern and Western India and the remaining amount of Rs 248 crore is for a water supply project in Odisha.

- SBI to sell electoral bonds from Oct. 1-10. This will be 12th phase of electoral bond sale through its 29 authorised branches, Ministry of Finance said.

- Greenlam Industries: Board has approved incorporation of wholly owned arm in India explore opportunities by way of greenfield project for manufacturing, sales and marketing of laminate and wood based products.

- Punjab National Bank has received a capital infusion of Rs 3,000 crore from the Government of India.

- Bank of Baroda: Government has conveyed its decision to infuse Rs 7,000 crore in the Bank.

- Williamson Magor: Tuladri Mallick resigned from the post of chief financial officer with effect from Sept. 26.

- Indian Bank has received Rs 2,354 crore of capital infusion from the Government of India.

- J&K Bank: Board extended the term of RK Chhibber as Interim Chairman and MD till Nov. 9.

- Talwalkars Better Value Fitness: Ministry of Corporate Affairs extended date of holding annual general meeting by three months.

- Century Textiles-UltraTech Cement merger scheme to effective from Oct. 1.

- Mercator: Board approved sale of two ships.

- Techno-Electric & Engineering: L&T Mutual Fund increased its stake from 4.7 percent to 5.53 percent.

IOCL cuts ATF prices for the fifth consecutive month. Pan-India prices cut by 12.4% compared to last year. pic.twitter.com/qPAt3liEIp

October 1, 2019Offering

- IRCTC IPO subscribed 0.81 times on day 1. Retail investors subscribed 1.15 times.

Brokerage Radar

Macquarie on Britannia

- Maintained ‘Underperform'; hiked price target to Rs 2,518 from Rs 2,279.

- Dairy business profitability could come under pressure.

- Concerns in biscuit business due to Amul cookies overdone.

- Cut Ebitda estimates on lower margins and revenue, but hike EPS estimates due to tax rate cut.

BofAML on Cummins India

- Maintained ‘Underperform'; cut price target to Rs 607 from Rs 669.

- Volume growth muted; margins fall on weak realisations.

- Export realizations decline; share in total sales shrinks.

- Domestic product mix change towards industrials.

- Margin revival likely but exports could remain weak.

UBS on Quess Corp

- Trimax resolution meaningfully positive.

- Believe market isn't pricing in RoCE improvement and potential rerating.

- Not much of a recent tax cut benefit albeit potential indirect beneficiary.

HSBC on Capital Goods

- Multiple new measures announced over last few weeks invite fresh investment.

- Expect export oriented, new industrial segment and capex supportive companies to benefit.

- Structural support but not enough cyclical support.

- Cummins India: Upgraded to ‘Buy' from ‘Hold'; hiked price target to Rs 700 from Rs 630.

- Bharat Forge: Upgraded to ‘Buy' from ‘Hold'; hiked price target to Rs 520 from Rs 500.

- L&T: Maintained ‘Buy'; hiked price target to Rs 1,780 from Rs 1,630.

- ABB India: Maintained ‘Hold'; hiked price target to Rs 1,570 from Rs 1,330.

- Siemens India: Maintained ‘Hold'; hiked price target to Rs 1,340 from Rs 1,080.

- SKF India: Maintained ‘Buy'; hiked price target to Rs 2,500 from Rs 2,300.

- Bosch: Maintained ‘Hold'; cut price target to Rs 15,500 from Rs 18,300.

Morgan Stanley on NBFCs

- Retail borrowers with weaker economic profiles could see higher credit costs and lower loan growth.

- IDFC First: Maintained ‘Underweight'; cut price target to Rs 24 from Rs 30.

- Corporate asset quality surprised negatively and remains vulnerable.

- IndoStar Capital: Maintained ‘Equal-weight'; cut price target to Rs 230 from Rs 380.

- Concerns on wholesale loan book to constrain its loan growth.

- Shriram City Union: Upgraded to ‘Equal-weight' from ‘Underweight'; cut price target to Rs 1,355 from Rs 1,425.

- Upgrade given margin of safety.

- See best risk reward for M&M Finance and Shriram Transport – cyclical stocks at 10-year trough valuations.

Trading Tweaks

- 5Paisa Capital, Pioneer Distilleries to move into short term ASM Framework.

- Tata Communications price band revised to 20 percent.

- Indiabulls Ventures, Anisha Impex price band revised to 10 percent.

- Vasundhara Rasayans, Indiabulls Real Estate price band revised to 5 percent.

Who's Meeting Whom

- Eicher Motors to meet India Nivesh Securities on Oct. 1.

- Mahindra & Mahindra to meet HSBC Wealth Management and Angel Broking on Oct. 3.

Insider Trading

- Zee Entertainment Enterprises promoter Essel International sold 41.6 lakh shares from Sept. 24-25.

- GFL promoter Inox Leasing & Finance acquired 50,000 shares on Sept. 27.

- Vakrangee promoter Dinesh Nadwana acquired 13 lakh shares on Sept. 30.

- IIFL Finance promoter group Ardent Impex acquired 94,000 shares on Sept. 30.

- Infibeam Avenues promoter Malav Mehta sold 50 lakh shares from July 27-Sept. 27.

- IIFL Securities promoter and director Orpheus Trading acquired 10 lakh shares on Sept. 30.

Money Market Update

India's bonds may open higher after the government kept its fiscal second-half borrowing program unchanged and said it will auction a new 10-year bond this week.

The government will sell Rs 2.68 lak crore of debt in the six months starting Oct. 1 and there is no plan to sell foreign-currency sovereign bonds overseas at the present time, a government official said. Analysts said the budgeted borrowings should allay fears about fiscal slippage for now.

The 10-year bond yields fell three basis points on Monday to 6.70 percent, having risen 14 basis points in September after the government's $20 billion tax giveaway stoked fiscal financing concerns.

In the currency market, implied opening from forwards suggests spot will start trading around 70.71 per dollar. The rupee ended at 70.86 on Monday, but will oil prices lower and risk sentiment slightly better, the local currency is expected to register gains.

F&O Cues

October Futures

- Nifty October futures closed at 11534, premium of 60 points versus 68 points.

- Nifty futures OI up 1 percent, adds 1.5 lakh shares in OI.

- Nifty Bank Oct futures closed at 29,325, premium of 190 points versus 204 points.

- Nifty Bank futures OI up 37 percent, adds 3.6 lakh shares in OI

Options

- Nifty PCR at 1.11 versus 1.19 (across all series)

Nifty Weakly Expiry: Oct 3

- Max OI on call side at 11,600 (22.7 lakh shares)

- Max OI on put side at 11,400 (19.8 lakh shares)

- Max OI addition seen at 11,400P (+8.3 lakh shares), 11,750C (+7.7 lakh hares)

Nifty Monthly Expiry: Oct 31

- Max OI on call side at 11,500 (19.4 lakh shares)

- Max OI on put side at 11,000 (18.4 lakh shares)

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.