The sell-off that sent global markets into a tailspin last week stretched into Monday, with stocks in Japan and Australia declining amid concern that global growth may be hurt by American protectionist policies.

The Singapore-traded SGX Nifty, an early indicator of NSE Nifty 50 Index's performance in India, fell 0.1 percent at 9,974 as of 7:15 a.m.

Short on time? Well, then listen to this podcast for a quick summary of the article!

DayBreak

Global Cues

- U.S. stocks tumbled, sending the S&P 500 Index to its biggest weekly loss in more than two years, on concern that a trade war and higher borrowing rates could throttle global growth.

- The yield on 10-year Treasuries fell one basis point to 2.82 percent.

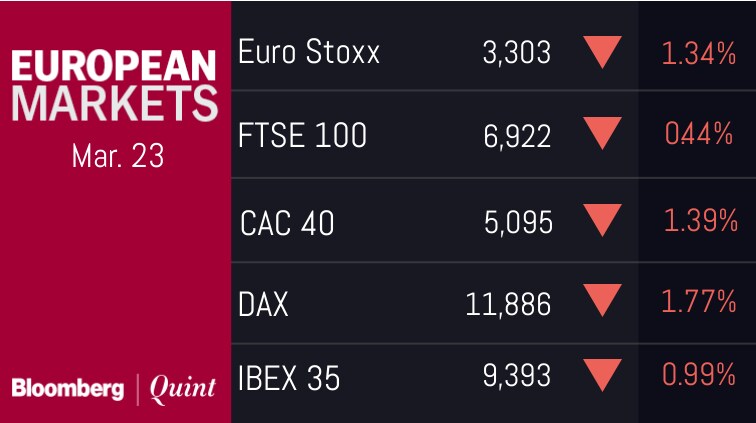

Europe Check

- The euro rose 0.5 percent to $1.2362, the strongest in more than a week.

- The British pound increased 0.3 percent to $1.4137.

- Germany's 10-year yield was little changed at 0.53 percent.

- Britain's 10-year yield gained one basis points to 1.44 percent.

Asian Cues

- Japan's Topix index declined 1 percent.

- Australia's S&P/ASX 200 Index lost 0.5 percent.

- South Korea's Kospi index dropped 0.3 percent.

- The MSCI Asia Pacific was down 0.4 percent after falling 3.5 percent last week.

- The S&P 500 Futures added 0.3 percent.

Here's a list of what's coming up this week:

- U.S. personal income and spending data for February, coupled with the Fed's favored inflation gauge are the key pieces of U.S. data. Income and spending are forecast to grow at the same pace as January but consensus sees the core PCE deflator picking up to 1.6 percent from 1.5 percent.

- This week's European economic agenda is highlighted by March CPI readings in the big four euro-area economies and output data for the U.K. Headline inflation probably ticked up in Germany, France, Spain and Italy. A third estimate of U.K. GDP is set to confirm growth of 0.4 percent in the fourth quarter.

- The U.S. Treasury will probably auction about $294 billion of bills and notes this week, its largest slate of supply ever.

- Crude oil contracts will begin trading Monday on the Shanghai International Energy Exchange.

Commodity Cues

- West Texas Intermediate crude climbed 0.7 percent to $66.34 a barrel.

- Brent traded 0.4 percent higher at $70.8 per barrel after closing 2.2 percent higher on Friday.

- Gold increased 0.1 percent to $1,348.76 an ounce, around the highest in more than a month.

- Sugar snapped two-day winning streak; ended 1.6 percent lower at 12.6 cents per pound.

Shanghai Exchange

- Steel traded lower for third day; down 2.6 percent.

- Aluminium traded lower for second day; down 0.3 percent.

- Zinc traded higher; up 0.4 percent.

- Copper traded lower for second day; down 0.8 percent.

- Rubber traded lower for seventh day; down 5.8 percent.

Gold futures gained nearly 3% last week.https://t.co/8Z87RcoaaD pic.twitter.com/7rJgxrssUA

Indian ADRs

Stocks To Watch

- Indiabulls Real Estate signed pact with Blackstone to divest 50 percent stake in assets at an enterprise value of Rs 9500 crore.

- RIL to combine Saavn with its digital music service Jio Music. To invest up to $100 million in music service.

- Sandur Manganese said, manganese ore annual production in mining lease has been increased from 7,400 to 32,000 tonnes.

- NTPC commissioned first unit of 800 mega-watt Lara power stations. This takes the total capacity of NTPC and its group to 46,100 mega-watt and 52,991 mega-watt, respectively.

- Tata Power signed pact with Tata Sons to sell 40 percent stake in Panatone Finvest for Rs 1,542.61 crore.

- Tata Power signed pact with Panatone Finvest to sell 4.7 percent stake in Tata Communications for Rs 613.46 crore.

- Vedanta's board approved a proposal to raise funds of up to Rs 4,500 crore through private placement.

- Lumax Auto to consider stock split in the ratio of 1:5.

- NHPC commissioned 50 mega-watt solar project in Theni, Tamil Nadu.

- Bharat Financials completed direct assignment deals worth Rs 1,391 crore.

- Capital First to consider fund raising on March 28.

- Uttam Galva received exchanges nod to declassify ArcelorMittal Netherlands BV as a promoter.

- Seven firms are ready to bid for Lanco Infratech (Economic Times).

- STC, MMTC merger on cards, says Minister Suresh Prabhu

359 infrastructure projects show cost overrun of Rs 2.18 lakh crore.https://t.co/hQouxDMrI7 pic.twitter.com/FGsaY6iUO6

Trading Tweaks

- GAIL India, Kellton Tech and Oil India last trading day before going ex-bonus.

- Talwalkars last trading day before ex-date for de-merger.

SEBI plans to come out with new buyback rules.https://t.co/Mygl3BRe8B pic.twitter.com/j8ykjHxcTJ

Who's Meeting Whom

- Bajaj Finserv to meet investors on March 26 - 28 in Singapore & Tokyo.

- Eris Life Science to meet Ambit Capital on March 26.

- Majesco to meet Jeetay Investment on March 27 and Reliance Nippon Life AM on March 28.

- Tata Motors to meet Ventura Securities, Altavista Capital Advisory Services and Mirabills Investment from March 27 - 28.

Insider Trades (As reported on March 23)

- Apollo Finance promoter of Apollo Tyres buys 2,72,364 shares on March 19 - 20.

- Anoop Moopen director of Aster DM Healthcare buys 73,291 on March 20 - 21.

- Rajesh Mehta promoters of Rajesh Exports buys 34,440 shares on March 22.

New Offerings

- Lemon Tree Hotels IPO day 1. Issue Price at Rs 54 - Rs 56 per share.

- ICICI Securities IPO day 3. Issue subscribed 0.36 times on day 2.

- Mishra Dhatu Nigam IPO issue subscribed 1.2 times on day 3.

All you need to know about the Lemon Tree Hotels IPO. @dhanuka_saloni reports. https://t.co/r7G3ftvLxy pic.twitter.com/Q7J8kQw7PC

Rupee

- Rupee closed at 65.01/$ on Friday compared to 65.11/$ on Thursday.

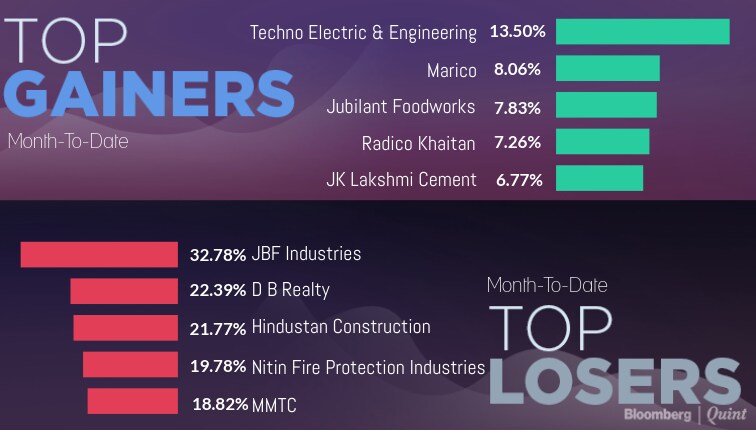

Top Gainers And Losers

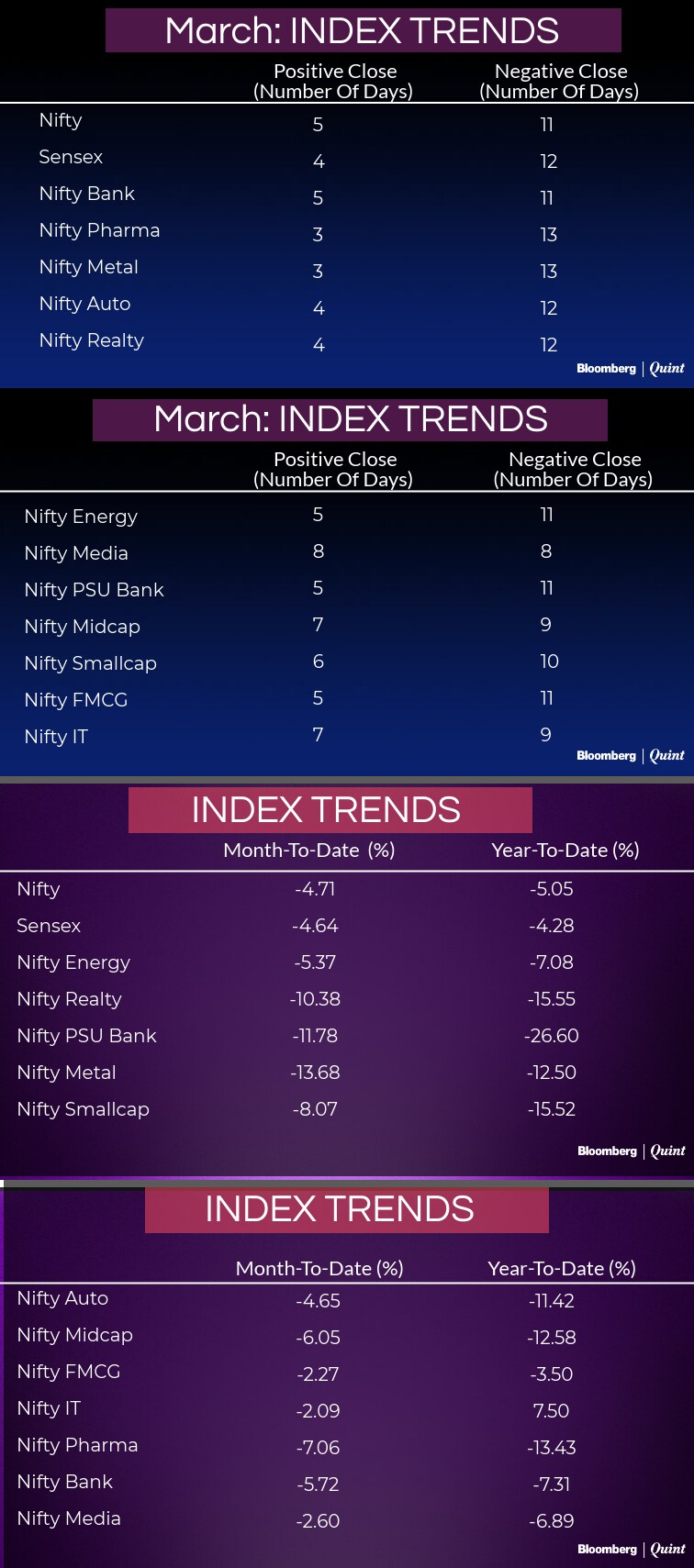

Index Trends

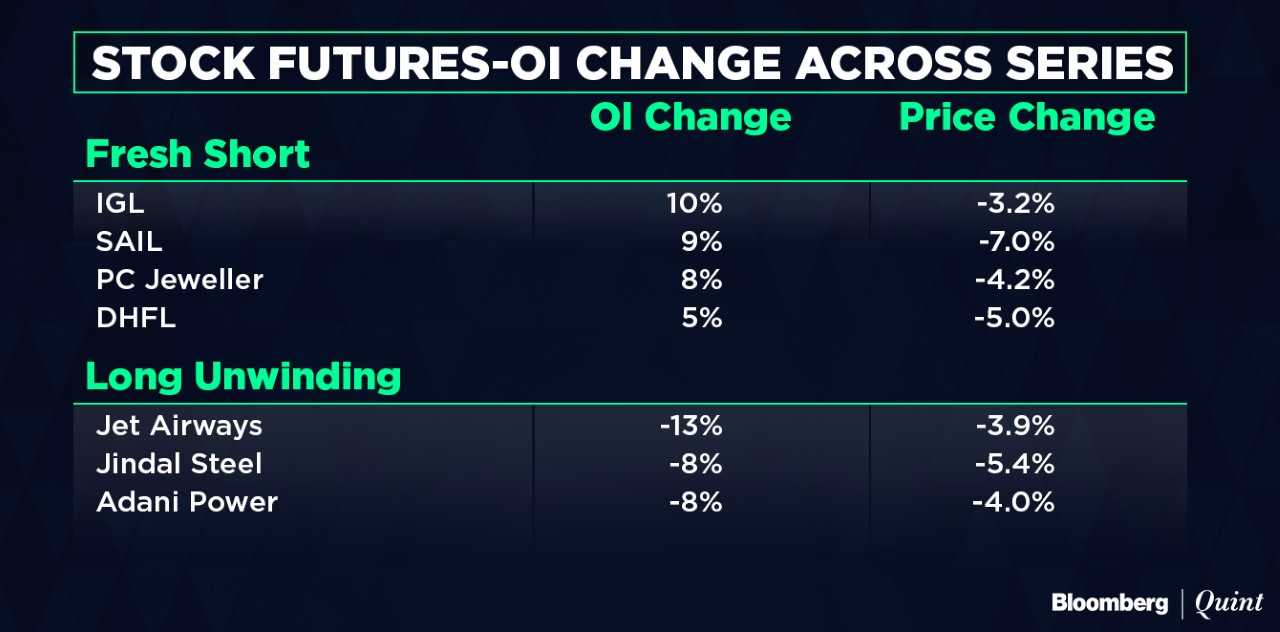

F&O Cues

- Nifty March Futures closed trading at 10,003.9 premium 6 points versus 13 points.

- Nifty April Futures trading premium of 49.6 points at levels of 10,047.6.

- All series-Nifty open interest down 1 percent, Bank Nifty open interest down 3 percent.

- Rollover-Nifty 23 percent, Bank Nifty 20 percent.

- India VIX ended at 15.5, up 1.9 percent.

- Max open interest for March series at 10,500 call strike, open interest at 54.6 lakh, open interest down 13 percent.

- Max open interest for March series at 10,000 Put, open interest at 51.8 lakh, open interest down 12 percent.

Foreign investors turn bullish on Indian equities.https://t.co/atCBTc33ec pic.twitter.com/07LkjxQhOq

F&O Ban

- In ban: HDIL, IDBI Bank, IFCI, Jet Airways and Oriental Bank.

- New in ban: Oriental Bank

- Out of ban: Jindal Steel, JP Associates and Reliance Communications.

Only intraday positions can be taken in stocks which are in F&O ban. There is a penalty in case of rollover of these intraday positions.

Put-Call Ratio

- Nifty PCR at 1.04 versus 1.05

- Nifty Bank PCR at 0.94 versus 1.15

Stocks Seeing High Open Interest Change

Fund Flows

Brokerage Radar

CLSA on Arvind

- Maintained ‘Buy' with a price target of Rs 524.

- Textiles returning to the growth path.

- Strategic investments in textiles to drive growth.

- Advanced Materials business gaining traction.

- Arvind continues to explore advance material space through JV.

- Cotton price volatility remains a near-term headwind.

- Proposed demerger to create value.

Morgan Stanley on Tata Power

- Maintained ‘Overweight' with a price target of Rs 94.

- Tata Power selling stakes in telecom business.

- Continue to see potential upside from such moves as leverage profile improves.

- Tata Power intends to sell stakes in defense business and other non-core investments.

- These stake sales if executed, would help deleverage faster.

Citi on Larsen & Toubro

- Maintained ‘Buy'; raised price target to Rs 1,563 from Rs 1,527.

- Business environment has been more challenging than expected.

- Government/PSUs/multilateral agencies continue to drive capex.

- Margins likely to improve 50 basis points over the next three years.

- Fourth quarter of every financial year is a swing quarter.

- Management focus on RoE keeps us enthused.

Citi on Indraprastha Gas

- Maintained ‘Buy' with a price target of Rs 400.

- Delhi budget goes green; Potential uplift to volumes.

- Lower CNG vat in UP to incentivise CNG conversions.

- Stay postitve on gas space on the back of host of structural factors.

CLSA on Cadila Healthcare

- Upgraded to ‘Buy' from ‘Underperform'; raised price target to Rs 450 from Rs 440.

- Improving India outlook and strong US pipeline to drive earnings.

- Improvement in new launches in U.S. expected in 2018.

- Biosimilars, vaccines and novel research products are long-term growth drivers.

- Cadila to look for more product deals in specialty space from current fiscal cash flows.

- Expect 16 percent compounded growth rate in earnings through the financial years till March 2020.

CLSA on Indiabulls Real Estate

- Maintained ‘Buy' with a price target of Rs 311.

- Deal to establish a valuation for Indiabulls Real Estate.

- Deal to mark a major strategic step in deleveraging the development business.

- Deal valuation of Rs 9,500 crore valuation should be accretive to Indiabulls.

JPMorgan on Reliance Industries

- Maintained ‘Neutral' with a price target of Rs 940.

- RJIO continues content acquisition drive.

- Expect spending on content to continue.

- In near term it would still be all about telecom.

- Jio remains key variable for Reliance Industries' investment case.

- Content monetisation key variable in Jio's long term monetisation of large investment in telecom.

Citi on Coffee Day Enterprises

- Maintained ‘Buy'; raised price target to Rs 350 from Rs 285.

- Stable coffee business; Growth boosted by strong export numbers.

- Commercialisation of key units to help profit growth in the second hald of the next financial year.

- Stake-sales in any allied business to aid cashflows and debt concerns.

Will U.S. trade actions against China help reduce its deficit?https://t.co/EqEJVWjO7t pic.twitter.com/riZqySXAex

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.