.jpg?downsize=773:435)

Afcons Infrastructure has established itself as a standout player in the infrastructure sector, consistently delivering growth and stability over the past six decades, Nuvama said as it initiated "Buy" rating with a target price of Rs 535.

Known for executing large and technically complex EPC projects, AIL has diversified its operations both geographically and across various segments, ensuring resilience against market fluctuations, the brokerage noted.

AIL's financial management has been robust, with efficient working capital management allowing the company to fund growth through internal accruals. Over the decade from FY14 to FY24, AIL's revenue and gross block have surged by 3.7–3.8 times, while its net debt-to-equity ratio has halved.

The company has achieved strong compound annual growth rates in order book, revenue, and profit after tax of 16%, 18%, and 29% respectively, from FY06 to FY24.

AIL's diversified business model has been key to its sustained growth. The company operates across multiple infrastructure segments, excluding building construction, and has a significant presence overseas, which historically accounts for 25–30% of its business. This diversification has enabled AIL to capitalise on opportunities and mitigate risks associated with sector-specific slowdowns, the brokerage noted.

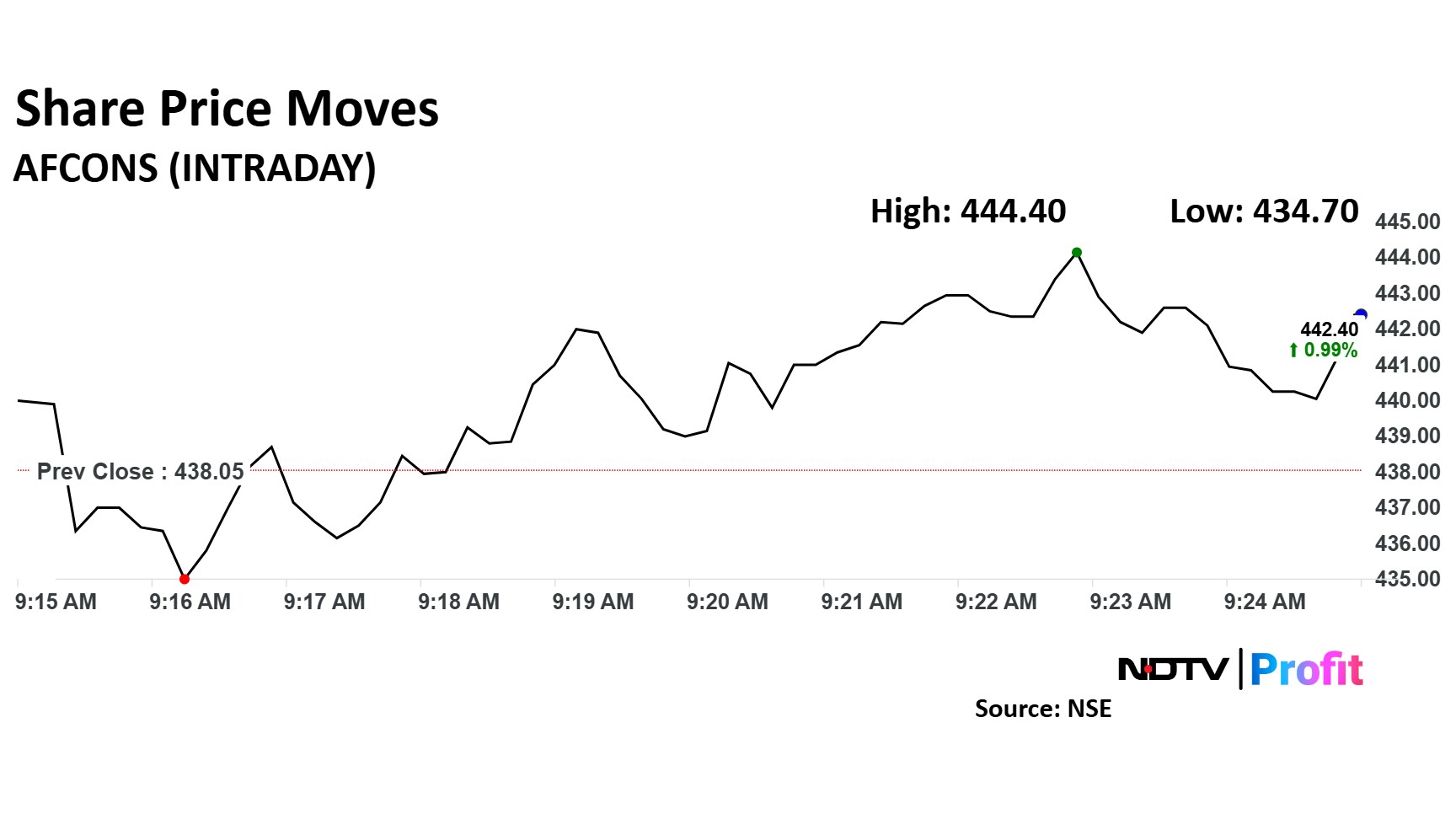

The scrip fell as much as 0.76% to Rs 434.70 apiece. It pared losses to trade 0.03% lower at Rs 437.90 apiece, as of 09:19 a.m. This compares to a flat NSE Nifty 50 index.

It has fallen 7.65% in the last 12 months. The relative strength index was at 47.

Six analysts tracking the company maintain a 'buy' rating on the stock, according to Bloomberg data. The average 12-month consensus price target implies an upside of 32.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.