Aditya Vision Ltd.'s share price jumped over 7%, hitting upper circuit after Nuvama initiated coverage on the stock with a 'buy' rating, setting a target price of Rs 672, representing a 36% upside potential.

The surge in AVL's stock price follows positive projections from Nuvama, which expects the company to deliver strong revenue, Ebitda, and PAT growth over the next few years.

Nuvama's analysts are optimistic about Aditya Vision's growth prospects, forecasting a 28% revenue CAGR, a 30% Ebitda growth, and a 41% PAT CAGR over fiscal 2024-27. This growth is expected to be driven by the company's expansion strategy and strong performance in under-penetrated markets, particularly in tier-2 and below towns.

Aditya Vision, a leading consumer electronics retailer focused on the Hindi-speaking heartland of India, has been capitalising on several key factors that contribute to its robust performance:

Rising electrification in tier-2 and below towns.

Replicating its successful Bihar model.

Expansion of financing options.

Better unit economics, compared to small-store retailers.

The multi-brand consumer electronics retail chain is headquartered in Patna, Bihar. Founded in 1999 with a single retail store in Patna, the company has steadily grown over the past three decades. Today, Aditya Vision has a widespread presence across all districts of Bihar and major cities in Jharkhand and Uttar Pradesh.

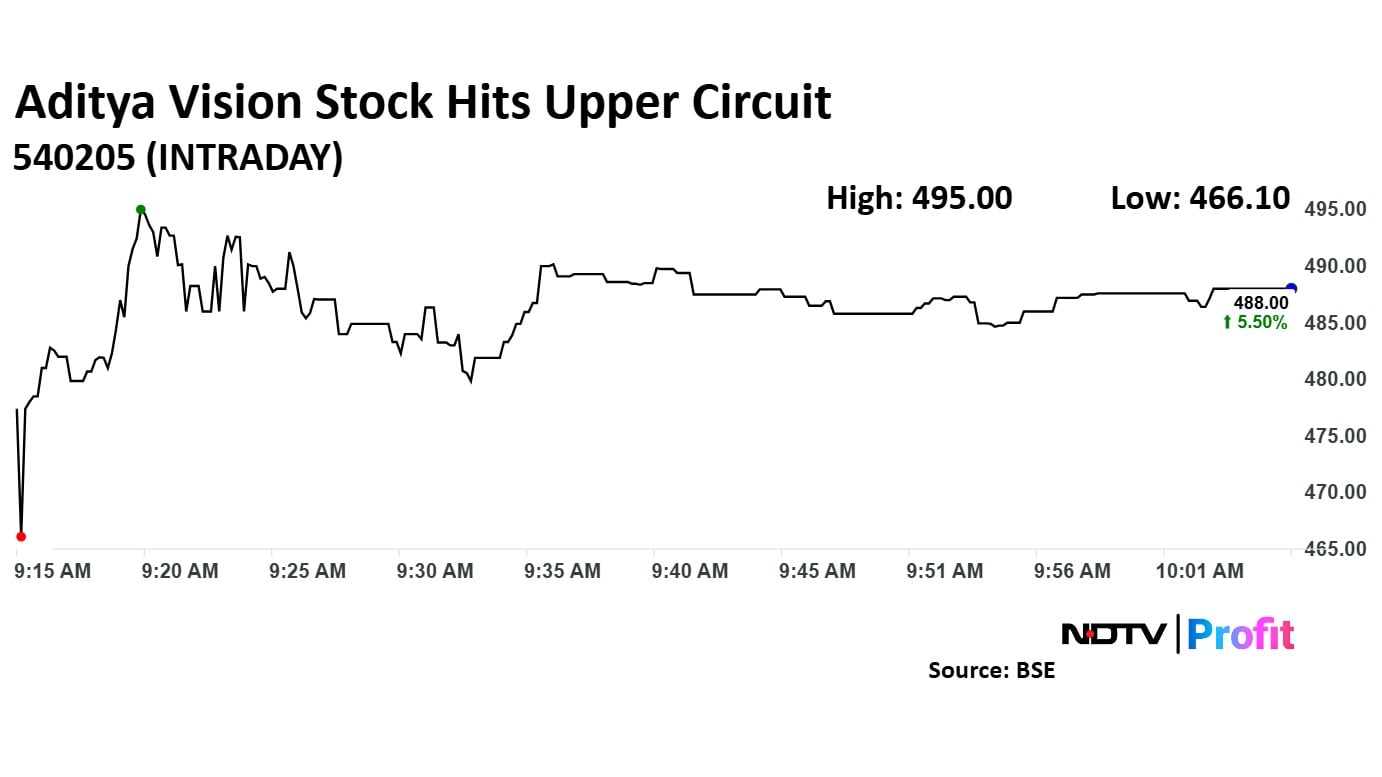

Aditya Vision Share Price Today

The scrip rose as much as 7.44% to Rs 496 apiece. It pared gains to trade 5.13% higher at Rs 485.35 apiece, as of 09:58 a.m. This compares to a 0.14% decline in the NSE Nifty 50.

The stock has risen 9.50% in the last 12 months. Total traded volume so far in the day stood at 6.1 times its 30-day average. The relative strength index was at 61.5.

All five analysts tracking the company maintain a 'buy' rating, according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 16.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.