Adani Energy Solutions Ltd.'s stock has received a bullish call from brokerage Investec after its strong third-quarter earnings. Maintaining a 'buy' rating, Investec has placed a target price of Rs 1,352 on the stock, implying a 67% potential upside over the previous close.

The Adani Group company's consolidated net profit surged in the third quarter of fiscal 2025, driven by strong Ebitda growth and a reversal of net deferred tax liability of Rs 185 crore primarily due to the divestment of the Dahanu plant in Adani Electricity Mumbai Ltd.

The transmission company's profit advanced 73% year-on-year to Rs 562 crore in the quarter ended December, in comparison with Rs 325 crore in the same quarter a year ago.

Revenue increased 27.8% to Rs 5,830 crore, driven from newly commissioned projects and higher energy sales, Investec noted.

Operating income growth came on the back of strong revenue growth, treasury income and steady regulated Ebitda in AEML, whose distribution loss has been improving consistently, the brokerage said.

With five new project wins so far this year, the under-construction transmission pipeline has zoomed to Rs 54,761 crore in the third quarter from Rs 17,000 crore in the previous quarter, Investec noted.

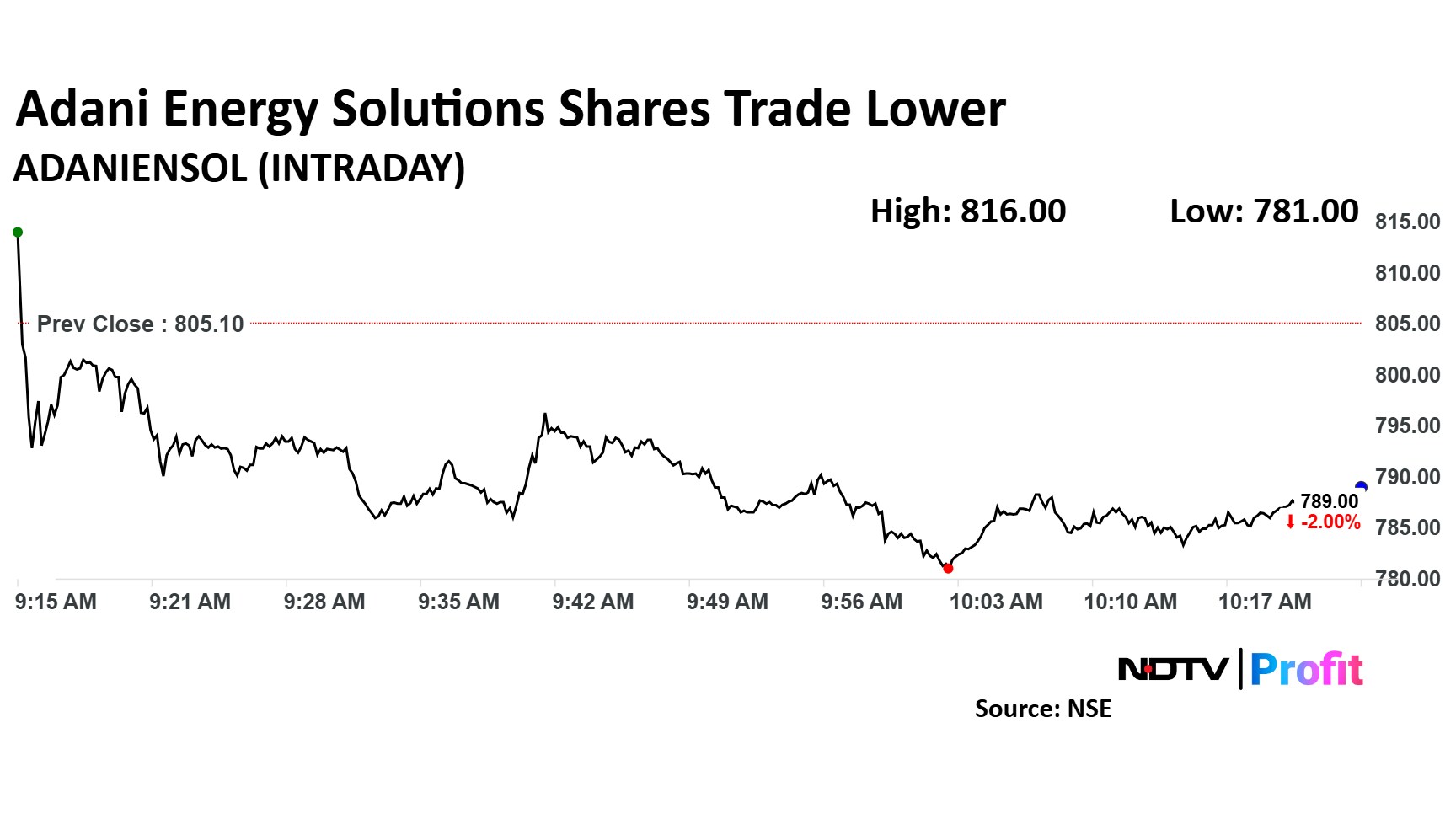

Adani Energy Solutions Share Price Movement

The shares of Adani Energy Solutions was trading 2% lower at Rs 789 apiece, as of 10:25 p.m. This compares to a flat benchmark NSE Nifty 50 index.

The stock has declined 24% in the last 12 month. The total traded volume so far in the day stood at 2.2 times its 30-day average. The relative strength index was at 49.

All six analysts tracking Adani Energy Solutions have a 'buy' rating on the stock, according to Bloomberg data. The average of 12-month analysts' price target of Rs 1,369 implies a potential upside of 74%.

Disclaimer: NDTV is a subsidiary of AMG Media Networks Ltd, an Adani Group Company.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.