Adani Energy Solutions Ltd.'s profit surged in the third quarter of fiscal 2025, driven by strong Ebitda growth and a reversal of net deferred tax liability of Rs 185 crore primarily due to the divestment of the Dahanu plant in AEML.

The transmission company's profit advanced 73% year-on-year to Rs 562 crore in the quarter ended December, in comparison with Rs 325 crore in the same quarter a year ago, according to an exchange filing on Thursday.

Adani Energy Solutions Q3 FY25 Highlights (Consolidated, YoY):

Revenue from operations rose 28% to Rs 5,830 crore.

Operating profit, or Ebitda rose 39% to Rs 2,125 crore.

Margin expanded 300 basis points to 36.5% versus 33.5%.

Net profit up 73% to Rs 562 crore.

The expansion in margin was aided by higher revenue, lower fuel costs, lower stock in trade purchases, and employee benefit expenses.

Adani Energy Solutions posted growth of 24% in total income at Rs 6,000 crore in the quarter under question, driven by the contributions from the recently commissioned MP Package-II, Kharghar-Vikhroli, Warora-Kurnool, KhavdaBhuj, Mahan-Sipat lines, and higher energy sales in Mumbai and Mundra utilities, the company said in a statement.

The company secured two new transmission projects: Khavda Phase IV Part-D and Rajasthan Phase III Part I (Bhadla-Fatehpur HVDC), thereby adding 3,044 circuit kilometres to its under-construction network. The Bhadla-Fatehpur HVDC project is the largest project the company has secured in its operating history.

In the distribution segment, energy demand, or units sold, in the Mumbai circle (AEML), ended 3% higher year-on-year and increased by 30% year-on-year at Mundra Utility. The distribution loss at AEML has been improving consistently and stands at 4.66% in the third quarter, according to the statement. Supply reliability has been maintained at over 99.9%.

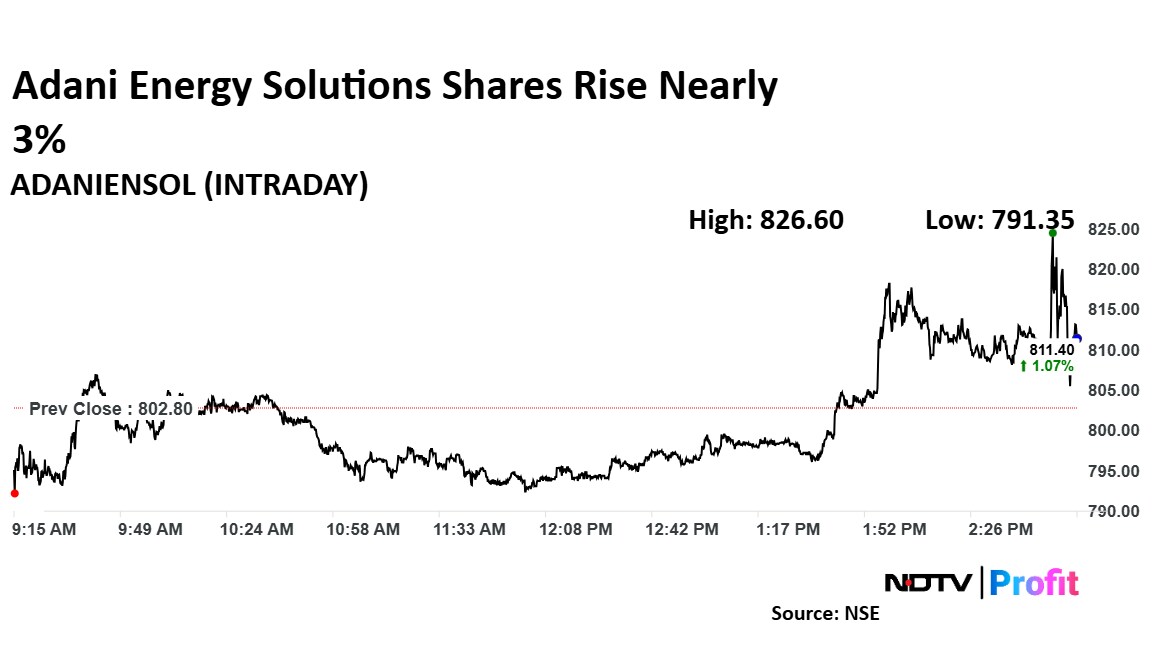

Adani Energy Solutions Shares Rise Nearly 3%

The shares of Adani Energy Solution rose nearly 3% to Rs 826.60 per share. It pared gains to trade 1.45% higher at Rs 814.45 apiece, as of 3:00 p.m. This compares to a 0.25% advance in the NSE Nifty 50 Index.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.